- Deutsche Bank predicts Bitcoin could be added to central bank reserves by 2030 as its volatility falls and its behavior resembles gold, despite not being “backed by anything.” Recent surges in gold and Bitcoin, driven by central banks seeking diversification and companies creating Bitcoin “treasuries,” show Bitcoin’s growing appeal as a safe-haven asset.

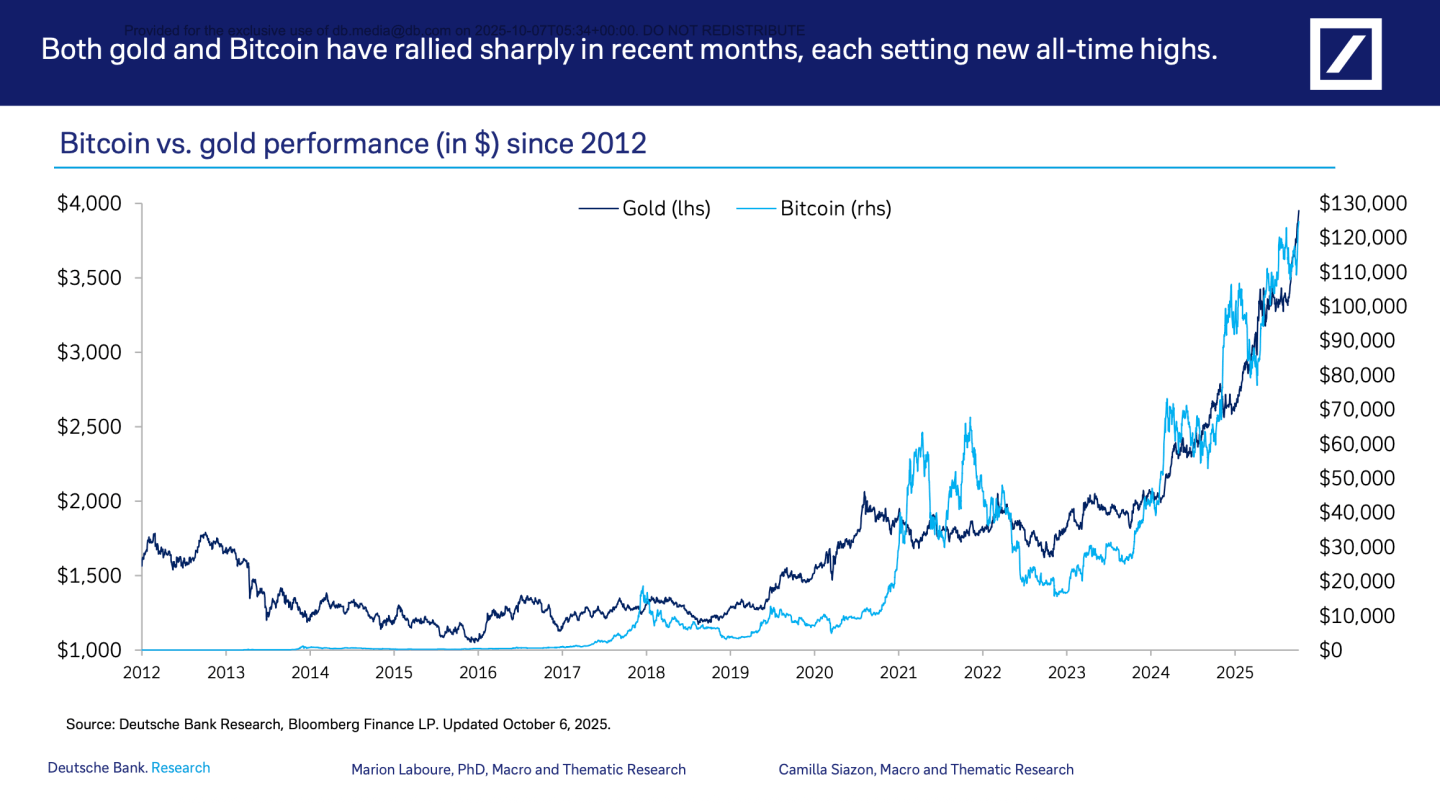

The price of Bitcoin briefly topped $125,000 yesterday, a new record high. And as its price goes up, its relative volatility declines, a new analysis by Deutsche Bank argues. That factor is making Bitcoin more like gold—an asset that has a fixed supply and a low price correlation with other assets.

