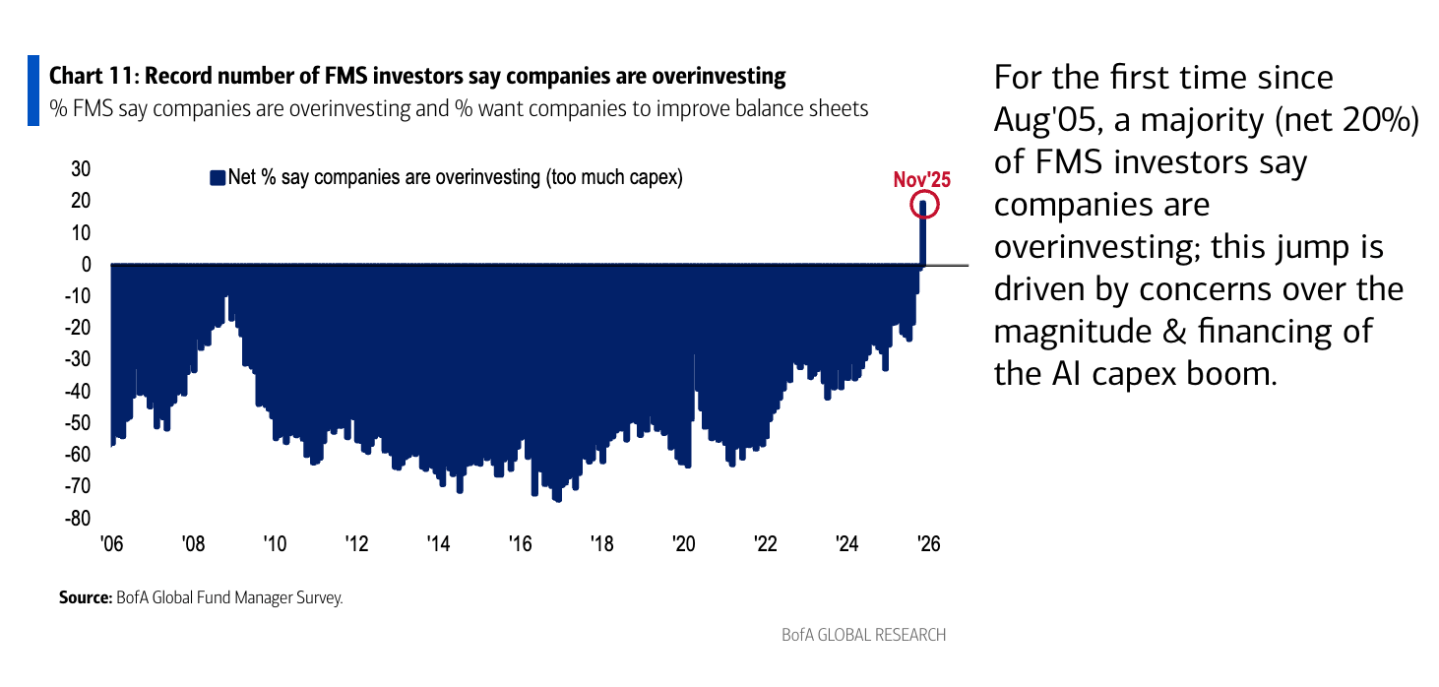

Global fund managers are signaling a historic reversal in sentiment regarding corporate spending, driven primarily by concerns over the aggressive pace and financing of the artificial intelligence (AI) capital expenditure boom. According to the latest Bank of America (BofA) Global Fund Manager Survey (FMS) conducted Nov. 7-13, investors have warned companies are “overinvesting” for the first time in two decades.

The survey of 202 panelists managing $550 billion in assets under management (AUM) revealed a net 20% of FMS investors now believe companies are deploying capital too aggressively—a sentiment not observed since August 2005. This dramatic shift is explicitly linked to the “magnitude & financing of the AI capex boom,” according to Bank of America Research.

The findings are especially resonant the day before Nvidia, the most valuable company in the world and the face (along with the still-private OpenAI) of what “Bond King” Jeffrey Gundlach called “a mania” earlier in the week, is due to report earnings.

Coins2Day‘s Shawn Tully reported Nvidia is facing small, but increasing skepticism among Wall Street analysts, with “cracks appearing” in its strategy. Shalett told Coins2Day in early October she was “very concerned” about what she was seeing in the AI space, with circular financing and market concentration among her concerns.

