The last time I interviewed Alfred Lin we discussed, among other things, contradictions.

Lin—famed as the thoughtful backer of companies like DoorDash, Airbnb, and Citadel Securities—said something I’ve thought about many times since: That it’s important to be able to hold ideas in “extreme tension,” because that’s, in effect, the only path to truth, to knowing what your options truly are.

“The thing about holding things in tension, in extreme tension, is that the right answer is almost definitely somewhere in the middle,” Lin told me in an interview in 2024 about how he thinks about founders. “If you start in the middle and radiate out from there, you think ‘Oh, this is obvious, it makes sense.’ Then you limit the number of solutions you look at. If you look at the extreme and work towards the center, you traverse almost every single possibility. That’s why when people hold things in tension, they tend to come up with more options.”

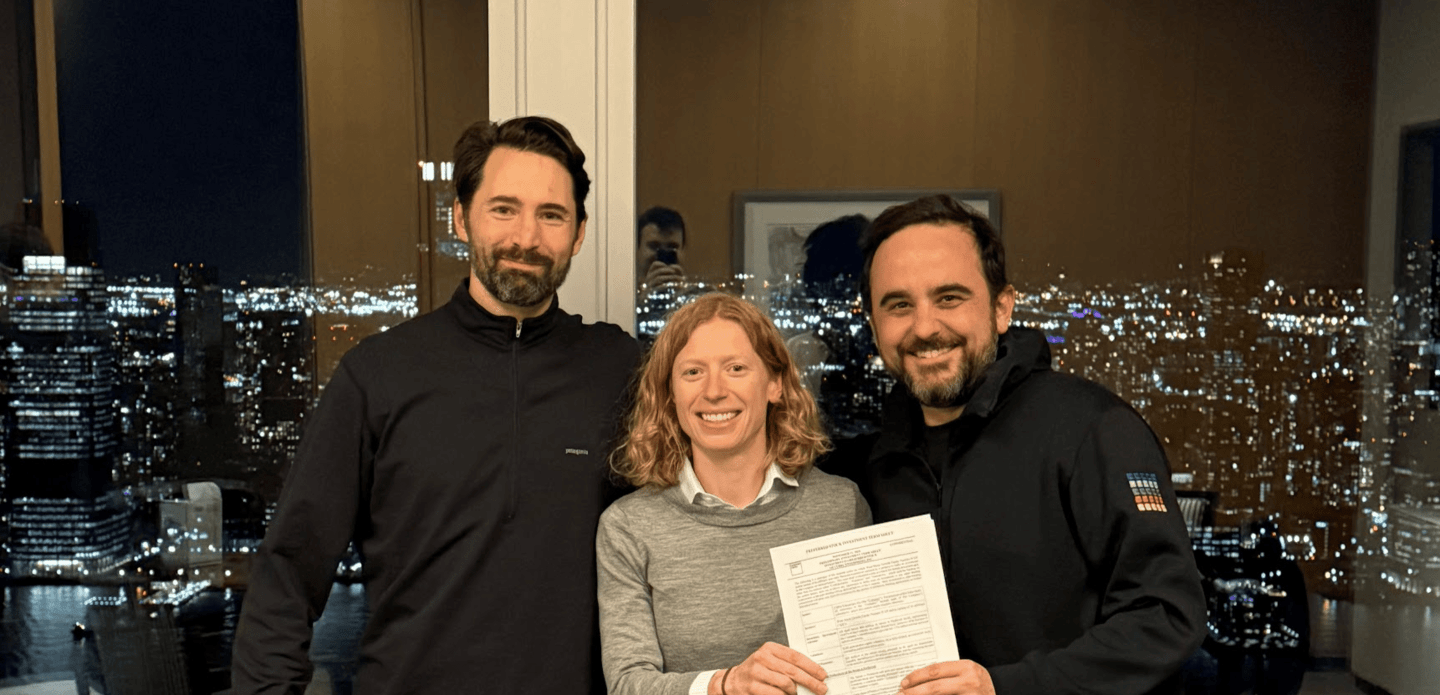

Lin has long been regarded as the best of the best among Silicon Valley VCs, and yesterday he came to the fore in a way I consider (yes, in somewhat contradictory terms) surprising but inevitable: Sequoia announced that Roelof Botha would step down as the firm’s steward, and that Lin and Sequoia partner Pat Grady would take up the mantle as co-stewards.

