Good morning. Autonomous AI agents are poised to transform how enterprises operate. Yet, new research suggests that their potential value is still widely underestimated.

According to a Bank of America Global Research analysis released this week, spending on agentic AI could reach $155 billion by 2030—triple the estimates of most industry analysts. This projection highlights the growing belief that agentic AI could fundamentally transform workforce productivity.

Agentic AI could be the “defining catalyst for AI monetization,” as agents can measurably boost workforce productivity, BofA analysts wrote in a research note to clients on Tuesday.

The analysts developed a framework to estimate how much of the total value of human work (measured by salaries and wages) could shift to AI agents. They started by calculating that global knowledge worker wages across seven major fields—sales, marketing, customer support, finance, human resources, IT, and operations—total $18.6 trillion annually. By 2030, they project AI agents could handle 10% of these workflows, unlocking $1.9 trillion in value. If software vendors capture 8% of this, agentic AI spending could reach $155 billion, according to the findings.

Despite rapid adoption—McKinsey reports 78% of companies use generative AI—more than 80% see no material earnings impact. Why? Productivity gains from tools like chatbots are hard to measure thus far. And most advanced use cases are still in pilot phases.

BofA analysts believe this could change as agentic AI matures. Unlike simple chatbots, agents can automate complex, multi-step processes, acting as proactive collaborators rather than reactive tools.

Amazon CEO Andy Jassy recently discussed the future of AI agents. In an email to employees on June 17, Jassy wrote: “We have strong conviction that AI agents will change how we all work and live.”

“There will be billions of these agents, across every company and in every imaginable field,” Jassy added. “Many of these agents have yet to be built but, make no mistake, they’re coming, and coming fast.” He also made a point that the company’s total corporate workforce would likely reduce as a result of efficiency gains from using AI extensively.

During Coins2Day’s recent Emerging CFO event, held in partnership with Workday, Jamie Miller, chief financial and operating officer at PayPal called AI agents a “game changer.” PayPal is targeting use cases involving high-volume manual work, such as invoice processing and accruals, Miller said. Agents can harmonize data from multiple formats and automate tasks like travel and expense compliance by auditing receipts and making recommendations. “As CFOs, we’re responsible for financial statements and compliance, so it’s critical to have the right checks, balances, and oversight,” Miller said.

Sheryl Estrada

[email protected]

Leaderboard

Coins2Day 500 Power Moves

Chris Lialios has been appointed interim CFO of Ulta Beauty, Inc. (No. 375), effective immediately. Paula Oyibo, who joined the company in 2019 and had served as CFO since April 2024, has left the company. Ulta Beauty has started an external search for a permanent successor with the assistance of an executive search firm. The company reaffirmed its fiscal 2025 guidance, issued on May 29, for per-share earnings of $22.65 to $23.20 and comparable-store sales ranging from flat to up 1.5%. Lialios has served as SVP and controller since 2018 and joined Ulta Beauty in 1999 as assistant controller.

Every Friday morning, the weekly Coins2Day 500 Power Moves column tracks Coins2Day 500 company C-suite shifts—see the most recent edition.

More notable moves

Brenda Lovcik has resigned as SVP and CFO of Trex Company, Inc. (NYSE: TREX), a manufacturer of wood-alternative decking and railing. Lovcik has accepted a position in Minnesota, near her family. She will continue to serve as CFO through August 5, at which time the CFO responsibilities will be assumed on an interim basis by Bryan Fairbanks. He previously served as CFO of Trex from August 2015 until being named CEO in April 2020.

Rajesh “Raj” Asarpota was appointed EVP and CFO of Maravai LifeSciences Holdings, Inc. (Nasdaq: MRVI), a global provider of life science reagents and services, effective June 30. He will succeed Kevin Herde, who is transitioning to an advisory role on the same date to support an effective transition. Asarpota brings nearly three decades of experience, including more than 10 years as CFO of both public and private life sciences and medical device companies.

Big Deal

Forty percent of respondents identified tariffs and trade policy as a top concern for their firm—the highest percentage to cite this issue since the second quarter of 2020, a period marked by the pandemic, severe supply chain disruptions, and the highest U.S. Inflation rates since the early 1980s, according to the report. Rounding out the top four concerns were economic uncertainty, monetary policy, and weakening demand.

Respondents most concerned about tariffs were more likely to reduce capital expenditures, pass through cost increases, and accelerate purchases. Manufacturers were more likely than non-manufacturers to take action in response to tariffs.

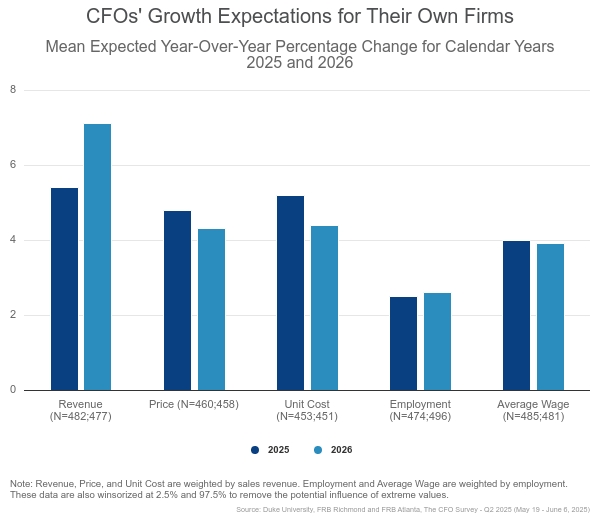

The second-quarter results suggest that CFOs expect heightened price and unit cost growth in 2025 and 2026. They also expect lower revenue growth than they did last quarter. (In the absence of changes to tariff policy in 2025 and 2026, the respondents said their expected cost and price growth would have been notably lower and their revenue growth somewhat higher.)

Going deeper

“Shell denies reports of BP megamerger of Big Oil rivals” is a Coins2Day report by Jordan Blum

From the report: “Shell said ‘no talks are taking place’ for a potential megamerger with rival BP that would cost more than $80 billion and represent the biggest energy deal of the century.

The denial comes on the heels of the Wall Street Journal reporting June 25 that Shell is in early talks to acquire BP in a much-rumored deal. BP has struggled financially in recent years—dealing with investor activism from Elliott Investment Management and others and launching a ‘hard reset’ in early 2025 that cuts costs, shifts away from renewables, and doubles down on fossil fuels.

Shell and BP are ranked No. 13 and No. 25 on the Coins2Day Global 500, respectively.”

Overheard

“At Informatica, we’re doing everything we can to help employees quickly ascend the AI learning curve. Our IT organization developed an AI literacy class that has been widely attended.”

—Informatica CEO Amit Walia, writes in a Coins2Day opinion piece titled, “How to future-proof your career in the age of AI.”