Good morning. Goldman Sachs is betting big on using AI to fundamentally rethink how the company operates.

At the Goldman Sachs U.S. Financial Services Conference on Tuesday, CFO Denis Coleman discussed the company’s recently announced OneGS 3.0 initiative—a multiyear overhaul of its OneGS program aimed at integrating AI throughout the bank’s operating model to reduce complexity and boost productivity. The effort is a top priority and will involve every division and function across the company, from business lines to control functions to engineering, Coleman said. “At its core, it’s an effort to drive more scale and more growth,” he said.

Goldman Sachs (No. 32 on the Coins2Day 500) is emphasizing the quality, availability, accuracy, and timeliness of data that underpins all of its AI initiatives, Coleman noted. That focus includes ensuring the company invests properly in shared platforms that span the organization.

“We’re asking all of our people to rethink the human processes they go through,” Coleman said. “And then we’re making investments in AI and agentic AI to accelerate change across these processes and platforms.”

They have identified six discrete workstreams, created dedicated teams, and tasked them with reviewing key activities, analyzing pain points, and identifying opportunities for efficiency, he said. Each group will then present formal investment cases for leadership review.

“We’ll fund some of those investments and hold teams accountable for the productivity outcomes that follow,” Coleman said. “This is a fundamental rethinking of how we expect our people to operate at Goldman Sachs.”

He added, “We don’t want to simply add more manual processes to drive growth. We need to convert some of that effort into digitized and automated systems—and rethink how those engines work.” Coleman expressed optimism that the OneGS 3.0 strategy will help fuel the firm’s continued growth.

‘The bar for talent remains high’

During the discussion, Coleman also addressed the talent environment, a key concern for many CFOs. “We continue to see incredible demands for people who want to come and work at Goldman Sachs, more than a million people asking to move in laterally to the firm,” Coleman said. “We can accommodate far less than 1%, so we’re still in a position to be extremely selective on the people that we hire.”

Goldman Sachs reduced headcount earlier in 2025 as part of its annual performance review process, which typically targets the lowest 3% to 5% of performers. The company moved that process up to the second quarter from its usual September timing. Despite those cuts, Goldman still expects a net increase in headcount by the end of 2025, supported by hiring in key growth areas.

“The bar for talent remains very high,” Coleman said. “We continue to operate as a pay-for-performance organization. Our goal is to pay competitively—especially for our very best people in each domain—and we are laser-focused on that.”

He added, “As long as markets stay buoyant and the outlook remains optimistic, maintaining that focus will be critical.”

Regarding the U.S. Economic outlook, Coleman described it as “resilient and conducive to business.” He added, “We obviously have a Fed decision coming up. Our economists expect a 25-basis-point cut, likely followed by a pause at the beginning of 2026, and then possibly two more cuts.” Coleman also noted that 2025 is shaping up to be the second-biggest year in history for announced mergers and acquisitions industrywide.

Sheryl Estrada

[email protected]

Leaderboard

Coins2Day 500 Power Moves

Kathryn A. Mikells, senior vice president and chief financial officer of Exxon Mobil (No. 8), will retire effective Feb. 1, 2026. Mikells, who has undergone several procedures to address a debilitating but non-life-threatening health issue, is stepping down to focus on her recovery, according to an SEC filing.

Mikells is among the CFOs represented on the Coins2Day Most Powerful Women list for 2025. She joined Exxon Mobil in 2021. Mikells is the company's first official CFO; before her appointment, the finance duties were shared across a range of executive roles. Mikells is the first woman to join the management committee of Exxon Mobil.

On Dec. 8, Exxon Mobil named Neil A. Hansen, 51, as her successor. Hansen has served as president of Exxon Mobil Global Business Solutions since May 2025 and previously held senior roles in Energy Products, Europe, Africa and Middle East Fuels, and in the company’s controllers, audit, treasury, and investor relations departments, including vice president of investor relations and corporate secretary.

Like other executive officers of the corporation, Hansen will not have an employment contract. His annual salary will be $1.02 million, and he remains eligible for performance-based bonuses and long-term equity incentives.

Every Friday morning, the weekly Coins2Day 500 Power Moves column tracks Coins2Day 500 company C-suite shifts—see the most recent edition.

More notable moves

Jeff Chesnut was appointed CFO of Conestoga Energy, a provider of low-carbon intensity, effective immediately. With over 25 years of experience in strategic planning, capital markets, and finance, Chesnut will play a pivotal role in executing Conestoga's growth strategy. Prior to joining Conestoga, Chesnut served as SVP of treasury, investor relations and corporate development at Upbound Group, Inc. (Nasdaq: UPBD). Before that, he served as EVP and CFO at publicly listed Loyalty Ventures Inc., which was a spinoff from publicly listed Alliance Data Systems, Inc. (Now Bread Financial), where he spent over a decade.

James Robert "Rob" Foster was promoted to SVP of finance and CFO of ATI Inc. (NYSE: ATI), effective Jan. 1. Foster succeeds Don Newman, who will serve as strategic advisor to the CEO beginning Jan. 1. As previously announced, Newman will retire on March 1, 2026, and serve in an advisory capacity. Foster, a longtime ATI leader, most recently served as president of ATI's specialty alloys and components business. He previously served as ATI's VP of finance, supply chain and capital projects, overseeing the company's global finance organization, capital deployment processes, and enterprise supply chain performance. Earlier, he led finance for both ATI's operating segments and the forged products business.