And that in turn increasingly makes Bitcoin a candidate to be added to central bank reserve assets, according to Deutche analysts Marion Laboure and Camilla Siazon.

“A strategic Bitcoin allocation could emerge as a modern cornerstone of financial security, echoing gold’s role in the 20th century. Assessing volatility, liquidity, strategic value and trust, we find that both assets will likely feature on central bank balance sheets by 2030,” they said in a research slide deck Tuesday.

Their argument is based on the fact that gold (a common central bank asset) and Bitcoin have both risen precipitously in price over the last few years. They produced this chart. (Note the differing vertical axes, which are flattering to the price of gold):

There’s another factor favoring Bitcoin right now: Companies that have created “Bitcoin treasuries” on their balance sheet. Hundreds of companies now count Bitcoin as an asset, most famously Michael Saylor’s Strategy, whose entire strategy is to buy more Bitcoin.

Gold is going up because central banks are steadily buying it has a hedge against political uncertainty in the U.S. And the weakening dollar. Central banks worldwide usually hold U.S. Dollars in their reserves, and while that continues to be the case, many nations have chosen to add gold to diversify their assets.

Marion Laboure and Camilla Siazon’s theory is that as Bitcoin behaves more like gold, and as central banks seek assets that don’t move in tandem with other assets, they’ll be tempted to add crypto.

There is, of course, one catch. Technically, Bitcoin is not an asset. It’s merely a piece of computer code signalling a price. Unlike cash, bonds, property or stocks, Bitcoin does not entitle the owner to any underlying asset, interest, or cash flow.

“The main counter-argument is that Bitcoin – backed by nothing – is too volatile for long-term value,” Laboure and Siazon admit. “Yet, its volatility has now fallen to historic lows.”

The price of gold—as measured by the Comex continuous contract market—sits at $3,983.80 per troy ounce this morning, a whisker below $4,000. Goldman Sachs expects it to go higher. Goldman analysts Lina Thomas and Daan Struyven raised their target price for gold to $4,900, up from their previous estimate of $4,300 because of “sticky” demand.

A big driver of that demand is emerging market central banks, they told clients. “EM central banks are likely to continue the structural diversification of their reserves into gold (contributing 19pp to the 23% price increase we expect by [December 2026]),” they said.

Gold prices have now risen more than 50% this year. That’s the kind of rise you’d normally see in a crisis, according to Jim Reid and his team at Deutsche Bank. They told clients Tuesday morning that markets haven’t seen prices rise like that for more than 40 years. It was “their fastest annual gain since 1979, when they rose +127% amidst a surge in inflation after the oil crisis that year,” they wrote.

And yet the stock markets aren’t behaving as if there is a crisis. The S&P 500 hit a new record high yesterday. It’s up 14.6% year-to-date.

That’s the central, weird theme of the markets right now: Investors are optimistic about stocks at the same time as they’re piling into “safe haven” assets like gold and—if you buy Deutsche Bank’s argument—Bitcoin.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were flat this morning. The index closed up 0.36% in its last session at a new high of 6,740.28.

- STOXX Europe 600 was up 0.15% in early trading.

- The U.K.’s FTSE 100 was up 0.15% in early trading.

- Japan’s Nikkei 225 was flat.

- China’s CSI 300 was up 0.45%.

- The South Korea KOSPI was up 2.7%.

- India’s Nifty 50 was up 0.54% before the end of the session.

- Bitcoin was flat at around $123.8K.