The watershed moment came in July when the federal government became the largest shareholder of MP Materials, a California miner of rare earth elements for the oft-overlooked but critical magnets that help connect the global economy.

The government’s unusual foray into private industry was accompanied by new rules setting minimum U.S. Market prices for some of these materials—a pricing floor it said was necessary to protect MP Materials from Chinese competitors it accused of “dumping” their goods at artificially low prices.

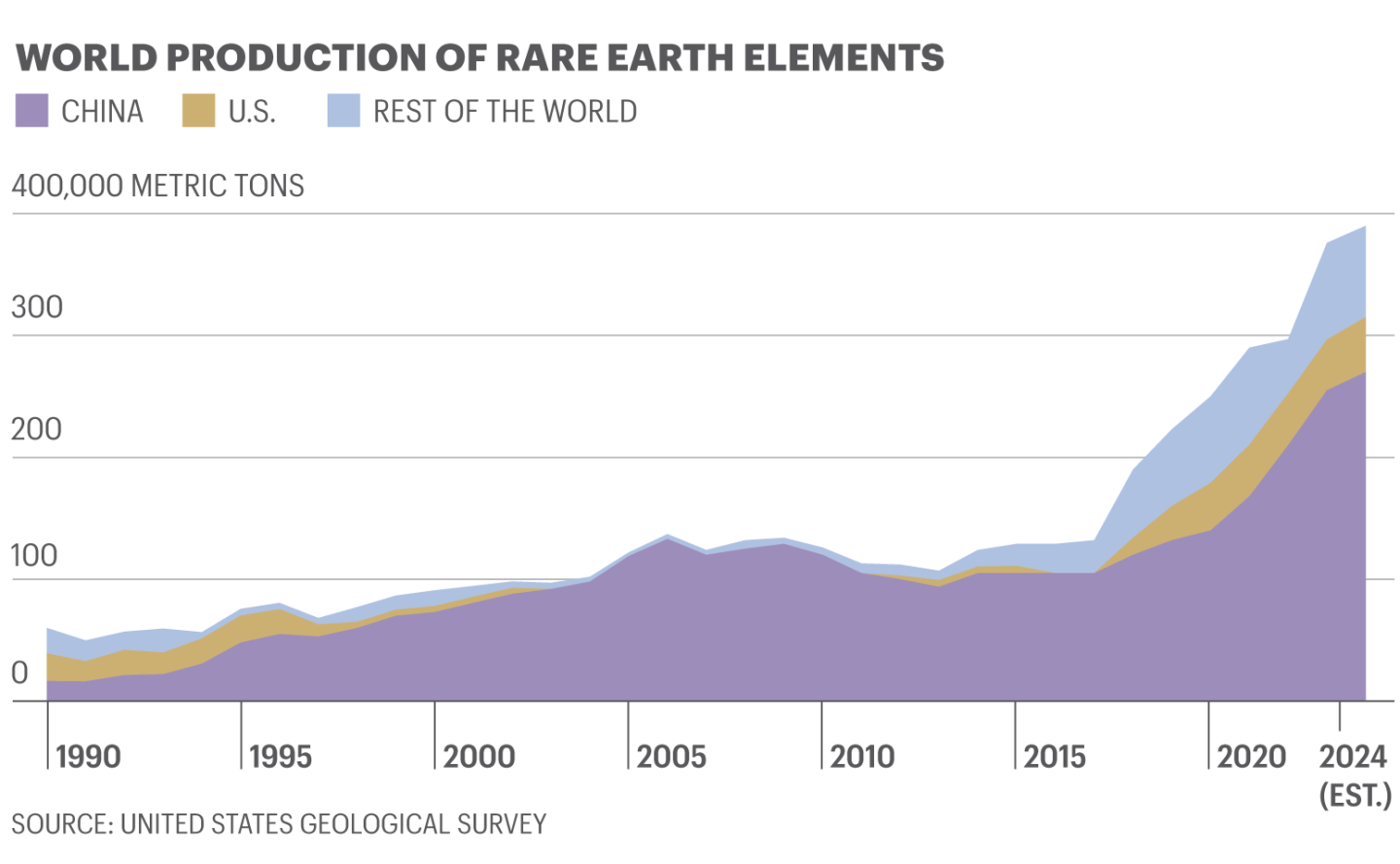

It marked the start of a campaign by the Trump administration to overturn China’s 30-year dominance of trade in many critical minerals that are increasingly integral to the products—from drones and automobiles to data centers and missiles—that drive America’s economy and help bolster its national security.

“This is really a Manhattan Project-style effort with all-out intensity,” MP Materials CEO James Litinsky told Coins2Day. MP is expanding its Mountain Pass mining, refining, and recycling in California and its new Texas magnet plant in this “Cold War 2.0.”

