PepsiCo plans to cut prices and eliminate some of its products under a deal with an activist investor announced Monday.

The Purchase, New York-based company, which makes Cheetos, Tostitos and other Frito-Lay products as well as beverages, said it will cut nearly 20% of its product offerings by early next year. PepsiCo said it will use the savings to invest in marketing and improved value for consumers. It didn’t disclose which products or how much it would cut prices.

PepsiCo said it also plans to accelerate the introduction of new offerings with simpler and more functional ingredients, including Doritos Protein and Simply NKD Cheetos and Doritos, which contain no artificial flavors or colors. The company also recently introduced a prebiotic version of its signature cola.

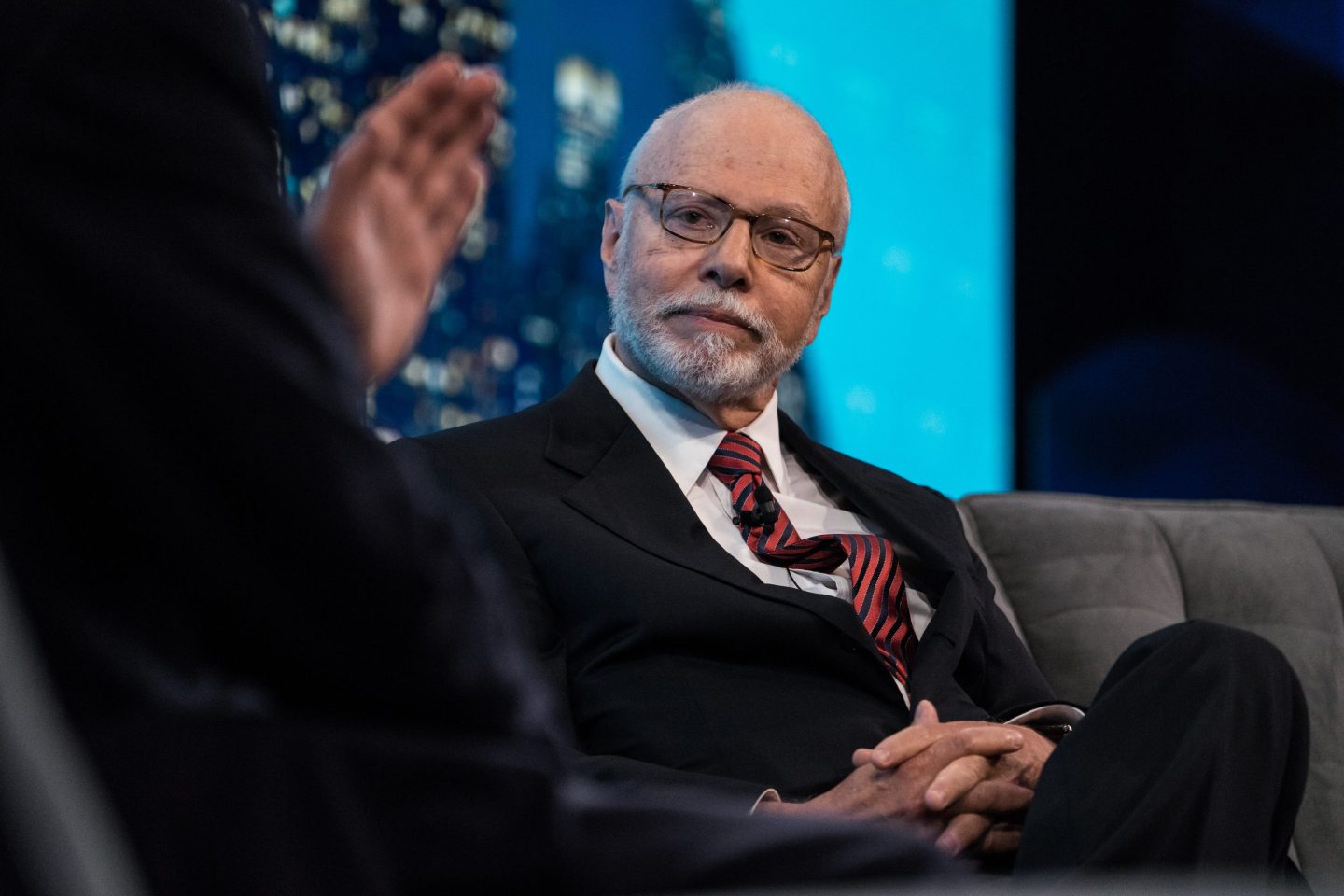

PepsiCo is making the changes after prodding from Elliott Investment Management, which took a $4 billion stake in the company in September. In a letter to PepsiCo’s board, Elliott said the company is being hurt by a lack of strategic clarity, decelerating growth and eroding profitability in its North American food and beverage businesses.

In a joint statement with PepsiCo Monday, Elliott Partner Marc Steinberg said the firm is confident that PepsiCo can create value for shareholders as it executes on its new plan.

“We appreciate our collaborative engagement with PepsiCo’s management team and the urgency they have demonstrated,” Steinberg said. “We believe the plan announced today to invest in affordability, accelerate innovation and aggressively reduce costs will drive greater revenue and profit growth.”

Elliott said it plans to continue working closely with the company.

PepsiCo shares were flat in after-hours trading Monday.

PepsiCo said it expects organic revenue to grow between 2% and 4% in 2026. The company’s organic revenue rose 1.5%. The first nine months of this year.

PepsiCo also said it plans to review its supply chain and continue to make changes to its board, with a focus on global leaders who can help it reach its growth and profitability goals.

“We feel encouraged about the actions and initiatives we are implementing with urgency to improve both marketplace and financial performance,” PepsiCo Chairman and CEO Ramon Laguarta said in a statement.

PepsiCo said in February that years of double-digit price increases and changing customer preferences have weakened demand for its drinks and snacks. In July, the company said it was trying to combat perceptions that its products are too expensive by expanding distribution of value brands like Chester’s and Santitas.