Nvidia posted record results for the second quarter of 2025, exceeding analysts’ expectations on both revenue and profit, yet shares slipped modestly in after-hours trading as its crucial data center division narrowly missed Wall Street forecasts.

Nvidia reported revenue of $46.7 billion for the second quarter, marking a 56% increase compared to the same period last year. Adjusted earnings per share reached $1.05, beating analyst estimates by $0.04. Investors had extremely high expectations for Nvidia’s data center division, with forecasts set at $41.3 billion. The reported figure was $41.1 billion, a 56% increase year-over-year but just below consensus, raising concerns about whether the pace of AI-driven growth is peaking or facing headwinds, leading to a roughly 3% drop in shares after the report. Investors could also be reacting to the fact that Nvidia’s sales gain was the smallest percentage in over two years and the forecast showed that it continues to expect a slowdown in growth.

Market context & AI impact

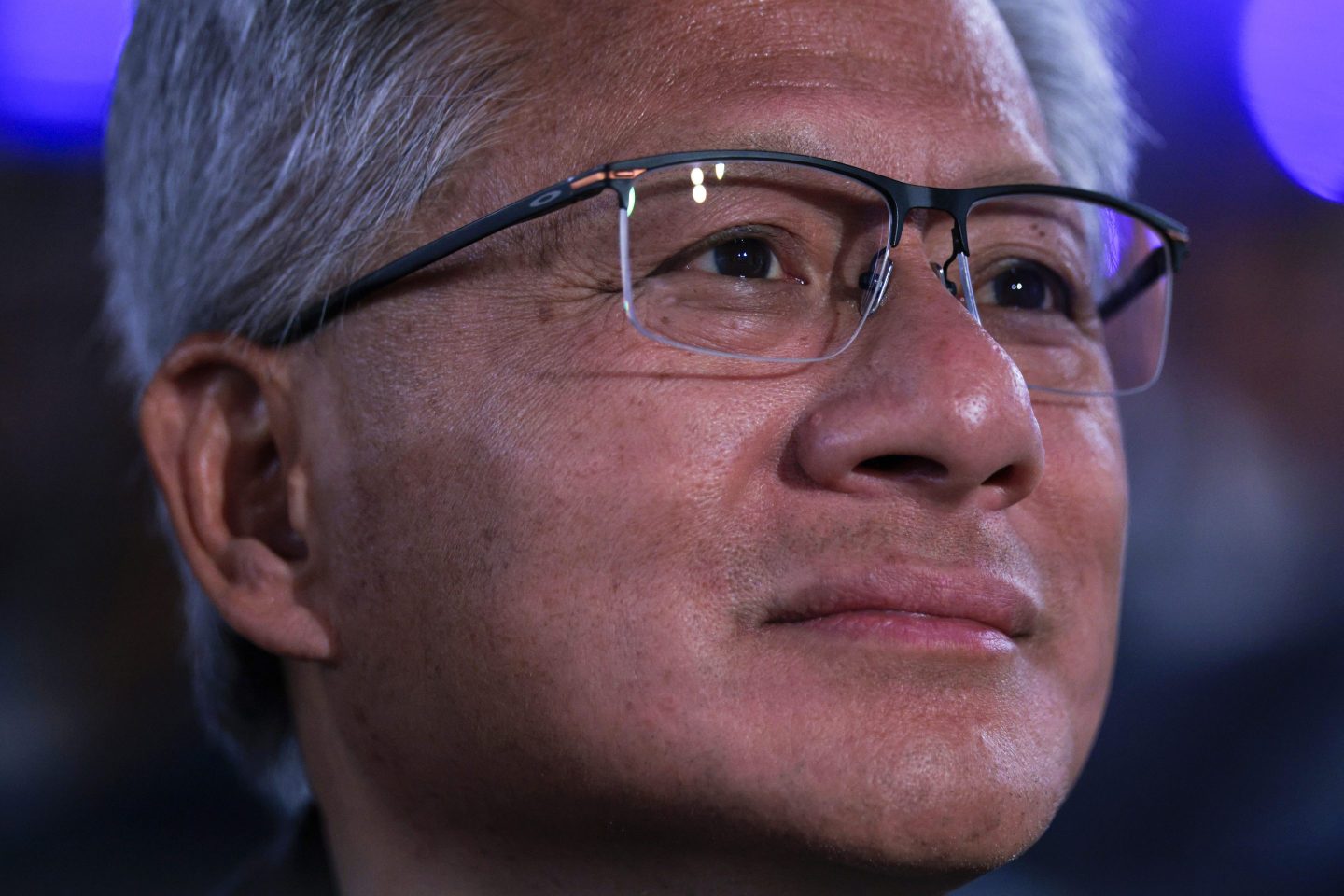

Nvidia remains the world’s most valuable company, with a market capitalization above $4 trillion, reflecting investor optimism about its dominant role in AI infrastructure. Tech giants including Microsoft, Meta, Amazon, and Alphabet continue to invest heavily in Nvidia-powered data centers, sustaining high demand for its graphics processing units (GPUs). The company’s Blackwell chip line remains in high demand, though CEO Jensen Huang acknowledged production capacity constraints rather than lack of customer interest.

Nvidia projected third-quarter revenue of $54 billion, plus or minus 2%, not assuming any future sales of its H20 AI chips to China, which have been affected by recent export restrictions and U.S. Policy shifts. The company also announced an aggressive $60 billion stock repurchase program, underscoring management’s confidence in continued growth and cash generation.

Jittery markets

Nvidia remains the top-performing stock among mega-cap technology names in 2025, rising over 30% year-to-date. Most Wall Street analysts maintain a buy rating, citing Nvidia’s outsized share of the fast-growing AI chip market and confidence in its next-generation product launches.

The market is slightly on edge due to increasing talk of an AI bubble, including from the mouth of OpenAI CEO Sam Altman himself. A report in The New York Times suggested that Meta may be restructuring its superintelligence division and a widely read MIT report found that 95% of generative AI pilots in the corporate sector were failing, with zero return on investment. The resulting sell-off wiped out Palantir’s gains in the weeks since its own blowout earnings report.

In reaction to the Nvidia earnings, several chip stocks traded down after-market on Wednesday, including Advanced Micro Devices dropping 1.3%, Micron Technology falling 1%, Taiwan Semiconductor Manufacturing shedding 1.7%, Broadcom dropping 1.2%, and Intel slipping 0.3%.

For this story, Coins2Day used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.