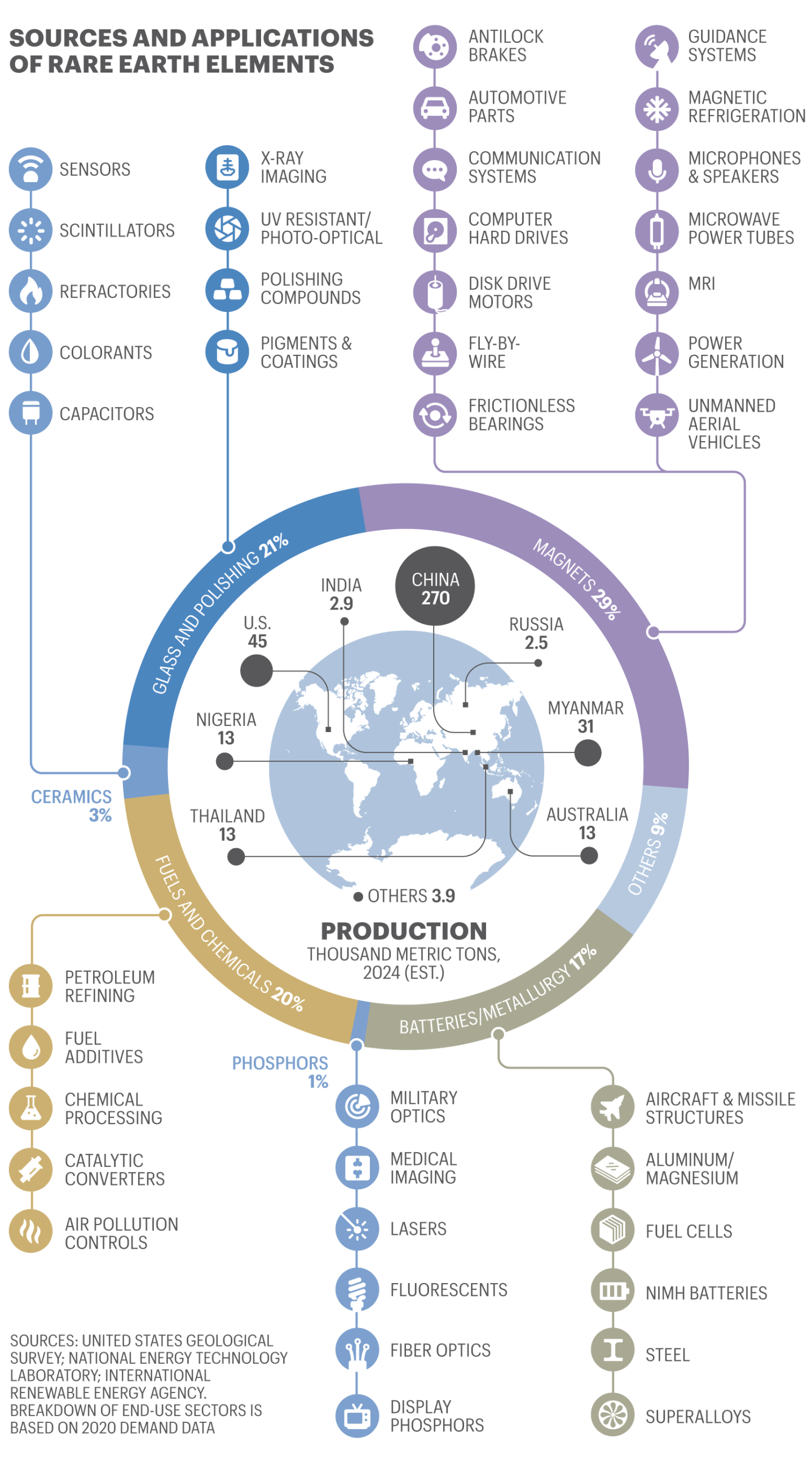

At issue are 60 natural elements deemed “critical minerals” by the U.S. Government, including the 17 so-called rare earths as well as key materials used in batteries. America has zero production of over half of them.

If it’s been a while since you studied the periodic table, rare earths are elements that share silvery-white soft heavy metal characteristics. While none are household names on their own, they are key ingredients in the amenities of modern life. Neodymium-iron-boron (NdFeB) magnets are used in virtually anything that moves. The “core four” rare earths for the magnets, motors, turbines, and more are neodymium and praseodymium, as well as the rarer dysprosium and terbium, which make magnets more heat resistant.

The oxymoron of rare earths is they’re abundant, but they’re difficult to produce because of the challenges extracting, separating, and refining them in large quantities. They’re harder to find in large concentrations, and the infrastructure and technical know-how to refine them are exceedingly difficult to build from scratch without being undermined by China’s subsidized cost advantages.