“At the end of the day … this is not going to be pretty,” if and when the massive spending story in the AI space begins to break down, she said. Earlier today, Nvidia trading down prompted a global stocks sell-off, and shares were down 2.53% as of press time.

For observers, this marked change is read as a clear message to high-growth tech firms: “Slow down, hyperscalers.” The concern about overinvestment is translating into broad balance sheet worries across the corporate sector.

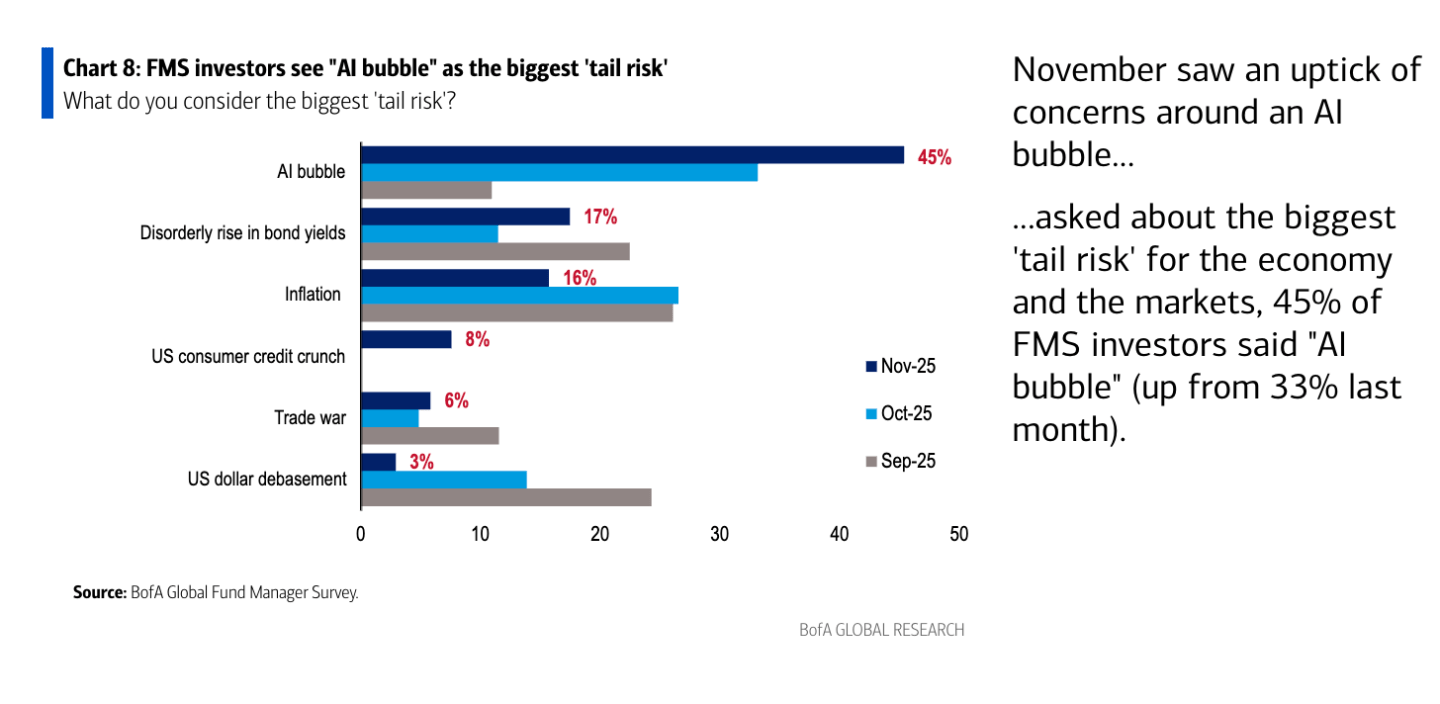

The AI bubble: A top tail risk

The anxiety surrounding corporate spending habits is inseparable from prevailing bubble fears in the technology sector. The BofA FMS identified the “AI bubble” as the #1 biggest “tail risk” for the economy and markets, cited by 45% of investors. This represented a big jump in concern, up from 33%, from the prior month.

