Good morning. The reciprocal tariffs are expected to be announced by President Trump on Wednesday, which is being referred to as “Liberation Day.” The administration’s position is that revenue from tariffs will pay for tax cuts elsewhere.

Meanwhile, inflation is starting to creep up. A key price gauge, the U.S. Personal Consumption Expenditures Index (excluding volatile items such as food and energy) rose 2.8% in February, compared with a year ago, following an increase of 2.7% in January. The data is closely watched by the Federal Reserve.

“The Fed is being put in a difficult position,” Mark T. Williams, a master lecturer at Boston University’s Questrom School of Business told me. “Despite growing inflation, the Fed may need to cut rates soon to lessen the likelihood of recession,” said Williams, a former bank examiner for the Federal Reserve.

“If they lower rates, they will stoke higher inflation, but if they wait too long, the economy could move into a full-fledged recession,” he explained. Goldman Sachs’ economists have recently hiked the probability of a U.S. Recession to 35% from 20%.

“A growing body of economic data is pointing toward higher inflation, reduced consumption, and a souring jobs market,” Williams said. And recently, the Atlanta Fed slashed its first quarter 2025 GDP forecast to -2.8%, he added.

During its latest meeting on March 19, the Federal Reserve left interest rates unchanged between 4.25% and 4.5%. As in December, Fed policymakers penciled in a median of two interest rate reductions in the famous “dot plot,” which shows where individual officials see rates headed. Fed Chair Jerome Powell said that tariff-induced inflation could be “transitory.”

Tariffs and inflation are top of mind for CFOs

Despite Powell’s perspective on tariffs and temporary inflation, data shows that many CFOs are concerned. A recent CNBC survey finds 90% of CFOs said tariffs will cause “resurgent inflation.” Half of CFOs said that the 2% target inflation rate will not be achieved until either the second half of 2026 or 2027.

“The CFO Survey,” recently released by Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta, gauges the sentiment of finance chiefs. Almost a third of respondents reported trade policy or tariffs are the most pressing concern, followed by inflation (19%). In addition, “uncertainty” (14%) made it to the top five concerns for the first time.

Some CFOs are taking precautionary actions. Almost 30% of firms said they planned to diversify supply chains. Meanwhile, 20% moved up purchases, and some said they were seeking out new domestic or foreign suppliers, according to the survey.

Another strategy is passing along higher costs to customers. But pricing requires taking a risk—such as pushing away customers, according to Deloitte. Companies should communicate to customers everything they’ve done until now to avoid raising prices, the firm advises. In addition, they should offer customers more options to trade down price-wise—while remaining within their brand—for a competitive advantage.

Matt Totsch, CFO at Trim-Tex, a manufacturing company, recently told me he’s taken actions such as front-loading inventory and shipments ahead of the tariffs, exploring opportunities for currency hedging, and using data-driven scenario planning and forecasts.

“There’s just no way to predict what these tariffs will do,” Totsch said. “But sometimes chaos can be a good opportunity. If you can find a way to leverage it, you can come out stronger.”

Does Williams have any advice for CFOs? “It’s all about risk management, recalibrating strategy, and being prepared,” he said. It’s time to “batten down the hatches,” he added.

Sheryl Estrada

[email protected]

Leaderboard

Rami Hasani was promoted CFO of UWM Holdings Corporation (NYSE: UWMC), effective April 1. He will succeed Andrew Hubacker who will be moving into a senior advisor role. Hasani originally joined the company in November 2020 as VP of financial reporting and compliance. Before joining the company, he spent over 15 years at Deloitte & Touche, LLP, most recently serving as a senior manager in the advisory practice.

David Jackola was promoted to EVP and CFO of APi Group Corporation (NYSE: APG), effective immediately. Jackola has been with the company since October 2021, most recently serving as interim CFO since December 2024. Before that, he served as CFO and VP of Transformation at APi International. Prior to that role, he was VP, controller and chief accounting officer at APi.

Big Deal

Grant Thornton has released its Q1 2025 survey of CFOs at public and private companies, which finds that just 47% are optimistic about the U.S. Economy, a 21-percentage-point drop from the previous quarter. However, finance leaders remain committed to technology modernization as a strategy for long-term benefits, according to the report.

