- While European markets benefited from the Ukraine war, analysts believe peace could boost the euro and stocks even more. Lingering distrust of Russia means Europe is unlikely to cut defense spending after any ceasefire. NATO’s new commitment to 5% of GDP for defense means military investment will continue regardless of peace talks, analysts at Macquarie say.

President Trump meets Russia’s Vladimir Putin in Alaska later this week to discuss the possibility of a ceasefire or a peace deal to end Russia’s invasion of Ukraine.

Politically, Trump would very much like to claim credit for ending the conflict on Europe’s eastern border. Unfortunately, Russia has broken 190 different “deals” over Ukraine since 1994, and 25 of those were since 2014. So there is every chance that a “deal” may be announced, followed by a resumption of hostilities by Moscow.

For investors in Europe, this may be no bad thing, according to Macquarie analysts Thierry Wizman and Gareth Berry. The euro may rally against the dollar, they predict, as it is unlikely that Europe will roll back defense spending simply because Putin signs another piece of paper.

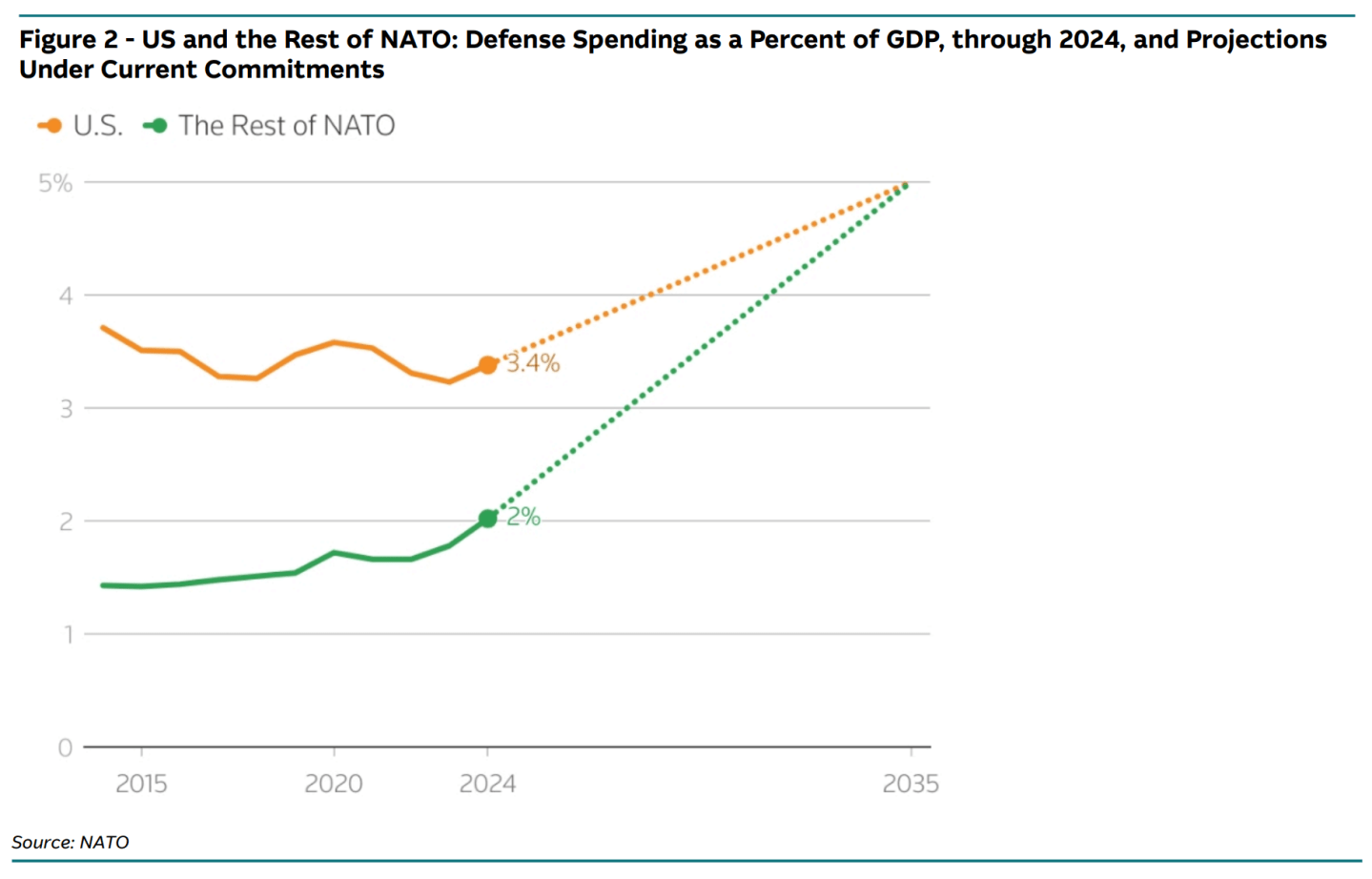

And, they note, European stocks have done well this year, boosted by a massive military spending package from NATO countries that commits all European allies to devote 5% of their GDP to defense.

“The prospect of European growth and reinflation may have also been boosted by the war, since the conflict energized new commitments to increase defense expenditure and associated infrastructure expenditure in Europe. Notably, the June 2025 NATO summit saw a formalization of the plan to get each country to spending the equivalent of 5% of GDP on defense by 2035,” they write. “The ramp up is steeper than in the U.S.”

The scale of Europe’s return to military spending is underappreciated, according to an analysis of satellite imagery carried out by the Financial Times. More than 7 million square meters of new military production facilities have been added in Europe since 2022, at 150 sites across 37 companies.

After the Cold War ended in 1989, Europe reduced its defense spending to enjoy a “peace dividend.” Might that not happen again, if Putin freezes his action in Eastern Ukraine? Unlikely, the Macquarie team says, because no one in Europe believes that Putin is likely to disarm or avoid future military engagements.

“A review of what analysts have written about this topic leans us strongly toward the view that the EU and NATO would not roll back commitments toward higher defense spending if some form of ‘peace’ came to Russia and Ukraine. Even with a peace agreement or ceasefire, the long-term implications of Russia’s actions and the potential for future conflict could lead the EU to maintain or increase defense spending to ensure long-term security and deter potential aggression later,” they wrote.