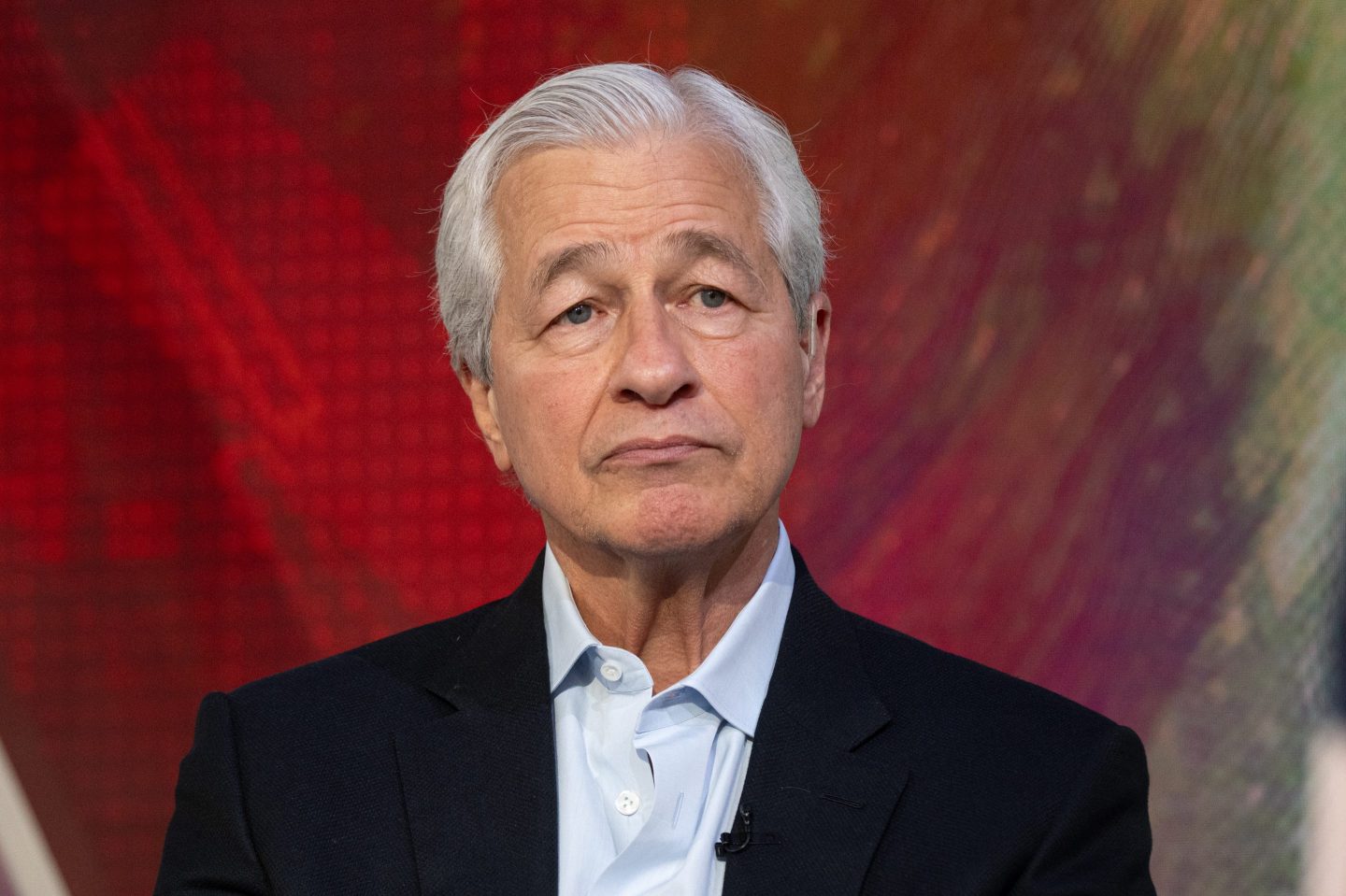

- JPMorgan CEO Jamie Dimon expressed concern that the U.S.’s aggressive foreign policy and trade tactics under Trump could weaken long-standing military and economic alliances, potentially pushing allies like Europe closer to rival powers such as China and Russia. While he supports America prioritizing its interests, Dimon warned that isolating allies could fragment the West, destabilize global security, and diminish democratic strength.