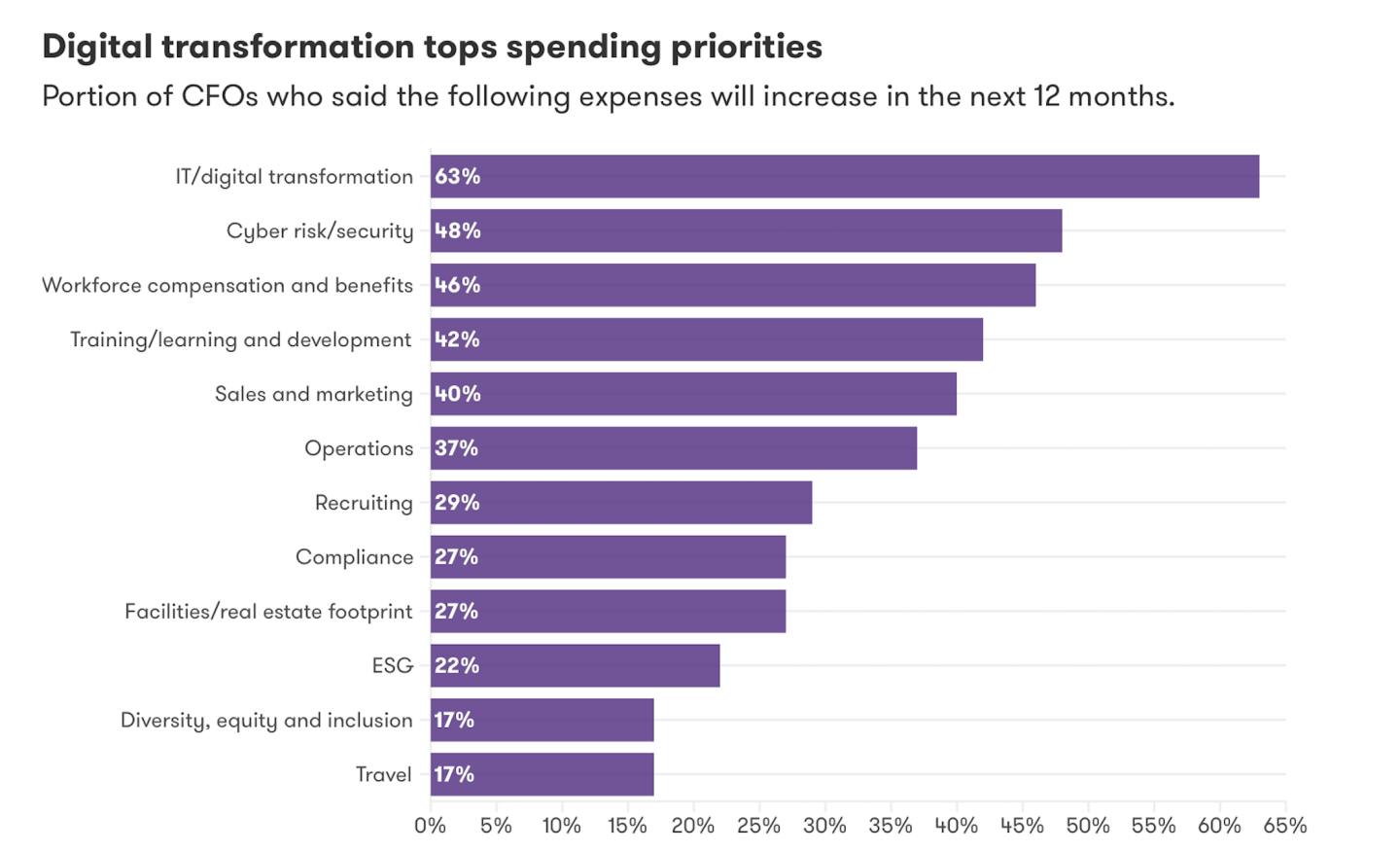

Sixty-three percent of respondents are prioritizing digital transformation spending followed by cyber risk spending (48%), and workforce compensation and benefits (46%).

CFOs are leaning toward digital transformation to manage uncertainty, optimize costs and enhance operational efficiency—but companies need to find a way through the current transition and focus on long-term results to achieve those benefits, Grant Thornton advises.

Going deeper

“How DeepSeek erased Silicon Valley’s AI lead and wiped $1 trillion from U.S. Markets” is a new Coins2Day article by Nicholas Gordon. “Hangzhou-based DeepSeek—not even a tech company, strictly speaking, but an offshoot of a hedge fund called High-Flyer—released R1, a ‘reasoning’ large language model (LLM) that matched the performance of OpenAI’s o1, which had been released just a few months earlier,” Gordon writes. “Not only had R1 seemingly come out of nowhere, it was both remarkably innovative and astoundingly cheap.”

Overheard

“One question that we ask everyone, regardless of if you’re a consultant or you’re working in technology…we say: ‘What have you learned in the last six months?’”

—Accenture CEO Julie Sweet said in a recent interview on the In Good Company podcast with Nicolai Tangen, the CEO of Norges Bank Investment Management. Sweet was asked what she looked for when hiring new consultants at the $64 billion tech giant, Coins2Day reported.