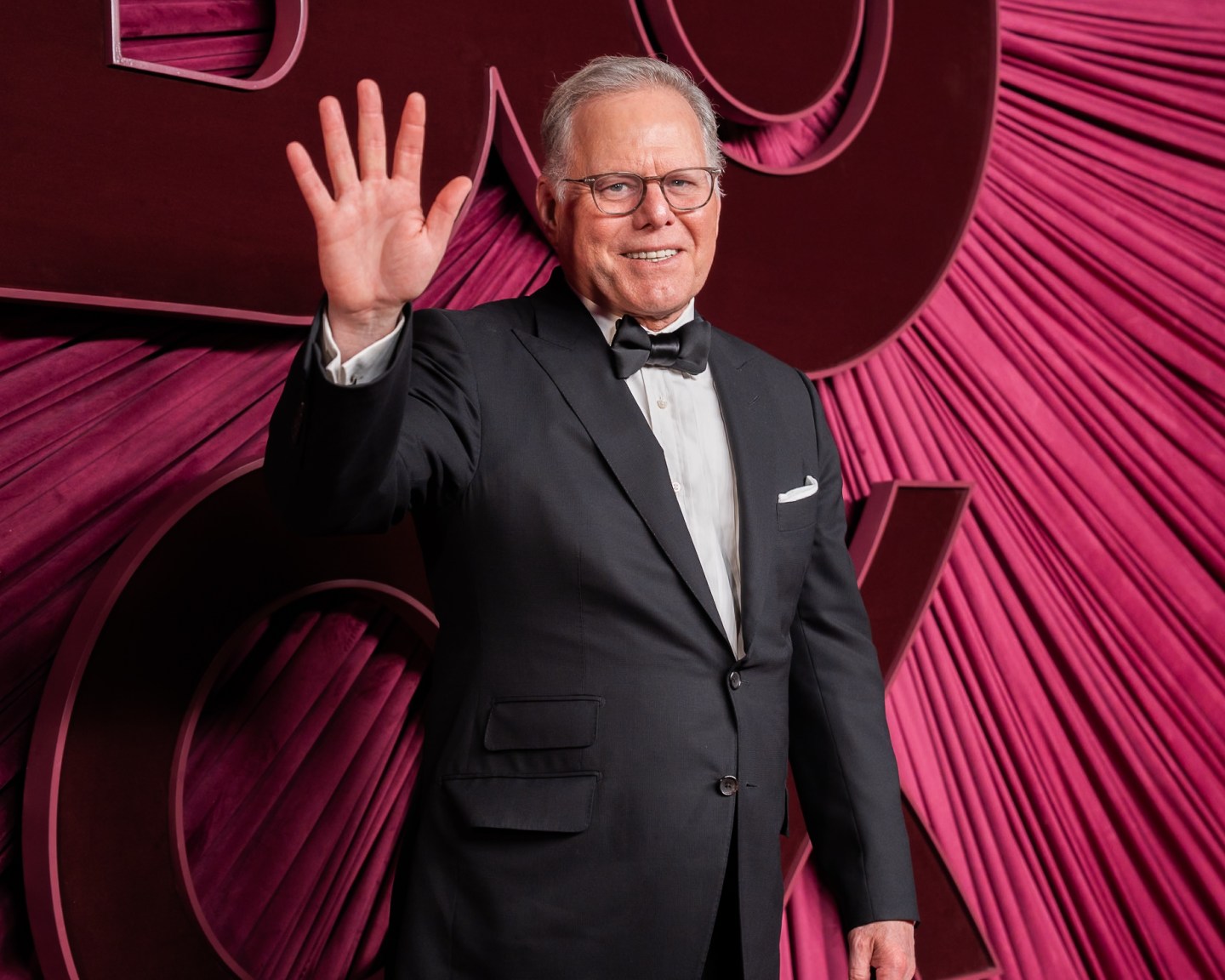

Money manager Mario Gabelli said it’s “highly likely” he will tender his clients’ Warner Bros. Discovery Inc. Shares to Paramount Skydance Corp. In an effort to spark a bidding war for the film and TV company.

In an interview, Gabelli said Paramount will ultimately have to increase its $30-a-share bid for Warner Bros. And that Netflix Inc. Will also likely counter with a higher offer. Saying he supports the Paramount tender is a way of signaling he prefers more competition for the company.

“We’re in the early rounds,” Gabelli said. “Round five of a nine-round challenge.”

Warner Bros. Shares were up 3.8% to $28.26 at the close in New York on Tuesday.

The longtime media investor attended Paramount’s presentation at a UBS conference on Tuesday and walked away impressed. Management “did a very good job” addressing potential regulatory challenges including at the state level, he said.

Gabelli’s firm and funds hold almost 5.7 million Warner Bros. Shares, according to data compiled by Bloomberg, worth about $160 million based on Tuesday’s closing price. He also owns shares in Paramount and Netflix.

Warner Bros. Agreed last week to sell its streaming and studios businesses, including HBO, to Netflix for $27.75 a share in cash and stock. Paramount on Monday went public with an all-cash tender offer for Warner Bros. And has been looking to convince investors its bid is better.

Gabelli plans to tender because the “terms of trade favor Paramount,” including an all-cash proposal that doesn’t rely on publicly traded stock or the spinoff of Warner Bros.’ Cable networks, as Netflix’s offer does.

Gabelli wouldn’t say which company was a better fit for Warner Bros.

“I don’t like to endorse things,” he said. “That’s why you play that card (a tender offer). It’s Texas hold ’em.”

On Tuesday, Gabelli’s company said in a regulatory filing it purchased more shares of the cinema and hotel company Marcus Corp.

Movie theater chains, which have been battered by tepid ticket sales and the threat of cutbacks in Hollywood releases, are a buy, Gabelli said. Paramount winning Warner Bros. Would be “clearly better” for theaters because management believes in traditional film releases.