U.S. GDP growth in the first half of 2025 was almost entirely driven by investment in data centers and information processing technology, according to Harvard economist Jason Furman. Excluding these technology-related categories, Furman calculated in a Sept. 27 post on X.com GDP growth would have been just 0.1% on an annualized basis, a near standstill that underlines the increasingly pivotal role of high-tech infrastructure in shaping macroeconomic outcomes.

Furman’s findings, shared online and echoed by financial analysts including Robert Armstrong of the Financial Times‘ Unhedged (the same writer who coined the term “TACO trade’), echo several months of observations on the remarkable surge in data-center infrastructure. In August, Renaissance Macro Research estimated, to date in 2025, the dollar value contributed to GDP growth by AI data-center buildout had surpassed U.S. Consumer spending for the first time ever. That’s remarkable considering consumer spending is two-thirds of GDP.

Technically, as Furman notes, investment in information-processing equipment and software was only 4% of U.S. GDP for the first half of 2025, yet it also accounted for fully 92% of GDP growth over that period. Furman added it’s probably not the case the U.S. Economy would have recorded almost no expansion at all absent this buildout, reasoning that “absent the AI boom we would probably have lower interest rates [and] electricity prices, thus some additional growth in other sectors. In very rough terms that could maybe make up about half of what we got from the AI boom.” But still, it’s big.

Tech giants such as Microsoft, Google, Amazon, Meta, and Nvidia have poured tens of billions of dollars into building and upgrading data centers, responding to explosive demand for artificial intelligence and large language models that require massive computing resources.

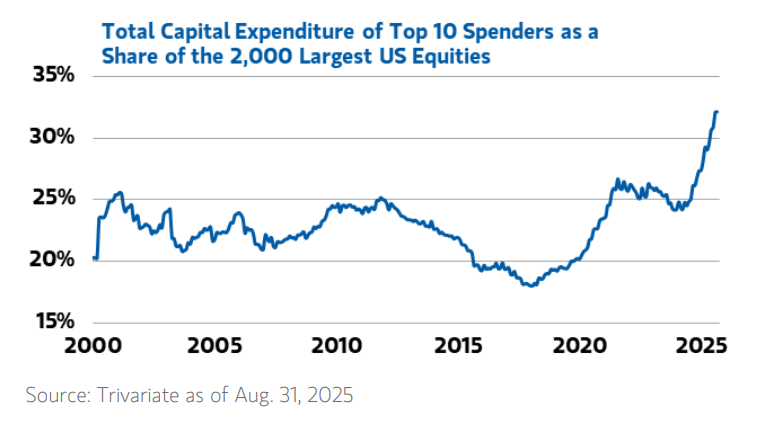

Lisa Shallet, chief investment officer for Morgan Stanley Wealth Management, flagged on Sept. 29 that spending was truly massive among the so-called “hyperscalers” who are striving for huge computing, storage and networking capacity.

“In recent years, hyperscaler capex on data center and related items has risen fourfold and is nearing $400 billion annually,” she wrote. “The speed of growth and size of the investment are skewing its aggregate economic impact, with the top 10 spenders accounting for nearly a third of all spending … For perspective, it’s estimated that data center-linked spending is adding roughly 100 basis points to U.S. Real GDP growth.”

The ‘mystery’ of the economy

This surge in technology-led growth comes against a backdrop of wider economic sluggishness and paradoxically strong GDP growth. Job creation has slowed, raising concerns that, absent technology investment, the U.S. Economy could have slipped into recession. Other sectors—from manufacturing and real estate to retail and services—contributed little or even detracted from overall output in the first half of 2025.

And yet, as Apollo Global Management Chief Economist Torsten Sløk has noted, the GDP figures speak of a (statistically) strong economy.

“The consensus has been wrong since January,” Sløk said in a note circulated to clients in early October, adding the average of economists’ forecasts has said the U.S. Economy would slow down for nine months consecutively. “But the reality is that it has simply not happened … We in the economics profession need to look ourselves in the mirror.”

Furman’s analysis adds to the snarky and accurate observation by Rusty Foster of Today in Tabs who quipped: “Our economy might just be three AI data centers in a trench coat”—an allusion to the data-center buildout boom and to the cartoon trope/sight gag of several young boys teaming up to disguise themselves as an adult.

Morgan Stanley Chief Economist Michael Gapen ventured a guess on Oct. 6 about “the mystery” of the 2025 economy, “between solid spending data and weak hiring.” He argued that it “can be explained by a corporate sector that absorbed the initial cost of tariffs and reduced unit labor costs and profitability rather than raising prices.”

In other words, something that has nothing to do with the data-center buildout that is widely fueling bubble fears, even among Amazon founder Jeff Bezos himself, who insists these data centers are an “industrial bubble” rather than a financial one, and we will all be glad someday to have such incredible computing power at our fingertips with so many hundreds of billions spent. The question of sustainable GDP growth is a separate one.