It’s a buyer’s market, and that means house hunters are walking away from contracts more frequently, according to data from Redfin. Sellers outnumber buyers in the housing market by about 500,000, the real estate firm said, as it found that buyers are wielding more negotiating leverage and asking sellers to cover the cost of any repairs that need to be done and demanding price cuts.

At the same time, many sellers are not accommodating the concerns of would-be buyers, who have become pickier and are seeking more concessions.

About 56,000 U.S. Purchase agreements were canceled in August, representing 15.1% of homes that went under contract. That’s the highest share for August deals falling through in records dating back to 2017. It’s also up from 14.3% in August 2024 and well above the post-pandemic housing frenzy’s rate of 11.4% in August 2021.

“Home purchases are falling through more frequently because buyers and sellers oftentimes aren’t on the same page and aren’t willing to compromise,” Redfin said in its report.

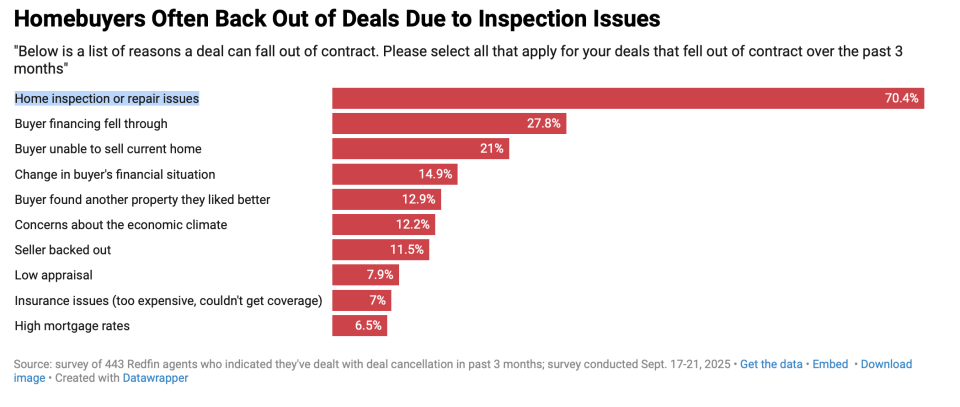

In a survey of Redfin’s real estate agents, 70.4% said home inspection or repair issues were the cause of canceled contracts—by far the top reason.

That was followed by 27.8% who said buyer financing fell through, 21% who said buyers were unable to sell their current homes, 14.9% who cited changes in a buyer’s financial situation, and 12.9% who said a buyer had found another house they preferred.

In addition, many of the cities with the highest cancellation rates were in Florida and Texas, which have seen a surge in housing supply after a pandemic-era exodus to those states triggered a building boom.

Meanwhile, sellers still think their homes will command high asking prices as they did during the housing bonanza in 2020 and 2021, or they paid so much for their properties and aren’t willing to budge on the price.

A new reality for sellers

“Some are having a hard time adjusting to the reality that it’s no longer a seller’s market, because it seems like just yesterday that homes were getting dozens of offers and fetching tens of thousands of dollars over the asking price,” Redfin said.

The report also pointed out that lower-priced homes are in greater demand because overall homeownership costs have jumped in recent years, and those homes are more likely to have issues come up during inspections.

Insurance premiums have surged in states like Florida and California that have seen more natural disasters, contributing to the increase in ownership costs.

Meanwhile, mortgage rates remain high despite coming down since the Federal Reserve lowered benchmark borrowing costs.

In fact, pending home sales actually fell in September, the first time in nearly three months, even as the weekly average mortgage rate dropped for nine consecutive weeks.

Amid the weak demand, home sales are headed for their worst year since 1995 as economic concerns spread from buyers to sellers. A Fannie Mae survey earlier this month showed nearly 70% of Americans believe the economy is headed in the wrong direction, and 73% think it’s a bad time to buy a house.

Given all the anxiety, sometimes sellers who are willing to accommodate buyers’ demands still can’t overcome their cold feet.

“I worked with one seller who received 78 repair requests from a buyer following the inspection, and that was after the seller had already agreed to lower their $375,000 asking price by $25,000 because the house needed some improvements,” said Dawn Liedtke, a Redfin real estate agent in Tampa. “The buyer came back and said they would handle the cost of the repairs, but only if the seller was willing to lower the price by another $100,000. The deal didn’t work out.”