For a man who has been thrust into the political spotlight as President Trump’s appointee to the Fed Board of Governors, relatively little is known about Stephen Miran. Back in May, when Coins2Day profiled President Trump’s then newly confirmed head of the Council of Economic Advisers, he spoke candidly about his formative years and economic training, but it was hard to find many peers who had even heard of him. Heads of the CEA are typically either prestigious names drawn from top universities (Ben Bernanke, Jason Furman, Austan Goolsbee) or longtime Washington operatives, or both. Despite a brief stint at the Department of the Treasury during Trump’s first term, Miran—who’d previously worked as an economist on Wall Street—checked neither box. In fact, many sources I spoke to for that story didn’t even know how to correctly pronounce his name (it’s MY-run not MIR-an).

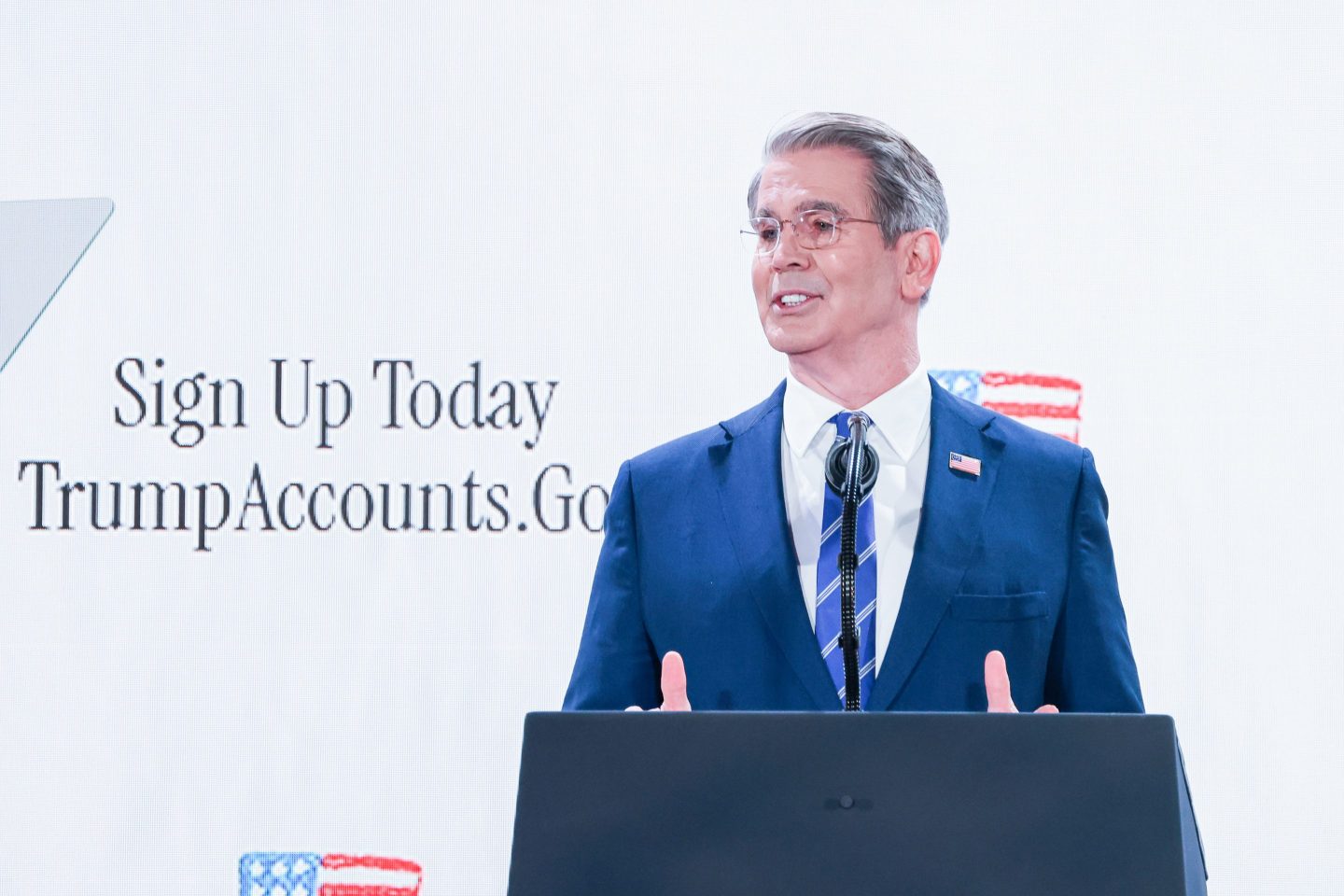

But it’s hard to escape his name now. In naming Miran to the Fed’s seven-member board, President Trump has ignited a firestorm with critics alleging that he is politicizing a vital and independent organ of the economy. At his first Fed meeting, in September, Miran indeed proved an outlier, voting for a jumbo, 50-basis-point reduction from the Fed, twice the 25 that carried the Federal Open Market Committee majority.

It’s no secret what Trump wants from his young appointee. But what does Miran really believe? To answer that question ahead of my interview with him, I went back to his writings. In the spring of 2023, he’d left the financial world to primarily become a pundit; his outlet was City Journal, published by leading conservative think tank the Manhattan Institute. Over the next 20 months, Miran would author well over 30 pieces for City Journal, covering topics that varied from trade policy to advice on personal investing, many of which were also published in the Financial Times, Barron’s, and the Wall Street Journal. I read all of those pieces, and got a compressive view of Miran’s economic philosophy. Put simply, he expressed a highly unusual mix of ultra-protectionism on trade, and conventional free-market views advocating sweeping deregulation, especially the elimination of costly environmental strictures.

But in light of today’s debate, I found it fascinating that a topic Miran returned to repeatedly was the Fed’s independence. Miran himself argued in his City Journal pieces that the central bank had already become a virtual arm of the U.S. Treasury under President Biden. And that the near-union proved a disaster for the economy. In the article titled “The Fed Isn’t as Independent as It Seems,” Miran pointed out that numerous officials had worked at both Treasury and the Fed at different times, including Jerome Powell and Janet Yellen, and noted that current Chicago Fed president Austan Goolsbee advised Biden’s 2020 campaign. Miran argued that “the merger of teams from the Fed and rest of the executive branch has served to fuse them together rather than keep the Fed cordoned off.”

