- International travel to the U.S. Appears set to decline, with bookings falling as tariff battles and more intense screening ward off potential visitors. Service-oriented sectors like restaurants and lodging will be hit hardest as Canadians lead the boycott.

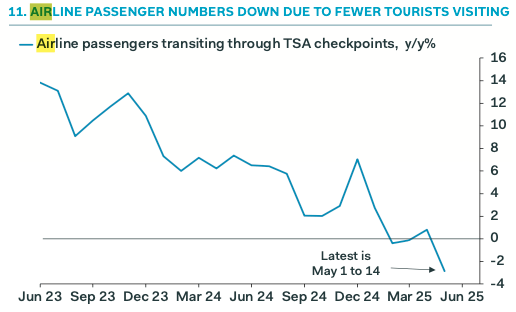

Tariff bluster, canceled visas, and enhanced screening at border crossings and other checkpoints may be pushing foreigners to put a pin in their plans to visit the U.S. This year. The impacts could ripple through America’s economy.

A 10% drop in international tourism this year—based on the decline in foreign visitors to the U.S. By air in March—could cost America $23 billion in gross domestic product and the equivalent of roughly 230,000 jobs, according to estimates from Implan chief economist Jennifer Thorvaldson.

Dining and lodging would be hit hardest, forfeiting over 50,000 and just under 45,000 jobs, respectively. Entertainment is next on the list with an estimated 25,000 jobs lost, followed by retail industries, including gas stations, at 19,500.

Lost labor income comes out to just over $13 billion, including wages, salaries, and earnings by proprietors.

“There’s not a lot of automation in service sectors,” Thorvaldson told Coins2Day, “and so the impact on employment is kind of outsized for the reduction in spending.”

It’s important to note the March dip in air traffic has been largely attributed to Easter falling much later than usual this year. Foreign arrivals spiked in April, bringing the decline over the two months to just 1.6%, according to Oxford Economics.

Still, the 10% figure appears to be a scenario worth modeling, with Oxford expecting international arrivals to fall 8.7% this year, down slightly from its March projection of a 9.4% drop.

It’s a stark reversal from the industry’s optimistic outlook heading into 2025. As recently as December 2024, Oxford anticipated an 8.8% boost in international arrivals and a 16% increase in spending by foreign tourists. As of last month, the firm found 11% fewer flights had been booked to the U.S. For the months of May through July compared with 2024.

“Delayed bookings may account for a share of this gap—as some travelers may still plan to visit—but a portion is likely due to travelers selecting a non-U.S. Destination instead or putting off the trip,” Aran Ryan, director of industry studies at Oxford subsidiary Tourism Economics, wrote in a note Tuesday.

Canada leads boycott of American tourism

That represents a direct hit to the service sector, as well as a blow to supply chains, and, of course, Americans’ pocketbooks. For every dollar no longer spent by foreign tourists in the U.S., an additional $1.19 is lost throughout the economy, according to Thorvaldson’s estimates.

It’s possible, she acknowledged, that some of the projected layoffs can be avoided by simply cutting workers’ hours. However, the effect on income and, therefore, household spending, remains the same.

“It really showcases how interconnected everything is in this economy,” she said.

Thorvaldson’s analysis covered the aggregate impact of a tourism shock on the U.S., rather than zeroing in on local and regional economies. However, popular tourist destinations like Florida, New York, and Las Vegas could be especially vulnerable.

Many towns on the Canadian border in places like Washington State are already reeling as Canadians put their “elbows up” and boycott the U.S. In response to President Donald Trump’s hostility on trade and threats to make America’s northern neighbor the “51st state.”

According to an April survey from Longwoods International, a Toronto market research firm specializing in tourism, three in five Canadians said current U.S. Policies, trade practices, and political statements make them less likely to travel to America in the next 12 months.

Data from April suggests that’s not just bluster, with the number of Canadian visitors returning from trips to the U.S. Declining 35% by land and 20% by air, according to Oxford. The firm expects the U.S. To see 20% fewer tourists from Canada overall this year, followed by a projected 6% decline in visitors from Western Europe.

Political hostility and tighter border controls aside, tourists may also find they can get a better bang for their buck outside of the world’s largest economy.

Even though the dollar has weakened since Trump’s chaotic tariff rollout in early April, it is still strong relative to many other major currencies. For example, visitors from Japan and Brazil can buy roughly 29% fewer U.S. Dollars with the yen and real, respectively, compared with the end of 2019.

“While costs are only one factor considered by travelers, this poses a headwind to inbound travel and a tailwind for outbound travel,” Ryan wrote.

In other words, wealthy Americans may still shell out cash abroad, but the U.S. Economy could take a significant hit as foreigners think twice.