Erica Wenger will take an elephant over a unicorn, every time.

“The more I thought about it, the more I realized I was against much of the unicorn obsession,” she said. “It’s just so one-dimensional. Listen, I’m all for making money, and I think elephants can be worth far more than a billion dollars. But people should be looking at traits beyond valuation to determine success. I’ve seen so many people gloat: ‘I backed eight, ten unicorns.’ I’m like: ‘what, you came in at the Series B?’ It wasn’t about the multiple, it wasn’t about the underlying health of the business.”

So, Wenger—who’s a three-time founder, including of exited startups Mistaken for Bacon and Mahkana—came to a decision: “Aileen [Lee] owned unicorns. I want to own elephants.” Elephants, she said, emphasized resilience, solid business fundamentals, and longevity, rather than making a point of chasing sometimes-ephemeral billion-dollar valuations. On Beehiiv in 2023, she first published her “elephants, not unicorns” thesis and it went viral, resonating in a landscape where profitability for all but the most sought-after AI darlings is key. Her goal was that the writing would serve as a branding bat signal. (Her essays have drawn in more than one million views, she told Coins2Day. Wenger, who also worked as Worklife Ventures’s head of platform, has more than 90,000 followers across social media platforms.)

“I want people to find me online, identify with my point of view, and seek me out,” said Wenger. “I want to have my brand and our firm be bigger than me. You can only have so many meetings in one day, so this was a way to reach people. You can also timestamp ideas: ‘I was calling this back then, look at the date.’”

