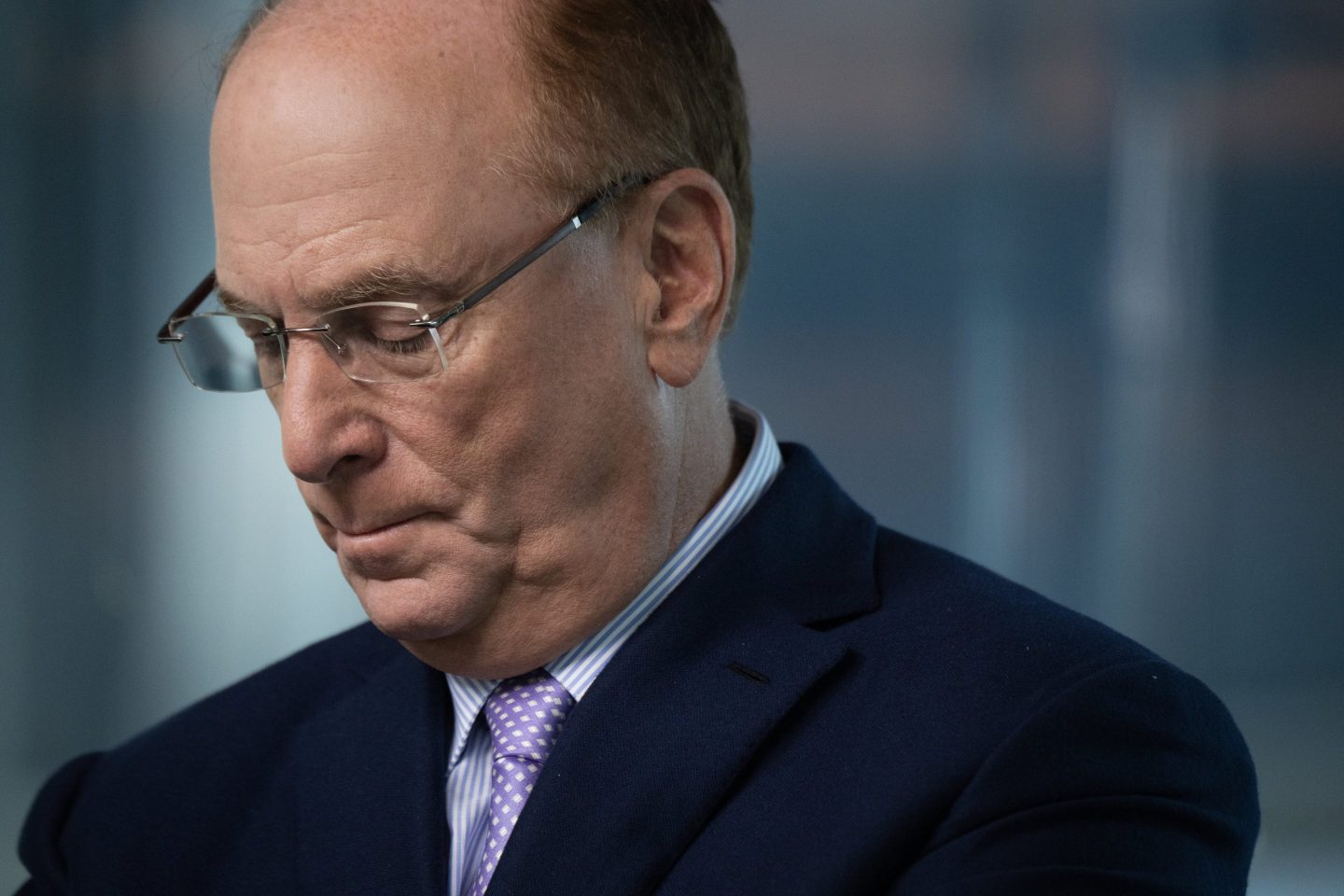

- In an annual letter published Monday when markets took a beating, BlackRock CEO Larry Fink said many people he spoke to were nervous about an economic downturn. Many of the fears stem from mounting uncertainty about how the Trump administration’s tariff policy will affect the economy.

Everyone keeps telling the CEO of the world’s largest asset manager how worried they are about the economy.

“I hear it from nearly every client, nearly every leader—nearly every person—I talk to,” BlackRock CEO Larry Fink wrote in his annual letter on Monday. “They’re more anxious about the economy than any time in recent memory.”

Fink’s comments came on Monday when the stock market slipped as soon as it opened and investors feared impending tariffs could further hurt the economy. Major indexes fell across the board. The S&P 500 dropped 0.75%, the Nasdaq Composite fell 1.82%, and stock futures fell on a negative outlook. Wall Street cut its economic projections and raised the chances of a recession. The inciting factor for the doom and gloom on Wall Street was the impending deadline for President Donald Trump’s tariffs, which are set to go into effect on Wednesday, April 2.

Since Trump took office, his back-and-forth tariff policies have roiled markets. Since Trump has frequently imposed tariffs, but then removed them, and targeted allies and adversaries alike, investors have little indication about what to expect.

“There is a vast array of potential tariffs on the table, with widely varying implications,” Bank of America global economist Antonio Gabriel wrote in an analyst note published Monday.

Bank of America expected Trump to impose a combination of tariffs targeting both specific countries and individual sectors of the economy, Gabriel added. So far, Trump has done both. Last week, Trump instituted a series of 25% tariffs on the automobile industry. Earlier this year, Trump targeted several countries like China, Canada, and Mexico with their own batch of tariffs.

Both sets of tariffs were met with concerns they would raise prices for consumers and cause a pullback in investment. Auto manufacturers, which import many components that are made abroad, would have little recourse but to increase costs for car buyers or lose billions by eating the costs on their own. Meanwhile, few details have been released about which goods would be included in any country-specific tariffs. This makes it hard for companies to assess their full impact on their supply chains.

Fink had pointed to eroding confidence in the economy throughout the year.

“The collective impact in the short run is that people are pausing, they’re pulling back,” Fink told CNN earlier this month. “Talking to CEOs throughout the economy, I hear that the economy is weakening as we speak.”

In this annual letter, however, Fink struck a different tone. He didn’t touch on the specifics of economic uncertainty that was rampant across the financial world. Instead, Fink opted for a hopeful message, pointing to the resiliency of capital markets over their 400-year history.

Capital markets are “the system we invented specifically to overcome contradictions like scarcity amid abundance, and anxiety amid prosperity,” Fink wrote.

But there is still a lack of confidence in the U.S. Economy. On Monday, Goldman Sachs raised its possibility of a recession from 20% to 35%. Deutsche Bank had an even drearier outlook with a 50/50 chance of a recession.

Wall Street fears tariffs could hamper economic growth. The Federal Reserve cut its GDP growth outlook down from 2.1% to 1.7% at its latest meeting in March. In remarks following the meeting, Federal Reserve Chair Jerome Powell cited Trump’s changing policies as a critical factor in the central bank’s forecast of where the economy was headed.