China mines the vast majority of rare earths and many of the critical minerals, but its strongest chokehold is the refining, where China dominates with a 90% global market share, including 99% for some. It is China’s threatened export controls on dysprosium, terbium, and magnets causing the most concern among U.S. Policymakers and businesses.

Even with the government-backed race to build up domestic mining and refining facilities, the U.S. Can’t go it alone. The country is hurrying to ink international partnerships to circumvent the China-controlled supply chains. Emerging recycling industries and magnet chemistry alternatives are required as well.

“The Trump administration is leaving no tool off the table to safeguard our national and economic security,” the White House told Coins2Day. The new effort is palpable, but it doesn’t erase decades of Chinese superiority and a lack of planning before a tariff war was launched—even now that a temporary truce was struck.

What’s next?

The industry consensus is that—with a concerted effort—the U.S. And allies can make a serious dent in Chinese control in less than five years. But it requires at least a decade to eliminate global reliance on China. In three years, the U.S. Capacity of magnet production could meet a small majority of domestic needs, according to energy research firm Wood Mackenzie. But bottlenecks in rare earths refining may still slow production for years.

Jeff Dickerson, principal advisor for Rystad Energy research firm, fears investors and foreign friends are wary of the U.S. Commitment required to see it through.

“Attention spans are fickle, and I worry that today’s focus on solving challenges will dissipate,” Dickerson said. “We’re stuck trying to dig our way out of a hole without a discernable plan, limited tools to act quickly, and allies who are skeptical of our reliability.”

As it stands now, global demand for magnets made from rare earths is expected to surge 25% over the next five years and then keep growing.

Federal financial support is increasingly flowing as more companies develop U.S. Mines, refining facilities, and magnet plants. The Trump administration, operating as an unofficial sovereign wealth fund with support flowing from various financial sources, recently took shareholder stakes in Canada’s Lithium Americas and its Thacker Pass mining project in Nevada, and in Trilogy Metals and its Alaska minerals projects.

The U.S. Also inked a landmark deal with Australia to increase access to rare earths and other critical minerals. And President Trump recently made several agreements in Asia. Elsewhere, Ramaco Resource’s aims to extract rare earths from its Brook coal mine in Wyoming. Energy Fuels added rare earths processing to its uranium plant in Utah and is planning mines internationally. USA Rare Earth plans to mine for rare earths in West Texas and produce magnets in Oklahoma.

On the refining and magnets side, Noveon is producing magnets in Texas and recycling them with goals to expand, and e-VAC Magnetics is opening a plant in South Carolina. Canada’s Ucore Rare Metals recently broke ground on a processing plant in Louisiana. The U.K.’s Pensana just scrapped plans for a rare earths refinery in England to develop one in the U.S. And the industry leader, Australia’s Lynas Rare Earths, wants to build a Texas processing plant but is still seeking more U.S. Government support.

A bevy of domestic projects are underway, but not all will come to fruition. Refiner Phoenix Tailings just opened its first plant in New Hampshire with major expansions planned.

“This is our Sputnik moment where the U.S. Finally woke up and saw that someone else is just killing us in this race,” said CEO Nick Myers.

Leader in the clubhouse

A decade ago, California’s Mountain Pass mine was failing because of heavy indebtedness and China’s price dumping into the global rare earths market.

A hedge fund manager who’d bought into the bonds during the bankruptcy proceedings, Litinsky formed MP Materials and acquired the Mountain Pass assets in 2017. Since then, MP has steadily built up its capabilities, including opening the—not one to miss a marketing opportunity—”Independence” magnet plant in Fort Worth, Texas.

Litinsky didn’t predict the AI boom, but he foresaw the rapidly growing need for magnets and all facets of the supply chain.

“You can have all the rare earths in the world but, if you don’t have magnet-making capability, you’re still sending them to China. You really need all pieces of this puzzle to solve the problem,” he said. “Multibillion-dollar supply chains don’t move overnight, and it was very clear that this would take a long time. We’ve done it thoughtfully in stages.”

Because of MP’s ownership of the only U.S. Mine dedicated to rare earths and its growing vertical integration of magnet production, the U.S. Department of Defense bought a 15% stake in the company this summer for $400 million, sending its market cap soaring.

MP and Apple quickly announced a $500 million partnership to supply magnets fully manufactured from recycled materials, a pledge that entails recycling expansions at both the Mountain Pass and Fort Worth facilities. The deal with the government gives MP confidence to progress with expansions because China’s price-dumping threats are largely removed courtesy of the floor-pricing mechanism.

“They took the things off the table that we needed to warp-speed our investment,” Litinsky said. “That’s actually quite unique.”

The race to build

NioCorp Developments aims to start construction next year on the big Elk Creek critical minerals and rare earths mine in Nebraska. In the meantime, the company awaits a decision on a pending $780 million loan from the Export-Import Bank and hopes to strike a floor-pricing deal with the government.

