Good morning. Fast-casual restaurant Dave’s Hot Chicken began as a $900 pop-up in a Los Angeles parking lot in 2017. Eight years later, the brand has expanded to over 345 stores worldwide—a remarkable rise from seven locations in early 2020. On Oct. 1, the company announced a partnership with Matternet to launch its first drone-delivery pilot in a Los Angeles suburb, following its entry into the billion-dollar club.

Known for its Nashville-style hot chicken, Dave’s attracted Atlanta-based private equity firm Roark Capital, which specializes in franchised businesses and acquired Subway in 2023. Roark owns two major restaurant holding companies: Inspire Brands (Dunkin’, Buffalo Wild Wings, Sonic) and GoTo Foods (Auntie Anne’s, Carvel, Cinnabon). Dave’s Hot Chicken was acquired by Roark this past summer for $1 billion and expects to reach 400 stores this year.

Founded by childhood friends Dave Kopushyan, Arman Oganesyan, and Tommy Rubenyan, the company has been led by Bill Phelps, co-founder of Wetzel’s Pretzels, as CEO since 2019. James McGehee joined as CFO in 2019 after connecting with the team through Wetzel’s. “I’ve been in the restaurant industry and accounting and finance since 1993, but I fell in love with food first,” McGehee told me.

Scott Putman, SVP of finance, who started with Dave’s in 2021, was previously corporate controller for Wetzel’s Pretzels. Many team members at Dave’s have worked with Phelps before. “People aren’t here by accident,” said McGehee, highlighting the team’s work ethic, expertise, and cultural fit.

Under Phelps, the company strengthened its franchise community by selecting experienced, culturally aligned operators, McGehee said. By combining a standout brand, strong franchisees, and expert management, Dave’s accelerated its growth, he said.

According to data from Technomic, a market research firm, Dave’s U.S. Sales increased 57% in 2024 and surpassed $600 million. Its menu includes chicken tenders, sliders, and bites, as well as cauliflower alternatives. Spice levels range from mild to the intense “Reaper.”

The company’s success is driven by sustained compound annual growth (around 40% CAGR over five years) and a scalable franchise model, McGehee said.

Gen Z is driving fast-food trends with their love of crispy chicken and bold flavor. And Dave’s has a robust social media following, including 2 million Instagram followers and over 4 million TikTok followers, contributing to its rapid expansion. Celebrity partners like Drake and Samuel L. Jackson also support the brand. Putman works closely with the marketing team, meeting weekly.

Navigating the M&A process

McGehee and Putman faced a complex merger-and-acquisition process. Thirteen groups submitted offers, five groups that were in diligence concurrently, McGehee said.

“With five groups doing diligence on us, you’re here all day, all night,” Putman said.

The two would eventually structure a hybrid asset and stock sale that saved shareholders $32 million in taxes, Putman said. By tailoring the approach to benefit both California and out-of-state investors, the team ensured the financial windfall was broadly shared, he said.

The billion-dollar deal with Roark was not just a payday for executives and founders. “A lot of our employees were able to have a life-changing event,” Putman said. Dave’s team worked for years to build the brand, and many shared in the sale’s success, seeing tangible rewards for their loyalty and hard work, he said. “It just feels so good to know my fellow co-workers have a better life for their families and themselves,” he added. “We fought for that.”

McGehee and Putman are also Dave’s franchisees as well, connecting with their peers annually. In January, the management team hosted an in-person meeting with the entire franchise system.

“What we love the most is the breakout sessions where we’re able to have more concentrated time with our franchise owners and operators,” McGehee said.

Sheryl Estrada

[email protected]

Leaderboard

Prithvi (Prith) Gandhi was appointed SVP and CFO of Trex Company, Inc. (NYSE: TREX), a composite decking and railing manufacturer, effective Oct. 6. Gandhi brings over 25 years of financial leadership experience. Most recently, he was EVP and CFO of Beacon Roofing Supply. Earlier in his career, Gandhi had an eight-year tenure at Owens Corning, where he held multiple senior finance roles, including as Interim CFO from 2019-2020.

Danny Leung was promoted to CFO of MoneyHero Limited (Nasdaq: MNY), a personal finance aggregation and comparison platform. Leung had been serving as the company’s interim CFO since Dec. 15, 2024. A senior finance and accounting executive with over two decades of diverse experience across growth-stage businesses, multinational organizations, and publicly traded companies, Leung joined MoneyHero in 2024 as the company’s group director of finance.