Now, this is surprising on some level: Botha is only 52, and the YouTube and Instagram investor has been leading Sequoia for nearly a decade (he’s been on his own as sole steward since 2022). At the same time, there’s a layer of inevitability: Sequoia has conducted generational transfers five times over its 53 years, has previously had co-stewards more often than not, and Grady and Lin are both uniquely suited to the task.

While Lin has led the firm’s early stage investing since 2017, Grady has steered Sequoia’s growth stage investing practice since 2015, leading deals in Snowflake, Zoom, ServiceNow, Harvey, and OpenEvidence. Both have longstanding reputations as excellent investors, proven over time in a business that even at its very best can be fickle. Lin is also on the board of Kalshi, and both led Sequoia’s investments in OpenAI.

If you aren’t familiar with Lin and Grady, some facts and throughlines: Lin’s early career was defined by his time as chairman, COO, and CFO at Zappos up until its blockbuster acquisition by Amazon. Meanwhile, Grady, the younger of the two, started his career at Summit Partners, landing at Sequoia in 2007. (Lin would join the firm in 2010.) Their backstories have some parallels, as both have personal histories that start far from the top of Silicon Valley: Lin’s parents immigrated from Taiwan when he was a kid, and Grady grew up in a Wyoming coal mining region.

Sequoia has its own contradictions to contend with moving forward—despite its more than $50 billion in assets under management, Sequoia’s long said it remains focused on generating best-in-class returns, and embodying the kind of excellence that implies in an unstable, long-game industry. (Sequoia has a little more than 20 investors, a number that’s remained consistent over time.)

This also happens at a moment where the venture capital goalposts are moving—the industry is bifurcating into asset managers and smaller shops, while politics is becoming an increasingly complicated flashpoint. Some firms, like a16z, have leaned into it, while others have tried to stay away from political issues entirely. Sequoia has kept to a philosophical middle path, maintaining the firm’s “institutional neutrality” while allowing partners to be personally vocal about politics. (There’s history here: Famously, Moritz was a vocal Democrat; Leone was prominently Republican.) That worked for years, but there’s evidence of cracks in that approach.

As Lin and Grady take the wheel—becoming the people who now tend to the most famous tree in venture capital—it’s a time of extremes and contradictions. As they look to keep Sequoia at the top of the startup investing game, they’ll have to consider those extremes and, in doing so, perhaps find the best possible vision for the future of venture capital.

Term Sheet Podcast… This week, I talked to Cityblock Health cofounder and CEO Dr. Toyin Ajayi. A former physician, Ajayi saw how the system can sometimes work against patients, driving burnout and increasing costs. In 2017, she cofounded Cityblock Health, a tech-forward health care startup that provides care to underserved communities. We talked about doctors as entrepreneurs, health care reform, and AI. Listen and watch here.

See you tomorrow,

Allie Garfinkle

X: @agarfinks

Email: [email protected]

Submit a deal for the Term Sheet newsletter here.

Allie Garfinkle curated the deals section of today’s newsletter. Subscribe here.

Venture Deals

- Beacon Software, a Toronto-based company that acquires software businesses, has raised a $250 million Series B. General Catalyst, Lightspeed, and D1 Capital led the round.

- Parable, a New York-based AI impact measurement startup, has raised $16.5 million in seed funding. HOF Capital led the round, joined by Story Ventures, InMotion Ventures, Lasagna, Panache, Supercharge, and Tripe Impact Capital.

Other

- Arctic Wolf announced plans to acquire ransomware detection company UpSight Security. Financial terms were not disclosed.