Good morning. Kohl’s needs to appoint its fourth CEO in less than three years after its chief executive was ousted due to an ethics violation linked to a compromising personal relationship.

Ashley Buchanan began his tenure as CEO of Kohl’s on Jan. 15, 2025, most recently serving as chief executive of The Michaels Companies. Before that, he held a variety of senior executive roles at Walmart and Sam’s Club. Buchanan’s appointment at Kohl’s followed Tom Kingsbury, who was in the role for two years. Kingbury had succeeded Michelle Gass, who left Kohl’s to lead Levi’s.

Kohl’s board chair Michael J. Bender said of Buchanan in January: “We know he will be a great leader for Kohl’s and will bring a new perspective in our next chapter.”

On Thursday, the company announced Buchanan’s firing.

Following an investigation conducted by outside counsel and overseen by the board’s audit committee, Kohl’s terminated Buchanan for cause, citing undisclosed conflicts of interest related to vendor transactions. The company stated in the announcement that his firing was unrelated to Kohl’s performance, financial reporting, or operational results.

Coins2Day’s Sydney Lake reported an SEC filing revealed Buchanan directed the company to conduct business with a vendor he had a personal relationship with under “highly unusual terms” that were favorable to the vendor. He also committed Kohl’s to a multimillion-dollar consulting agreement in which the same individual was part of the consulting team. Buchanan did not disclose his relationship as required under the company’s code of ethics.

The unusual deal involved a woman with whom he has had a romantic relationship, the Wall Street Journal reported.

A needed turnaround amid CEO turmoil

So what will become of Buchanan’s career? I asked Shawn Cole, president and founding partner of executive search firm Cowen Partners, for his assessment, and I think it serves as a warning for anyone in a C-suite role. “His career is effectively over,” Cole told me.

“This is a major embarrassment for Kohl’s, the board and shareholders,” he said. “This situation underscores the importance of backchannel references; even minimal due diligence could have revealed any prior issues.”

It’s also an embarrassment for the search firm that recommended Buchanan, Cole said. “I’m unclear if it is the same search firm continuing the new search, but this would certainly fall under the replacement guarantee,” he said.

Bender is now serving as interim CEO. He is a former president and CEO of Eyemart Express. Bender also previously served as COO of global eCommerce at Walmart.

In the backdrop of the scandal, Kohl’s (No. 235 on the Coins2Day 500) has reported 12 straight quarters of revenue declines. Its store brands haven’t resonated with shoppers. For the other brands it sells, Kohl’s competes with retailers such as Amazon, Target, Dick’s Sporting Goods, and Walmart. There have been recent store closings and layoffs.

Kohl’s CFO, Jill Timm, has been with the company since 1999, becoming finance chief in 2019. Over the years, she has served in several finance roles, such as VP of financial planning and analysis and EVP of finance. “Timm is clearly a highly qualified CFO and has done a commendable job maintaining the business despite declining sales,” Cole said. But as for choosing the next CEO, Kohl’s board will most likely select an external candidate to address a glaring issue—a deep disconnect with customers.

“Kohl’s doesn’t have a margin or efficiency problem—it has a revenue problem,” he said. “What Kohl’s needs is a retail veteran with a background in marketing, operations, and turnarounds.” The company needs a CEO who can rebuild trust through private label revitalization and frictionless shopping experiences.

Have a good weekend. See you on Monday.

Sheryl Estrada

[email protected]

Leaderboard

Coins2Day 500 Power Moves

Peter Hadley was promoted to CFO of ADP (No. 228), a global technology and HCM company, effective July 1. Hadley succeeds Don McGuire, who has served as CFO since 2021. McGuire will remain available through Sept. 30 to support the transition. Since 2022, Hadley has served as corporate VP and treasurer of ADP.

Steve Priest, CFO of eBay, Inc. (No. 390), a global commerce provider, is leaving the company, effective May 11. Priest will remain in an advisory position until July 31. Peggy Alford was appointed the next CFO. Alford is a former EVP of global sales and merchant services at PayPal. She will join eBay in an advisory capacity on May 5, and begin her CFO tenure on May 12.

John Woods, vice chair and CFO of Citizens Financial Group, Inc. (No. 337) is departing from the company to become CFO at State Street Corporation. Woods is expected to leave in August 2025. The company will initiate a formal internal and external search for a CFO.

Every Friday morning, the weekly Coins2Day 500 Power Moves column tracks Coins2Day 500 company C-suite shifts—see the most recent edition.

More notable moves this week:

Richard Orazietti will step down as CFO of Aris Mining Corporation (NYSE-A: ARMN) following the completion of the company's Q1 reporting. As part of a planned leadership succession, Cameron Paterson will join Aris Mining as CFO in July. Paterson joins the company from Pan American Silver where he served in executive roles, including as VP of financial reporting, and SVP of finance and information technology.

Jay Shah was appointed CFO of Synapse Health, a medical equipment provider. Shah has more than 20 years of experience. Most recently, he served as CFO at Integra Partners. Before that, Shah held several leadership roles at American Express Company, including VP and CFO of global commercial payments. He also served as served as VP and CFO at Global Prepaid Group and Global Real Estate Group.