Big Deal

The 11th annual Women in the Workplace report, released by McKinsey & Company and LeanIn.Org, examines the state of women in corporate America and Canada. This year, only half of companies are prioritizing women’s career advancement—a continuation of a multiyear decline in commitment to gender diversity. For the first time, women are less interested than men in being promoted.

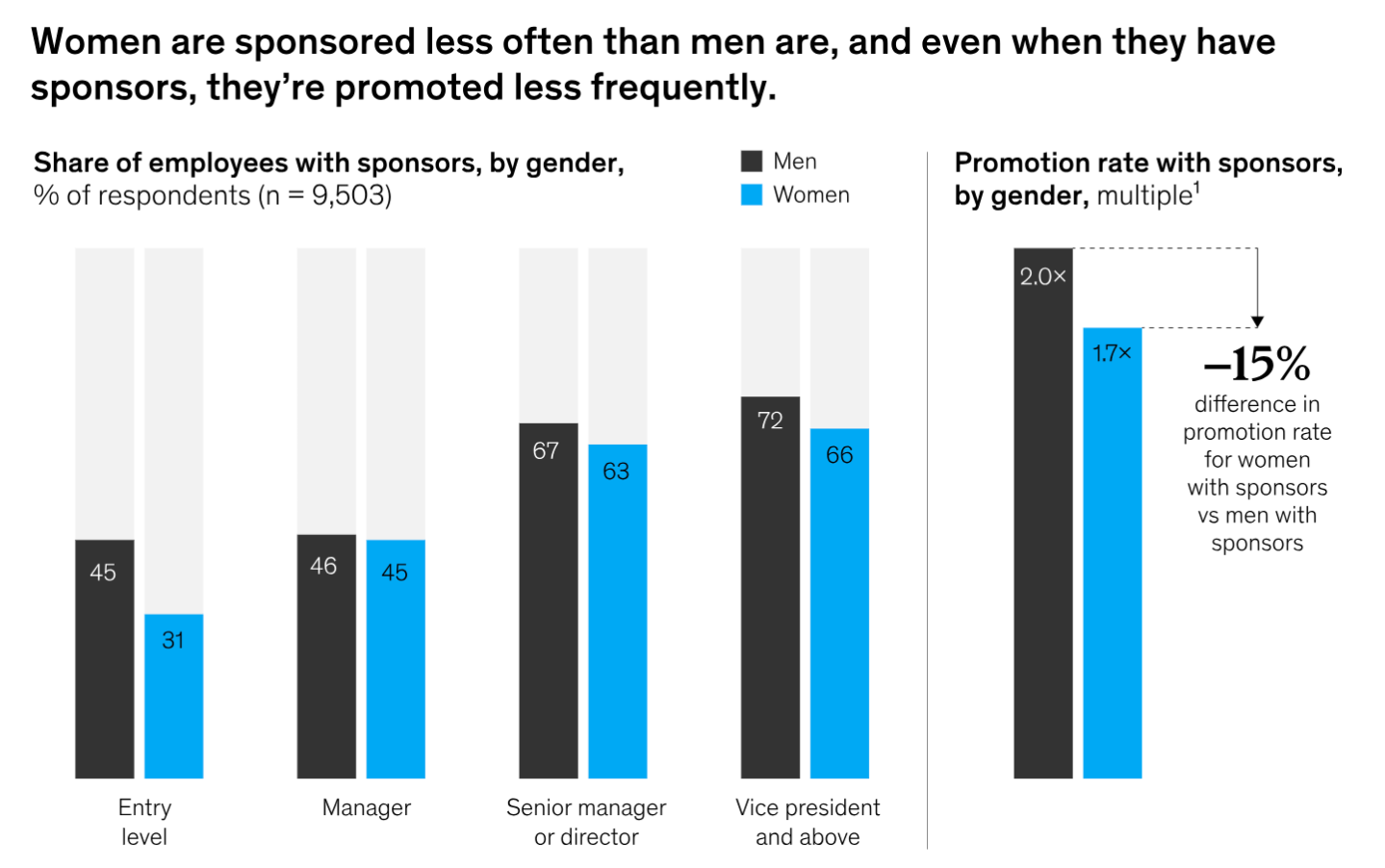

One of the key findings is that sponsorship matters. “Women overall are less likely than men to have a sponsor—and entry-level women stand out for receiving far less sponsorship than any other group of women or men,” according to the report. “Even when entry-level women do have a sponsor, they’re promoted at a lower rate than men. Sponsors have a substantial impact on career outcomes: in the past two years, employees with sponsors have been promoted at nearly twice the rate of those without.”

Going deeper

Overheard

"I think in the next five years, you’re going to see large sections of factory work replaced by robots—and part of the reason for that is that these physical AI robots can be reprogrammed into different tasks."

— Arm CEO Rene Haas said at Coins2Day Brainstorm AI in San Francisco on Monday.