Big Deal

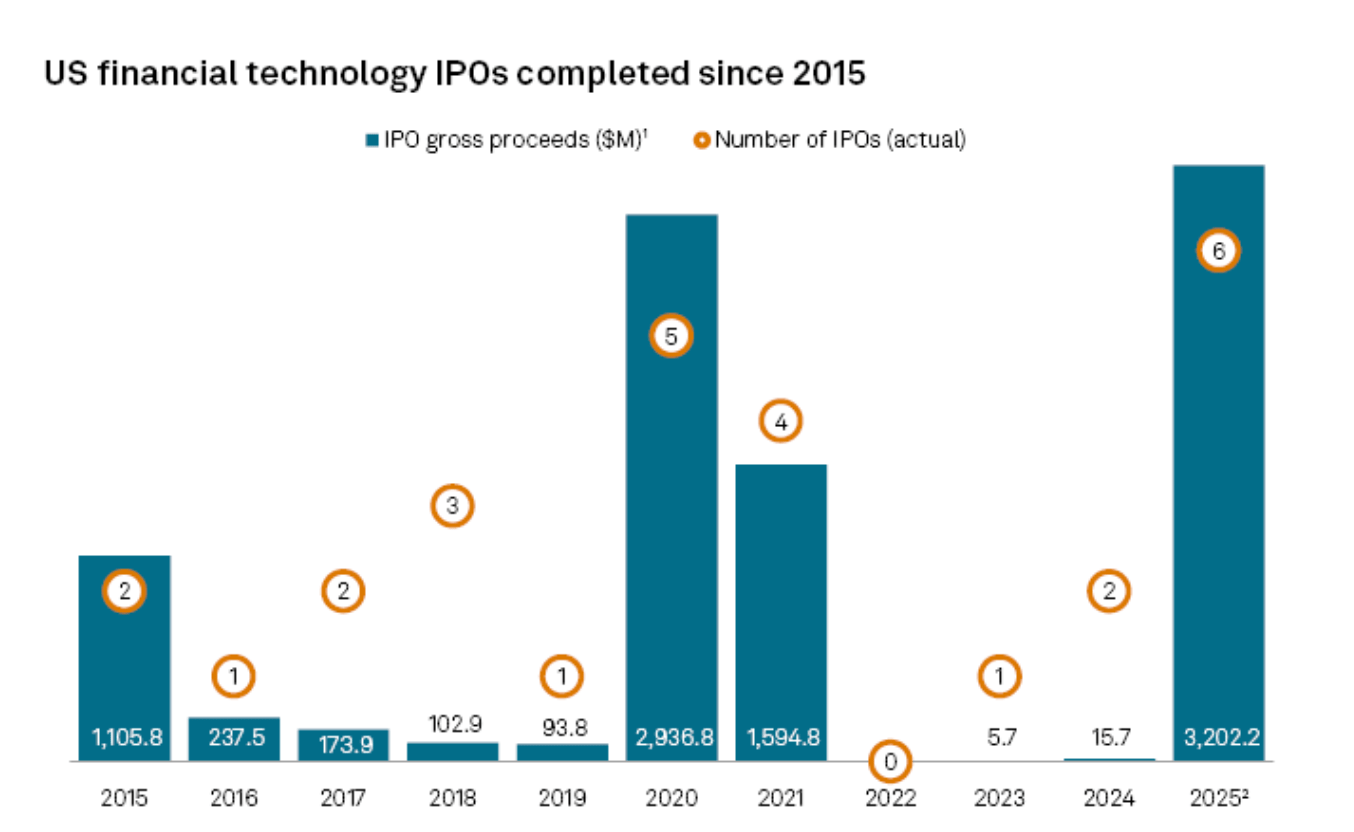

After a slow period for fintech initial public offerings, the IPO market rebounded in 2025, with six fintech companies going public so far this year, according to data from S&P Global Market Intelligence.

As of Sept. 22, these six companies have raised approximately $3.2 billion, marking the highest annual total in at least a decade and surpassing the $2.94 billion raised by five fintech IPOs in 2020, the research finds. The 2025 offerings include Figure Technology Solutions Inc., Gemini Space Station Inc., Platinum Analytics Cayman Ltd., Bullish, Chime Financial Inc., and Aether Holdings Inc.

Courtesy of S&P Global Market Intelligence

Going deeper

"America saw ‘essentially no job growth’ last month, warns Moody’s, and any roles added were in three wealthy states," is a new report by Coins2Day's Eleanor Pringle.

From the report: "Markets are climbing confidently despite the fact that last week concluded without the usual jobs data. Releases by the Bureau of Labor Statistics (BLS) are often key insights into the future trajectory of the economy, but investors are taking the optimistic view in the absence of any bad news.

But Moody’s is warning that private reporting paints a less rosy picture, describing role additions to the jobs market as 'paltry.' Everyone from Wall Street to the Federal Reserve knows America’s labor market is weakening—adding just 22,000 jobs, according to the BLS’s latest release for August—but are unsure by how much."

Overheard

"We are undoubtedly at a tipping point where leaders can train AI systems — but only if human values and intelligence form the foundation on which AI is built will it truly succeed."

—Derya Matras, Meta's VP for EMEA, writes in a Coins2Day opinion piece.