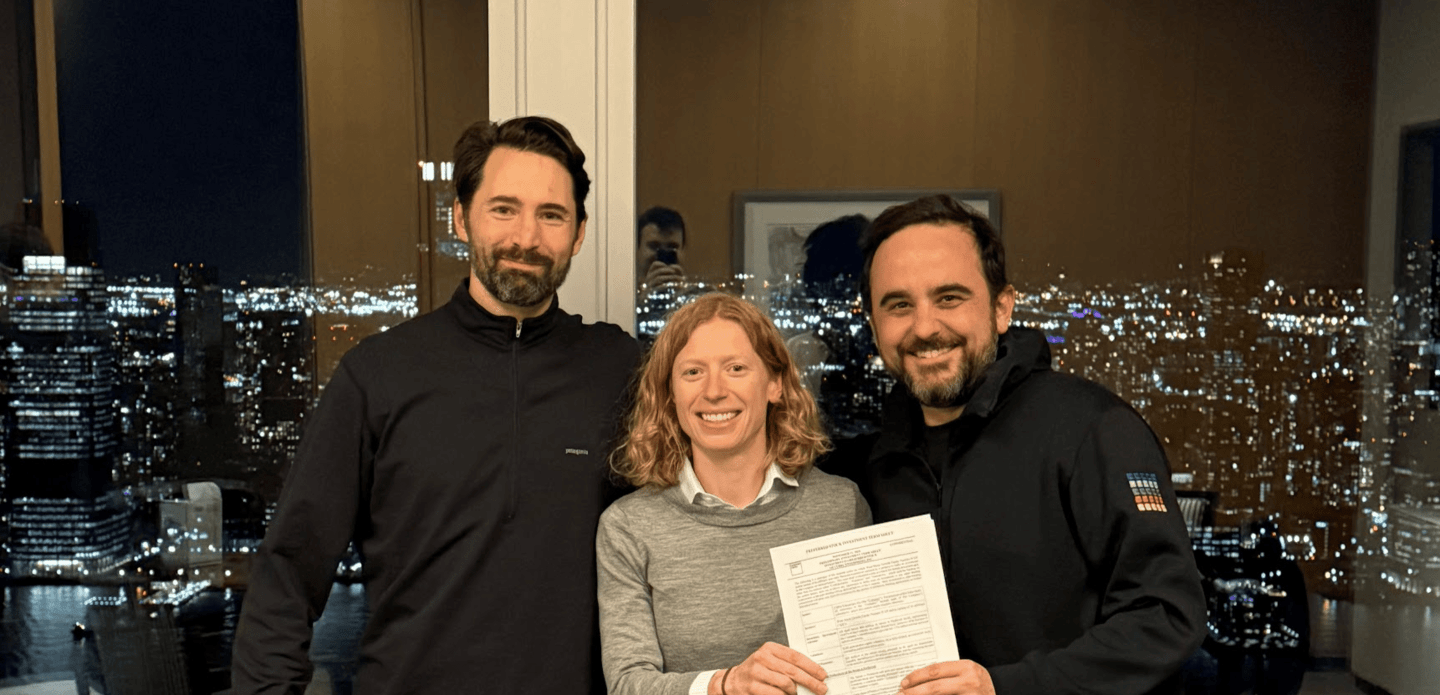

Wenger kept up the wildlife theme, in some sense, when she started Park Rangers Capital in 2023. Now, after raising from 130 LPs, she’s closed the firm’s first fund at $4.3 million, and there are some early prospective winners in her portfolio like Superpower, Clay, and Beehiiv.

“I really wanted to create a broader analogy about what I want to see change in venture,” said Wenger. “When I was a founder, I always felt like the relationship between the VC and founder was a little funky. The VC shouldn’t be the star of the show, it’s actually the founder who’s building. So, the analogy is that the founders are the national parks of the world. They’re majestic. They have life in them… And VCs are the humble park rangers. They’re stewards of the land. They make sure no one’s littering. They let you in, let you out, protect and serve.”

Wenger wanted to evoke “integrity, service, and humility” with the name. It was a characteristic act of narrative-making that resonated with Jacob Peters, founder of $300 million health tech startup Superpower.

“She’s proving that brand, content, and conviction can compound just like capital,” he said via email. “While most investors wait for reputation to happen over decades, Erica is deliberately building it through ideas that resonate.”

To start, Park Rangers have been writing checks between $100,000 and $200,000. But General Atlantic’s Anton Levy—known for backing Alibaba, Uber, Snapchat, and Slack—said via email that Wenger will keep punching above her weight.

“I’ve only known Erica for a few years, but Erica is a force of nature in the best way,” said Levy, co-president, managing director, chairman of the global technology group at General Atlantic. “She’s a hustler in the best sense of the word… relentless, creative, and deeply connected to the founders she backs. What makes her unique is that she doesn’t just talk about community and distribution, she lives it. She’s built a brand, a platform, and a network that most firms multiples her size would envy. “

Term Sheet asked Wenger the central question of this series: what’s next?

“For me, it’s continuing to build out our distribution, building out a really well-respected and beloved firm,” she said. “The way we ask our founders to build their own distribution—that’s the ultimate moat—we’re doing the same thing as a firm. My philosophy is that software is a commodity, as is capital. So, to stand out in this next decade, you have to be an incredible storyteller and go-to-market leader. You have to have a great brand, great content, and be very human. As a fund, we’re mimicking what we tell our founders to do.”

See you Monday,

Allie Garfinkle

X: @agarfinks

Email: [email protected]

Submit a deal for the Term Sheet newsletter here.

Joey Abrams curated the deals section of today’s newsletter. Subscribe here.

Venture Deals

- CHAOS Industries, a Los Angeles, Calif.-based developer of threat-detection and anti-radar software for the defense industry, raised $510 million in Series D funding. Valor Equity Partners led the round and was joined by 8VC and Accel.

- Gopuff, a Philadelphia, Penn.-based courier service, raised $250 million in funding. Eldridge Industries and Valor Equity Partners led the round and were joined by Baillie Gifford, Equalis Capital, and others.

- Alembic, a San Francisco-based developer of a causal AI platform designed to provide marketing analytics for C-Suite executives, raised $145 million in Series B funding. Prysm Capital and Accenture led the round and were joined by Silver Lake Waterman, Liquid 2 Ventures, and others.

- Parallel, a Palo Alto, Calif.-based company developing infrastructure designed to enable AI agents to access and think with the web, raised $100 million in Series A funding. Kleiner Perkins and Index Ventures led the round and were joined by Spark Capital and existing investors.