“The needs are immediate. We’re going to have to bite the bullet, and we’re going to have to build these facilities,” NioCorp CEO Mark Smith told Coins2Day. “With that wake-up message that China sent us, the markets opened up, and now we’re going to be able to address onshoring of these supply chains.”

There’s no doubt that NioCorp and others are angling for similar deals to what MP struck with the federal government, even if it’s just an arrangement on pricing. But it’s also clear not everyone will succeed in scoring such agreements.

“When I go to D.C., I make sure I call that [MP deal] a precedent, and nobody argues,” Smith said. “I’m a true-blue American. When it first came out, I was extremely happy. On the other hand, I like our democratic and capitalist society, and government price supports don’t feel very good. But, when you realize what it’s going to do to stop that vicious Chinese MO they’ve undertaken for 30 or 40 years, it’s really positive.”

The same applies to international projects, especially in territories Trump says he wants to annex.

Critical Metals CEO Tony Sage is developing the massive Tanbreez rare earths mine in Greenland and recently received a letter of intent for a $120 million Ex-Im Bank loan. Sage wants to work with the U.S. To supply the desired heavy rare earths, such as terbium.

“In the 19th century, there was the gold boom. The 20th century was the oil boom,” Sage said. “We’re in the rare earths boom now, but this boom is going to fund everything for the next 30 to 50 years. Everything in your life needs rare earths.”

Many of the proposals are from young companies without vertical integration. That may make it harder for them to ink enough offtake contracts to reach final investment decisions and commence construction, Rystad’s Dickerson said. “This all screams risk to financiers who also have the experience of volatile commodity price cycles in most mineral commodity markets over the past 30 years.”

A possible exception is uranium mining leader Energy Fuels, the third-largest, publicly traded rare earths miner and refiner after Lynas and MP. When uranium markets struggled a few years ago, Energy Fuels started processing rare earths at its White Mesa Mill in Utah.

Now, Energy Fuels aims to develop critical minerals mines in Australia and Madagascar. Too many domestic mining projects lack the necessary mineral quality and economics, Energy Fuels CEO Mark Chalmers said. It will take the combination of domestic refining and magnets production coupled with more international mining and separating partnerships for the U.S. To win in the long run, he said.

“You need these next five years to really get that pendulum to swing in the right direction in a material way,” Chalmers said.

And it may not hurt that Energy Fuel’s Australia mining development is the Donald Project—named after a minerals deposit, not President Trump. “We’ve had a few smiles and chuckles out of that,” he added with a laugh.

Recycling and other alternatives

One way to avoid the challenges of mining and refining rare earths is to simply not use them. Minnesota’s Niron Magnetics is one of the players pursuing alternate paths, recently breaking ground on its first plant with magnets made from iron nitride—utilizing iron from domestic steelmaking and nitrogen from the fertilizer industry.

“We will need to triple the number of magnets in the world,” said Niron CEO Jonathan Rowntree. “There are only enough rare earths for that to double from what’s being actively mined right now and new mines that are opening. This was always going to be a problem.”

The technology took well over a decade to develop, and Niron is still working to further advance the strength of the magnets. But the company already has a partnership with major automaker Stellantis for motor development.

“We were born and raised to compete with China, but we’re playing a different game where there’s no chokehold on the raw material supply or equipment to make our product,” Rowntree said.

The other key approach to upsetting the critical minerals supply chains is recycling. In the U.S., Tesla cofounder and Redwood Materials CEO JB Straubel leads the industry in battery recycling in Nevada and a brand-new, $3.5 billion plant in South Carolina.

The goal is to take old batteries from EVs and other equipment to essentially mine them for their core critical minerals—lithium, cobalt, nickel, and copper. The end goal is creating a circular economy where recycling—not mining—becomes the primary source of the minerals.

“It’s kind of obvious, but not very intuitive, that almost all of the raw materials inside of batteries are reusable,” Straubel told Coins2Day. “As EVs and other energy storage products proliferate in the market, we have this incredible opportunity to evolve toward this materials economy for those products that will be 98% or 99% remanufactured over time.”

The end result is Redwood already is the nation’s unofficial leading “miner” of cobalt through its recycling efforts, and near the top in lithium and nickel.

MP Materials, for instance, plans to take the same recycling route with magnets and rare earths. In magnet manufacturing, more than 20% of the materials are lost during the process and can be recycled, Litinsky said. It will take all of these efforts combined to break China’s monopolistic practices and prevent China from rebuilding its dominance, he said.

“Regardless of which way this goes, Humpty Dumpty is not getting put back together again,” Litinsky said. “Clearly, supply chains are changing no matter what happens.”

A version of this article appears in the December 2025/January 202 6 issue of Coins2Day with the headline “How rare earths became ground zero in the U.S.-China rivalry.”