- President Trump’s 50% tariffs on copper, due to start August 1, are causing unusual distortions in the metal markets. Copper is now 25% more expensive in New York than London. And there’s a rally in copper scrap.

It’s happening. President Trump is indeed imposing a 50% tariff on all imported copper. He posted on Truth Social yesterday: “After receiving a robust NATIONAL SECURITY ASSESSMENT. Copper is necessary for Semiconductors, Aircraft, Ships, Ammunition, Data Centers, Lithium-ion Batteries, Radar Systems, Missile Defense Systems, and even, Hypersonic Weapons, of which we are building many. Copper is the second most used material by the Department of Defense!”

The markets are already behaving strangely. Copper futures spiked upward, obviously.

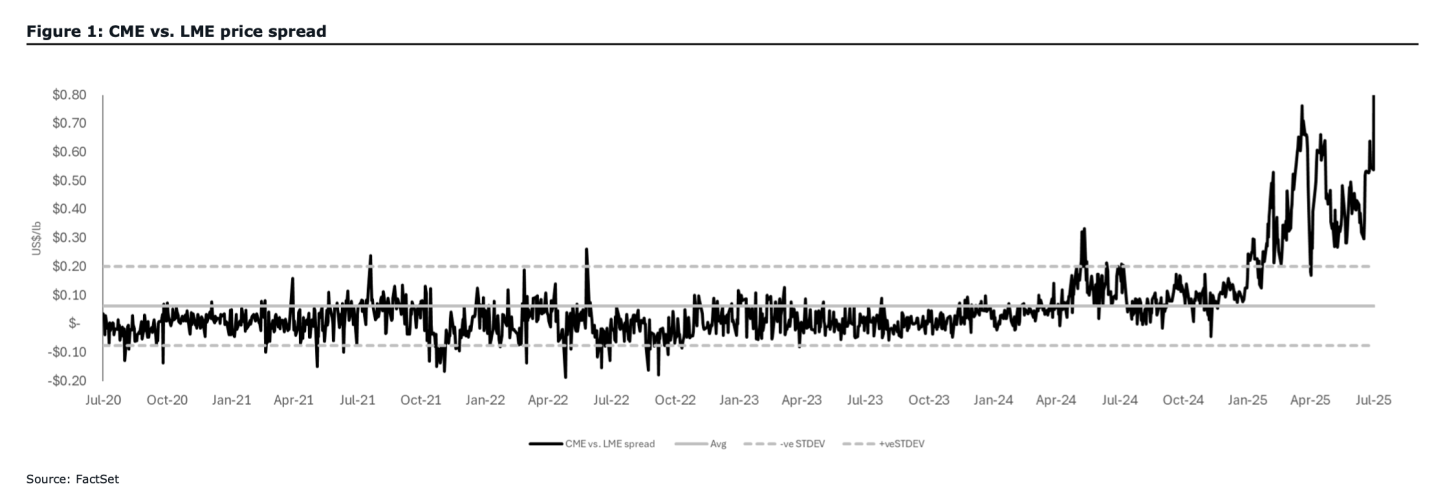

Now the price of copper is 25% higher in New York than it is in London, according to Bloomberg. This chart from Canaccord Genuity, via Dalton Baretto et al., shows the spread:

Copper is used in a vast array of consumer and industrial products.

Most businesses, even if only marginally, are affected by the price of copper. While the cost of copper is going up for American businesses and consumers, the rest of the world is scratching its head while it enjoys a considerable discount on the price of copper.

Trump thinks the U.S. Will become self-sufficient in copper production, but that is extremely unlikely to happen, according to Bernstein analysts Bob Brackett and Andrianto Guntoro:

“The US is home to only two primary smelters. The cost of building a smelter is perhaps $6 bln per million tons capacity … The timeline of building a smelter from scratch is perhaps 5 years. Globally, smelters are oversupplied, and smelter economics are terrible (negative treatment charges/refining charges). It is highly unlikely that a company would invest $5-6 bln for a project that wouldn’t be operational during a Trump presidency with poor margins. Therefore, the tariff incents no proper economic action but rather simply adds cost to US manufacturers. Therefore, we think logic ultimately prevails, and the policy is radically transformed (keeping 50% on everyone else but exempting ‘friendly trading partners’ Chile, Canada and Peru from the tariffs solves the problem),” they told clients.

Jefferies analysts Christopher LaFemina and Patricia Hove agree: “The US will still rely on foreign mines to meet demand for the foreseeable future.”

In the meantime, weird distortions in the metals markets have already started to kick in.

In addition to the New York-London spread, there’s suddenly a rally in scrap copper.

Bloomberg’s John Authers reports: “A short-term fix … requires boosting production from copper scrap, which has traditionally been shipped to processors overseas. The surge in Comex prices invariably fed into scrap. That might now turn out to be a lifeline, even if temporary, while policymakers await the broader impact from tariffs.”

This is where we are now: The Golden Age of scrap metal.

Here’s a snapshot of the action prior to the opening bell in New York:

- S&P 500 futures were down marginally this morning, premarket. The underlying index rose 0.61% yesterday.

- The UK’s FTSE 100 rose 1.14% to touch a new all-time high.

- Stoxx Europe 600 was up 0.59% in early trading.

- South Korea’s Kospi was up 1.58% this morning.

- The Nikkei 225 was down 0.44%.

- Bitcoin neared its all-time high according to Bloomberg, hitting $112,009 on some exchanges. Coinbase rose 5.36% on the news. BTC is currently just above $111K.