- China’s lopsided trade flows and Xi Jinping’s focus on manufacturing may represent the biggest danger to the global economy, according to former Treasury official Brad Setser. But he added that President Donald Trump’s tariffs are not the solution and could even make matters worse, especially if US trade policy remains unpredictable.

China’s policies and the flood of exports it’s unloading around the world could pose the worst threat to the global economy, even eclipsing President Donald Trump’s tariffs, according to a former Treasury official.

To be sure, Trump’s aggressive tariff stance has caused so much unpredictability that US trade partners don’t know how to react and businesses can’t plan, said Brad Setser, a senior fellow at the Council on Foreign Relations and a deputy assistant secretary at the Treasury Department during the Obama administration.

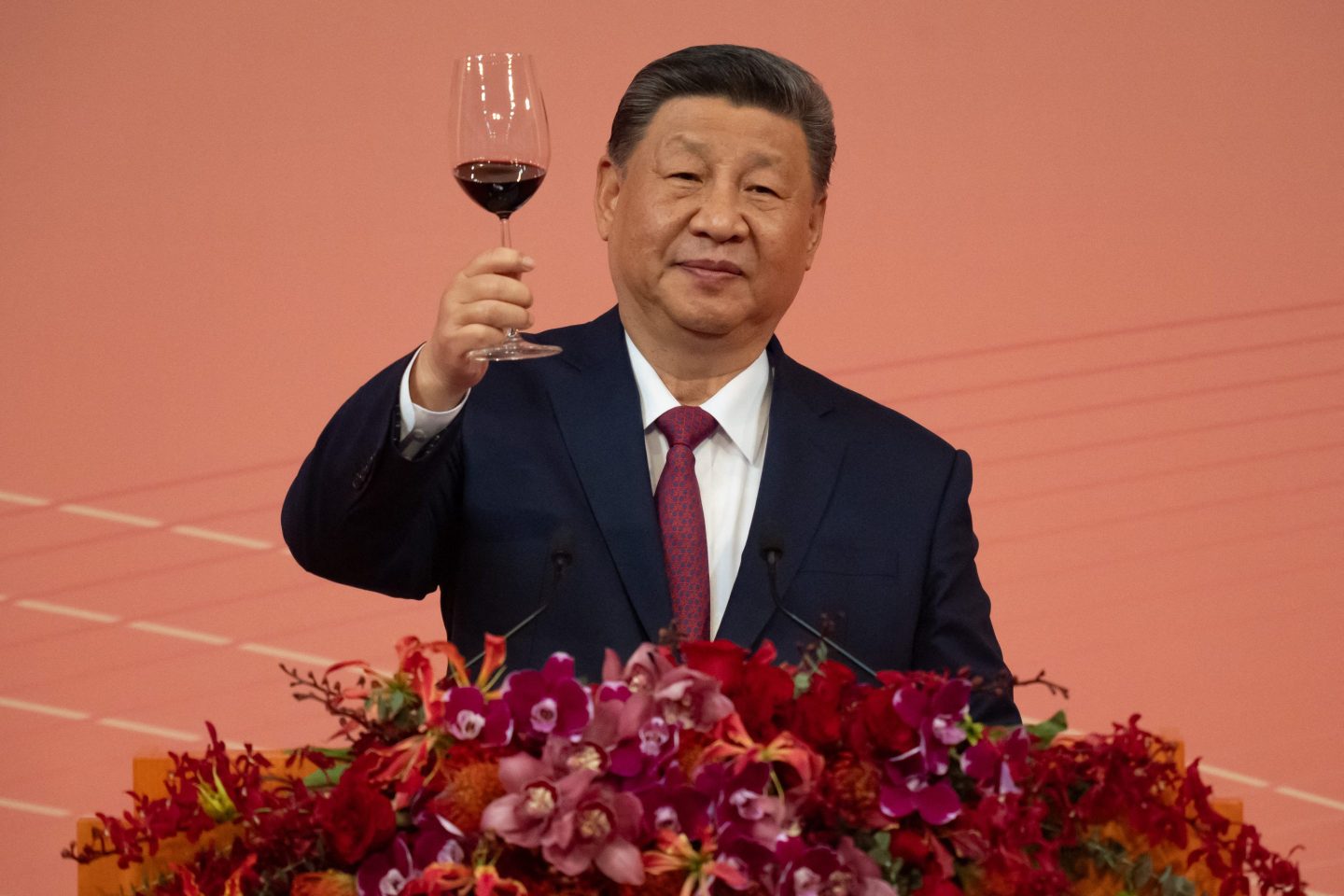

“But he is not the only danger the world economy faces and may not even be the biggest,” Setser wrote in a New York Times op-ed on Tuesday. “That may be President Xi Jinping of China, whose more strategic and calibrated industrial and economic policies are fundamentally distorting and harming global trade.”

Trump has imposed tariffs on China, announced duties on steel and aluminum, paused tariffs on Canada and Mexico, and directed his administration to study reciprocal tariffs, with potential to enact them in April.

Meanwhile, a closer look at China’s trade data reveals a radical shift in how the country has been interacting with the rest of the world recently, Setser said.

Imports of manufactured goods into China have grown by an average of just $15 billion annually over the last six years, essentially unchanged after accounting for inflation. But exports from China have shot up by more than $150 billion.

“When it comes to manufactured goods, trade with China is virtually a one-way street,” Setser said.

That massive disparity is hurting other economies, especially other export-oriented ones like Germany and Japan, he added.

The problem can be traced back to China’s refusal to rebalance its economy after the global financial crash away from its heavy dependence on investment and trade. Rather than shift the economy toward the consumer sector, Beijing fueled a real estate and infrastructure bonanza. But fearing a bubble, Xi clamped down on the boom, setting off a slump that China still hasn’t recovered from.

At the same time, Xi avoided directing massive stimulus to consumers during the pandemic, unlike many other countries that fueled demand for Chinese products. Instead of consumers, China offered support to its manufacturers, resulting in overproduction that only overseas demand couldn’t match.

Now, China alone has the capacity to produce two-thirds of the world’s demand for cars, Setser said. Similarly, China makes more than half the world’s supply of steel, aluminum, and ships. China’s volume of exports is expanding three times faster than global trade, meaning its gains are coming at the expense of others.

“This points to a world economy in which China has no need for the industrial inputs of other countries while leaving those countries dependent on Chinese-made goods—and vulnerable to Beijing’s political and economic pressure,” he predicted.

Trump’s tariffs could actually make the problem worse, Setser noted. One-off duties and retaliation wouldn’t fundamentally change trade flows, but Trump’s unpredictability makes adjusting to his tariffs extremely difficult.

Indeed, Trump has also threatened to target Europe next with tariffs, claiming its use of value-added taxes is unfair to US exporters. And more recently, he has floated tariffs on autos, chips and drugs.

“Mr. Xi has a one-way vision of trade. Mr. Trump often sounds as if he doesn’t believe in any trade. Between the two of them, the global economy is in for a rough ride,” Setser warned.

Others have also raised alarms about China’s overcapacity and its support for manufacturers over consumers, saying it would hurt China’s economy too. With domestic demand weak, any excess supply in China could result in deflation.

Zongyuan Zoe Liu, a China scholar at the Council on Foreign Relations, pointed to Beijing’s decades-old strategy of favoring industrial production.

“Simply put, in many crucial economic sectors, China is producing far more output than it, or foreign markets, can sustainably absorb,” she wrote in Foreign Affairs magazine last August. “As a result, the Chinese economy runs the risk of getting caught in a doom loop of falling prices, insolvency, factory closures, and, ultimately, job losses.”