- Fabric8Labs, a San Diego, Calif.-based developer of advanced additive manufacturing facilities that can create metal parts that cannot be created with traditional manufacturing, raised $50 million in funding. NEA and Intel Capital led the round and were joined by existing investors Lam Capital, TDK Ventures, SE Ventures, and others.

- CloudX, a San Francisco-based AI-powered advertising platform for mobile publishers, raised $30 million in Series A funding. Addition led the round and was joined by DST Global, Terrain, and others.

- sunday, an Atlanta, Ga.-based payment platform designed for restaurant hospitality, raised $21 million in Series B funding from DST Global Partners and others.

- Vend Park, a Boston, Mass.-based AI-powered parking technology and operations company, raised $17.5 million in Series A funding. Blue Heron Capital led the round and was joined by Nuveen’s Real Asset Ventures, Communitas Capital, and others.

- Anzen, a San Francisco-based AI-powered distribution platform for commercial insurance, raised $16 million in Series A funding. Madrona led the round and was joined by Sandbox Industries, SNR, Andreessen Horowitz, and others.

- Milestone, a Tel Aviv, Israel-based platform for measuring the adoption and impact of AI coding tools, raised $10 million in seed funding. Heavybit and Hanaco Ventures led the round and were joined by Atlassian Ventures and angel investors.

- Obello, a San Francisco-based AI-powered graphic design platform, raised $8.5 million in seed funding. Obvious Ventures led the round and was joined by Baukunst and others.

- Bindwell, a San Francisco-based company using AI to develop pesticides designed to be safer, raised $6 million in seed funding. General Catalyst and A Capital led the round and were joined by SV Angel and Paul Graham.

- Skycore Semiconductors, a Copenhagen, Denmark-based developer of power integrated circuit technology for data centers, raised €5 million ($5.8 million) in seed funding. Amadeus APEX Technology Fund led the round and was joined by First Momentum, Mätch VC, and Balnord.

- Cronvall, a Helsinki, Finland-based industrial procurement marketplace, raised €3.9 million ($4.5 million) in funding from Greencode Ventures, Stephen Industries, and Innovestor.

- Vida, an Austin, Texas-based AI phone agent operating system for enterprises, raised $4 million in Series A funding. Trammell Venture Partners led the round and was joined by Timechain and others.

- Theo Ai, a Palo Alto, Calif.-based legal AI platform designed to predict the outcomes of cases, raised $3.4 million in a seed extension. Run Ventures led the round.

- Greenshoe, a Chicago, Ill.-based AI platform designed for SEC disclosure automation and investor relations, raised $3 million in seed funding. AIX Ventures led the round and was joined by Hearst Level Up Ventures, Blueprint FTC, Service Provider Capital, and others.

- Preveta, a Los Angeles, Calif.-based AI-powered care navigation platform designed for specialty care, raised $2.4 million in a Series A extension. Navigate Ventures and Sovereign Capital led the round and were joined by Bullpen Capital and TMV.

- Sensetics, a Princeton, N.J.-based haptics and touch data company, raised $1.8 million in pre-seed funding. MetaVC Partners and Fitz Gate Ventures led the round and were joined by Blue Sky Capital and AIC Ventures.

Private Equity

- TSG Consumer acquired a minority stake in Pura Vida Miami, a Miami, Fla.-based all-day cafe and lifestyle brand. Financial terms were not disclosed.

Exits

- Cognizant agreed to acquire 3Cloud, a Chicago, Ill.-based Microsoft Azure services provider, from Gryphon Investors. Financial terms were not disclosed.

- Investcorp acquired Kanawha Scales & Systems, a Poca, W.V.-based provider of calibration, maintenance, and repair systems for industrial weighing systems and automated control solutions, from American Equipment Holdings, a portfolio company of Rotunda Capital Partners. Financial terms were not disclosed.

Funds + Funds of Funds

- nvp capital, a New York City-based venture capital firm, raised $80 million for its second fund focused on enterprise software and vertical AI companies.

People

- Redpoint Ventures, a San Francisco-based venture capital firm, hired Renee Shah as a partner. Previously, she was with Amplify Partners.