Federal tariff revenue soared to historic highs in fiscal year 2025, fueled by the Trump administration’s aggressive trade strategy, according to a new analysis from a leading fiscal watchdog. The Committee for a Responsible Federal Budget (CRFB) reports that customs duties generated $195 billion this year—a more than 250% jump from the previous year’s tally and a clear signal of the fiscal impact generated by heightened trade measures. Despite this boost, and one-time savings from reforms to student loans amounting to $200 billion, the CRFB notes that the deficit still totaled $1.8 trillion (roughly 6% of GDP), warning that lawmakers will need to identify substantially more deficit reduction to put the $38 trillion national debt on a sustainable path.

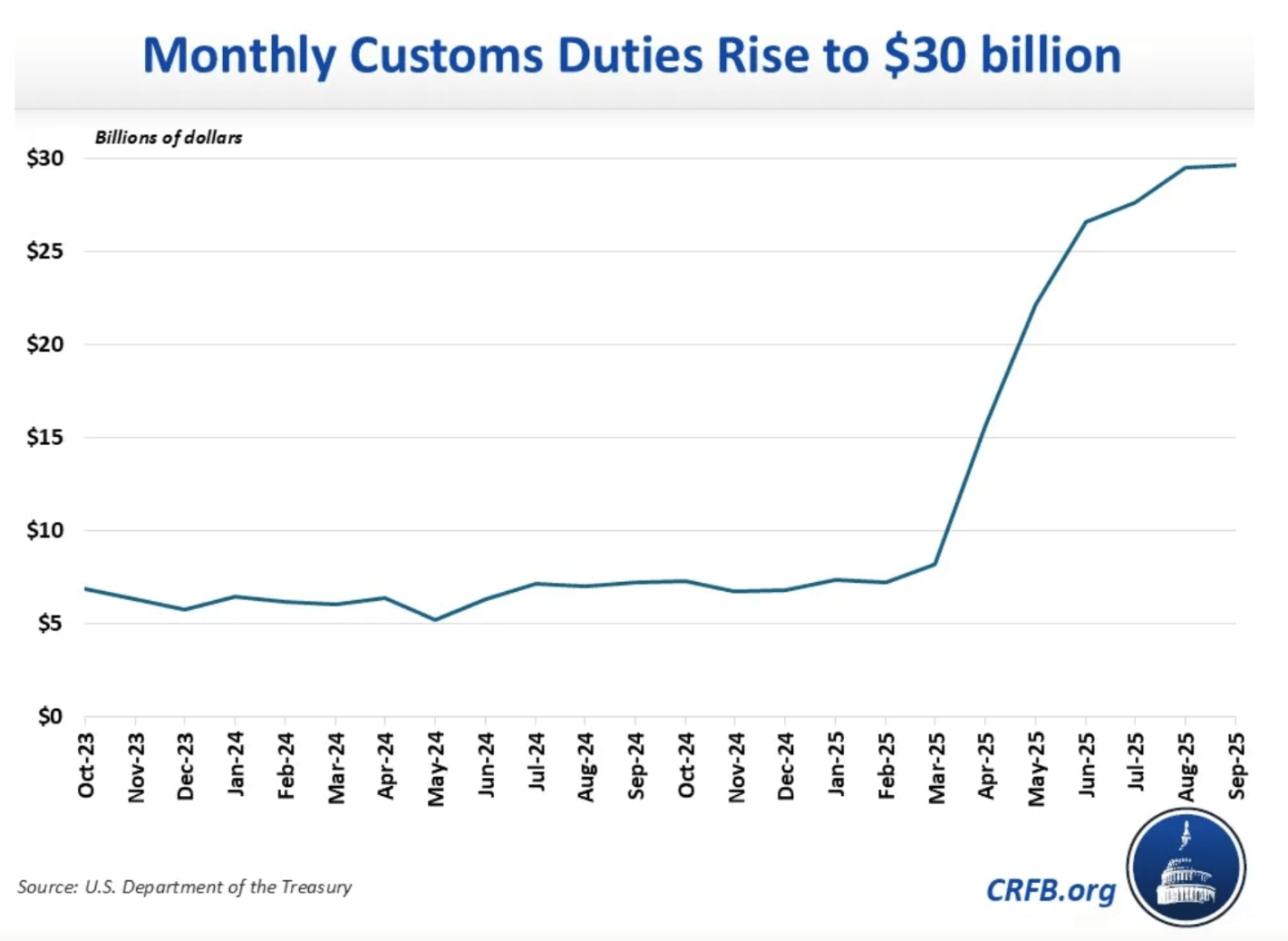

Customs duty collections, which began the fiscal year under preexisting rates, spiked dramatically as the administration introduced new and expanded tariffs throughout the year. Monthly revenue climbed from $7 billion in January to $30 billion by September, culminating in a total annual tariff collection of $195 billion—nearly $118 billion (or 150%) more than the $77 billion collected in 2024. Much of this revenue—roughly $150 billion—came in the second half of the year, where receipts outpaced the same period last year by almost 300%.

The CRFB did not comment in this analysis on exactly who is paying for the tariffs, a subject that is much debated and somewhat opaque given how tariffs are calculated. Federal Reserve governor Chris Waller told CNBC in October that the data he sees suggests that wealthier Americans are bearing a much heavier load from tariff pass-throughs, while Coins2Day’s Shawn Tully and Steve “the Money Doctor” Hanke wrote in August that the tariffs are really a sales tax in disguise.

Student loan savings provide major budget cushion

CRFB’s projections suggest that should current tariffs persist, they could yield as much as $3 trillion in revenue from 2025 through 2035, offsetting a major share of the costs associated with recent spending initiatives. Calculated under standard assumptions, this revenue would cover about two-thirds of the primary deficit impact of the One Big Beautiful Bill Act (OBBBA) over the next five years—more if temporary OBBBA provisions expire on schedule.

However, this optimistic outlook is clouded by significant legal uncertainty. Many of the Trump-era tariffs—particularly those enacted under the International Emergency Economic Powers Act (IEEPA)—have been deemed illegal by lower courts. These rulings have been upheld on appeal but remain under Supreme Court review, with oral arguments scheduled for November and a potential decision before the year’s end. The Trump administration has moved to enact more tariffs not on an IEEPA basis, so even a Supreme Court ruling that the tariffs are as illegal as many scholars say they seem to be on their face could result in other, more technically legal tariffs being erected.

Should the Supreme Court affirm the lower courts’ decisions, as much as $90 billion of the $195 billion collected this year could be refunded to importers, per calculations from U.S. Customs, and projected future revenue from these tariffs would fall by more than half. The deficit, as a share of the economy, would climb—annual federal shortfalls are projected to reach 6.7% of GDP, and the national debt would rise to 126% of GDP by 2035.

For this story, Coins2Day used generative AI to help with an initial draft. An editor verified the accuracy of the information before publishing.