Most of all, Miran stressed that the Fed did the Treasury’s bidding in the post-pandemic period under Biden. He notes that the Treasury issued enormous volumes of short-term debt in funding trillions of dollars in stimulus, and that instead of doing its duty and substantially tightening to blunt a steep rise in prices, the Powell Fed kept the Fed funds rate far too low for too long, triggering the notorious explosion in prices. “Indeed, despite federal deficits that ballooned in this time to $2 trillion and a stimulative shortening of Treasury’s issuance profile, the Fed passively allowed fiscal policy to continue overheating the economy,” Miran writes. “The Powell Fed didn’t begin to raise rates until consumer price inflation was 8.5%.”

Of course, Miran’s other favorite topic is trade. When I interviewed him in May he talked for the first time about the formative experiences that made him such a hawk. As a newly minted PhD from Harvard, Miran worked as an economist for a currency-focused hedge fund, and was shocked at how different the marketplace really was from the version in economic textbooks. Miran says he witnessed firsthand that China was clearly manipulating the value of their currency to keep the yuan artificially cheap, boosting its imports to the U.S., and making our goods overpriced to their markets, sapping our exports. “Heavily managed currencies were making markets behave in weird ways,” he told me.

Miran also showed the broad scope of his intellectual interests. As an undergrad at Boston University, he’d taken a second major in philosophy, and developed great admiration for the 18th-century Scottish legend David Hume, who inspired the father of economics, Adam Smith, and iconic naturalist Charles Darwin. Hume was a pioneering empiricist during the Enlightenment who insisted that insights on human nature arose not from theories and hypotheses, but only direct observation of how people behaved—and that it was impossible to make predictions by studying what had happened in the past. “I credit that [the study of Hume] with teaching me to ask radically inconvenient questions,” says Miran.

We will soon see if Miran’s eloquent argument for Fed independence applies only to the past, or crumbles under the weight of a powerful president pushing his new appointee.