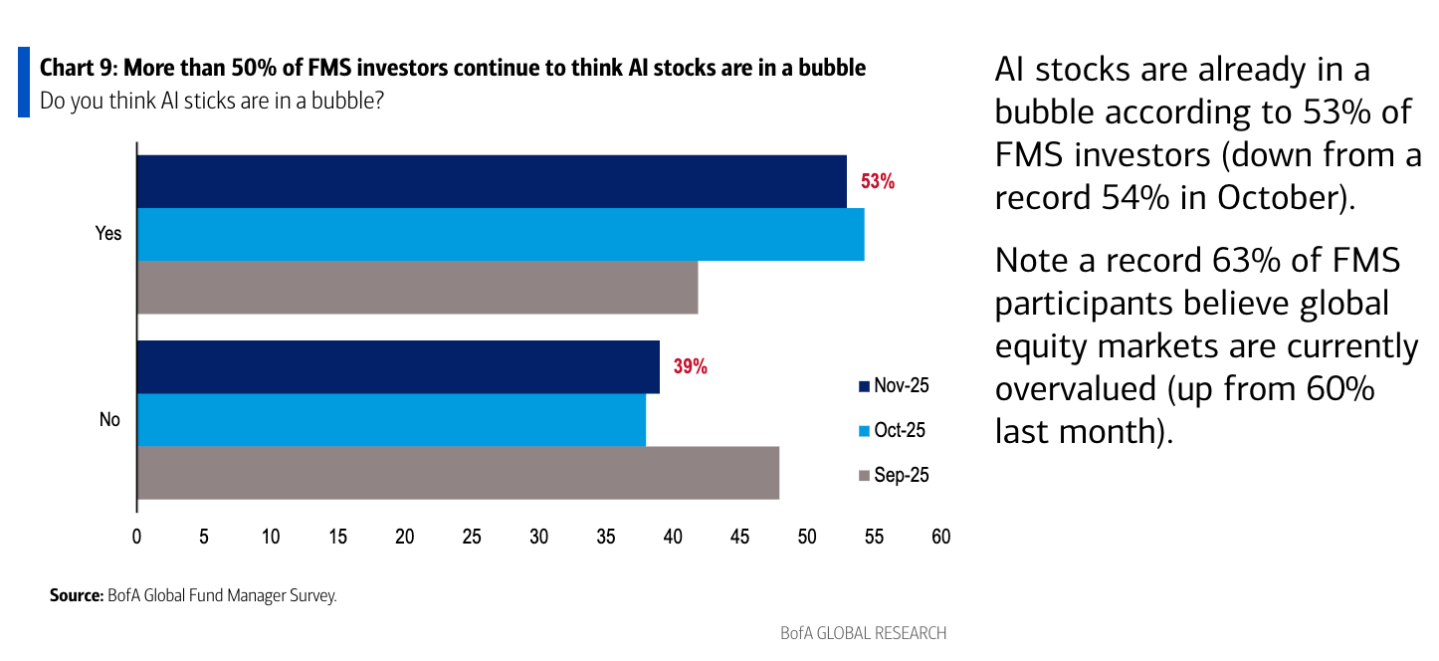

More than half of the surveyed investors, 53%, already believe AI stocks are in a bubble (a result actually down 1% from the previous month). This concentrated risk is further evidenced by the fact “Long Magnificent 7” remains the No. 1 most crowded trade, selected by 54% of FMS participants. This means a large portion of the market is heavily invested in the very companies driving the high capital expenditure managers are now flagging as excessive.

Bullishness meets caution

The new concern over corporate spending arrives despite a prevailing sense of bullishness among investors. Overall investor sentiment, based on cash levels, equity allocation, and global growth expectations, rose to its highest level since February 2025.

Fund managers are currently running extremely low cash levels, dropping to 3.7%. Historically, cash levels at or below 4.0% function as a “sell signal” for global equities. BofA notes that this low cash level has occurred 20 times since 2002, and on every occasion, stocks subsequently fell in the following one to three months. The BofA report suggested that market “froth” may correct further without a December rate cut from the Federal Reserve.

Paradoxically, while investment spending is viewed as excessive now, the potential benefits of AI remain a long-term optimism. The “good news” is that 53% of FMS investors already believe that AI is increasing productivity. Looking ahead to 2026, widespread AI productivity gains are viewed as the single most bullish catalyst for the market (43%). However, the most bearish development expected is inflation coupled with Fed rate hikes (45%).

In a startling weekend appearance on the Prof G Markets podcast with Ed Elson and Scott Galloway, NYU Stern Finance professor Aswath Damodoran offered a stark alternative view: The market is massively underpricing the risk of a major correction. He said there was a greater chance, than “any time in the last 20 years,” of a “market and economic crisis that is potentially catastrophic.” Damodoran recommended investors consider hedging their portfolios by investing in something outside of stocks: collectibles, even baseball cards.

“If that’s where you want to put some of your money into baseball cards, because you’ve truly done your work on baseball cards, who am I to step in and say that’s not a great place to put your money?”