While billions of dollars might have been wiped off portfolios as a result of President Trump’s tariff plans, JPMorgan Chase CEO Jamie Dimon’s primary concern isn’t the markets.

What he’s really worried about is that the White House’s aggressive foreign policy might be harming military and trade alliances that have stood firm since the Second World War, allowing for rival powers to gain further influence.

Rising geopolitical tensions have been at the top of Dimon’s list of fears for some time now, particularly since the war between Russia and Ukraine.

With Europe now the focus of this conflict and a key partner to the U.S., Dimon has cautioned the Oval Office against pushing the continent into the arms of another global power.

“I think the most important thing is that we don’t read a book in 40 years: How the West Was Lost,” Dimon told the Financial Times in an interview.

“I think it’s one thing for any nation or the United States to say, ‘I think this is unfair around trade, around the cost of military—I think there’s some very good points. I think Europe knows that they need to spend more on their military, but that does not mean we shouldn’t have military alliance with you.”

Military spending is a bone President Trump has been waiting to pick with Europe, saying the continent is not doing enough to protect itself and is instead relying on the might of Uncle Sam.

Data confirms that the EU is indeed not spending as much—relatively—on defense as the U.S. Think tank the Stockholm International Peace Research Institute (SIPRI) found that in 2023, the U.S. Spent $916 billion on defense, which was 3.4% of the nation’s GDP.

Conversely, the European Council confirmed that in 2024 the EU spent €326 billion ($370.5 billion) on its military, which came to 1.9% of European GDP.

There are some nations in the EU and in Europe that are spending more on their defense, with the U.K., Germany, Ukraine, and France featuring in the top 10 spenders according to SIPRI.

However (with the exception of Ukraine), none of these nations spent more than 2.3% of their GDP on defense.

Dimon added the case for Europe to buck up its ideas isn’t merely military, saying: “[It’s] the same with the economy, they need to do more. GDP per person in Europe has dropped from something like 70% of America to 50%, it’s not sustainable. I think Europe has already recognized it needs to change its own rules, regulations, and guidelines if they want to go faster.

“The goal should be, in my view, to strengthen Europe and get them closer. Not to get them weaker and get them further. I think fragmentation of the Western world is a bad idea … and you can end up with a world that looks like before World War I and World War II, where it’s almost every nation for themselves, trying to figure out how they’re going to protect themselves, and unfortunately that might lead to proliferation of nuclear weapons.”

America first, not America alone

In a letter to shareholders published earlier this month, Dimon warned the U.S. Against prioritizing its own goals to the detriment of its relationships with allies.

The man paid $39 million to lead America’s biggest bank in 2024 wrote: “If Europe’s economic weakness leads to fragmentation, each nation will need to seek out its own relationships to secure its future … Such moves would ultimately make these countries far more reliant on China and Russia—over time effectively making them vassal states.

“Economics is the longtime glue, and America First is fine, as long as it doesn’t end up being America alone.”

Dimon, who will be handing over the reins of JPMorgan sometime in the next five years, reiterated this point when speaking to the FT, saying that he still has faith that the American economy is the strongest in the world, but that cannot lead to overconfidence.

America is “still very strong, but yes, a lot of this uncertainty is challenging that a little bit … Hopefully these tariffs and trade wars settle down and go away so people can say, ‘I can rely on America,’” Dimon added.

“I’m not worried about the markets as much as I am about keeping the Western world together, free and safe for democracy, and that to me means you want to strengthen the economic relationships … We should be careful, I mean, I don’t think anyone should assume they have a divine right to success and therefore don’t worry about it. I can’t take it for granted. I would never take anything for granted though,” he continued.