Tatyana Kosheleva was appointed CFO of NMS Labs, a forensic and clinical toxicology services provider, effective April 28. Kosheleva brings more than 20 years of global financial leadership experience. Most recently, she served as CFO of Nordic Pharma, Inc., where she led initiatives in financial infrastructure development, internal controls, strategic acquisitions, and product commercialization.

Big Deal

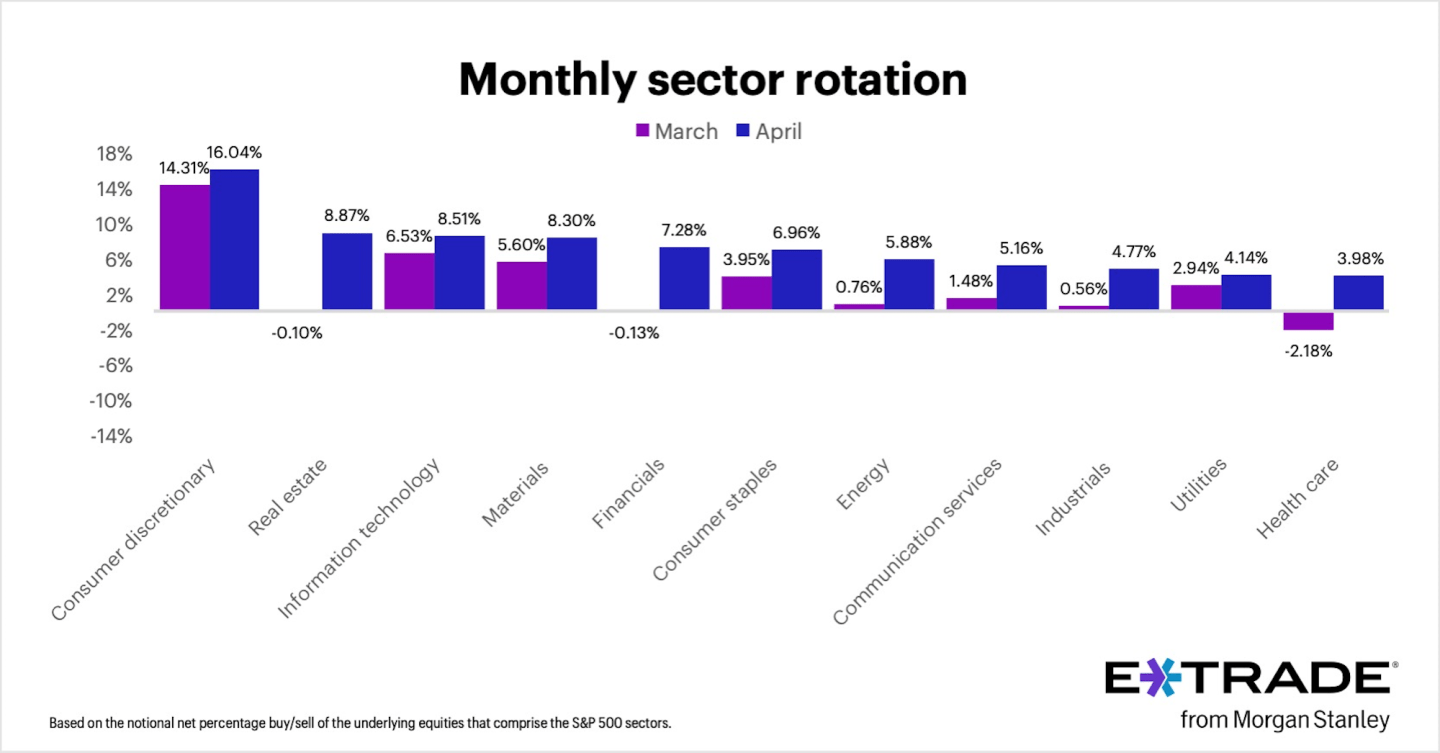

E*TRADE from Morgan Stanley’s monthly analysis finds the three most-bought sectors on the platform in April were consumer discretionary (+16.04%), real estate (+8.87%), and information technology (+8.51%). The data is based on the net percentage buy/sell behavior of stocks on the platform that comprise the S&P 500 sectors.

“Last month’s dip into bear-market territory didn’t prevent E*TRADE from Morgan Stanley clients from being net buyers in every S&P 500 sector in April,” Chris Larkin, managing director of trading and investing, said in a statement. “Clients bought consumer discretionary the most, but they also made significant pushes into real estate, tech, and materials. While the latter two sectors were also among the top bullish targets in March, the shift into real estate stood out in that clients were net sellers the month before.”

Going deeper

Here are four Coins2Day weekend reads:

“Amazon CEO says the $2 trillion retailer is ‘pretty maniacally focused’ on keeping prices down amid tariff pressure” by Stuart Dyos

“Robinhood says customers deposited a record $6.5 billion in April as active traders try to profit off market chaos” by Greg McKenna

“Mark Zuckerberg reveals the morning routine that’s ‘better than caffeine’” by Alexa Mikhail

Overheard

“I was joking with a colleague that I redefined what R and R means—resilience and results—because that’s what I feel like I’m focusing on.”

—Accenture Chair and CEO Julie Sweet said during a webinar hosted this week by Coins2Day’s Diane Brady alongside Great Place to Work CEO Michael C. Bush, and it also featured Delta Air Lines CEO Ed Bastian.