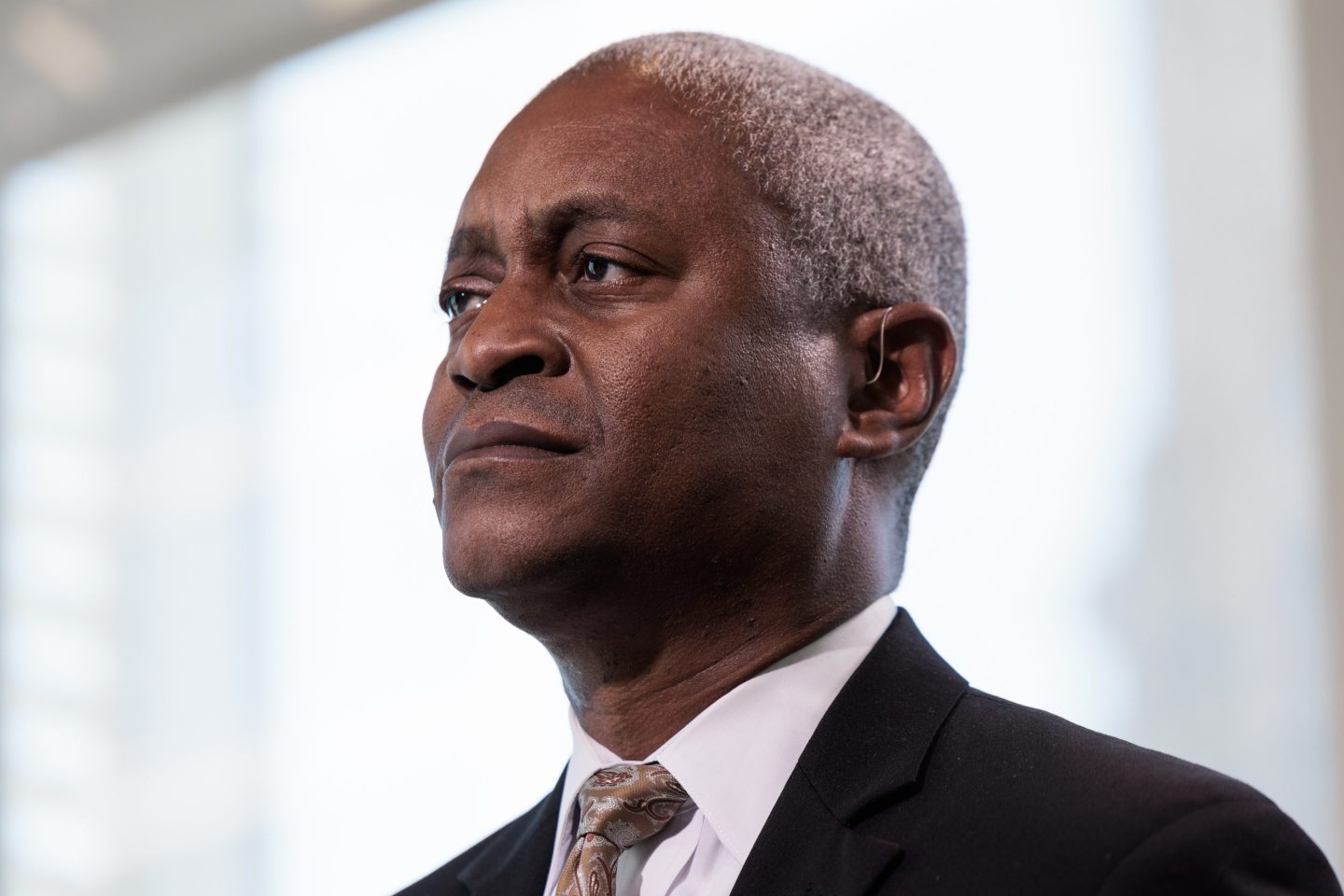

- Atlanta Fed President Raphael Bostic explained it would take time for the central bank to fully understand the economic effects of the White House’s new tariff policy. Because of that prolonged process, he only saw room for one interest rate cut this year.

The range of possibilities for what could happen to the U.S. Economy is still too wide for the Federal Reserve to be able to make any definitive decisions about its future, according to Atlanta Fed President Raphael Bostic.

With the Fed sitting tight, he added, there will likely be less room than previously expected for interest rate cuts.

“I’m leaning much more into one cut this year,” Bostic said during an interview with CNBC on Monday.

The one rate cut for the year is an adjustment to Bostic’s own forecast from February, when said he was expecting two cuts in 2025. Fed officials overall had also expected two rate cuts for 2025. In March, it released its summary of economic projections known as the “dot plot,” which showed most Federal Open Market Committee members expected two cuts. Bostic’s predictions are included in the “dot plot” but he is not currently a voting member of the committee that makes interest rate decisions.

The Fed would only have room for one cut this year because it would need time to assess the full impact President Trump’s tariffs would have on the economy, according to Bostic.

“At the beginning of this year, when we were thinking about tariffs, we were not thinking about them at the level that has been proposed here or with the diversity across sectors and across countries,” he said. “That requires a different kind of calculus. That’s one of the reasons why I’ve said, we’ve got to step back and pause because the details are going to matter in terms of flowing through to an aggregate picture [of the economy]. So for me I’m expecting it’s going to take a bit longer for that to sort out.”

The current tariff policy has changed significantly since the announcement of “reciprocal” duties on April 2. It is also likely to change further given the White House’s ongoing trade negotiations with over a dozen countries. Bostic estimates having to wait three to six months for any policy uncertainty to be resolved. “That’ll be an important determinant about people’s willingness and appetite for investing in the US.,” he said.

The White House’s tariff policy caught many businesses off guard because they were expecting other economic policies from the Trump administration such as deregulation, Bostic added. “What we saw through that whole period was a marketplace that was coming to terms with a different reality than what they expected,” he said.

The fear among businesses is that the only way for them to offset their tariff-driven cost increases will be to raise prices on consumers. Last week, Walmart—the biggest retailer in the world, which prides itself on keeping prices low—said it expected it would have to raise them because its own costs were going up. If businesses across the board raised prices, that would lead to a spike in inflation.

Because of those dynamics, Bostic said he was more concerned with inflation than unemployment at the moment.

“I worry a lot about the inflation side,” he said. “Mainly because we’re seeing expectations move in a troublesome way. The short-run expectations have gone up a lot, and some of the longer-run expectation measures are starting to migrate.”

Short-term expectations in the immediate aftermath of the tariff announcement increased, continuing a trend from the start of 2025, according to data from the Atlanta Fed. The Fed is especially focused on long-term inflation expectations because they are better indicators of whether businesses and consumers expect a brief hit to the economy or see a more lasting problem on the horizon. If it’s the latter, they’re much more likely to cut their spending, which can kickstart an economic downturn.

What has people worried is that tariffs will eventually show up in sticker prices.

“We’re not really seeing the impact of the tariffs in pricing and in how the economy is being experienced by people,” Bostic said. “But everyone feels like it’s coming and that bit of foreboding causes people to worry.”