The U.S., Japan, South Korea and Taiwan are on a mission to restructure the global chip supply chain. The proposed “Chip 4 Alliance” wants to internalize all parts of the semiconductor business—research and development, design, manufacturing, packaging, sales and consumption—in-house. This chip clique will only reach outside the circle in strictly controlled circumstances.

These four economies constitute almost the entire global semiconductor industry, accounting for 82% of the global market share, and 74% of the semiconductor global value chain with 84% of chip design. They collectively occupy a 77% share in the market for manufacturing equipment and as high as 99% for memory chips. Thus, the Alliance is more than just cooperation and coordination: What these four governments determine will shape the global market.

But the Chip 4 Alliance raises a critical and complicated question: Can countries control production and manage trade for a product defined by innovation and competition?

If they can, we’re looking at something very new: an OPEC-style cartel for the digital age.

To the extent that participating members in the Chip 4 Alliance promise to regulate their respective domestic semiconductor industries in a coordinated way, and orient their businesses in a certain direction, this endeavor may introduce something akin to a state-owned enterprise, operated collectively and managed multinationally.

Put bluntly, the four Alliance members can lay out, in the long run, which companies do what, who produces parts and materials, how they are sourced, and where chips are distributed and sold. They will also align their R&D, financial support, and incentives. The chip sector will feature government-arranged financial support, on-going governmental influence, public-private joint business planning, and public mandate fulfilment.

This is none other than a well-known recipe for SOEs, a topic which took center stage in recent trade agreements such as the Indo-Pacific Economic Framework (IPEF), the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or the United States-Mexico-Canada Agreement (USMCA).

Economists have long argued that enterprises under the direction or indirect control of the government sap economic efficiency and hamper market competition.

It’s thus ironic that a new scheme for the global semiconductor industry could create a new type of SOE: the “multinational SOE,” distinct from the national SOEs targeted by by recent regulations and investment agreements.

If key decisions of the semiconductor businesses of the four members are made at the request (if not direction) of respective government agencies, those businesses are presumably set to be a new breed of state enterprise for the digital age.

What’s more, if their business decisions are coordinated and orchestrated by the pool of governments—whether an alliance, network or any other title—they will be virtually under the collective control of the participating governments.

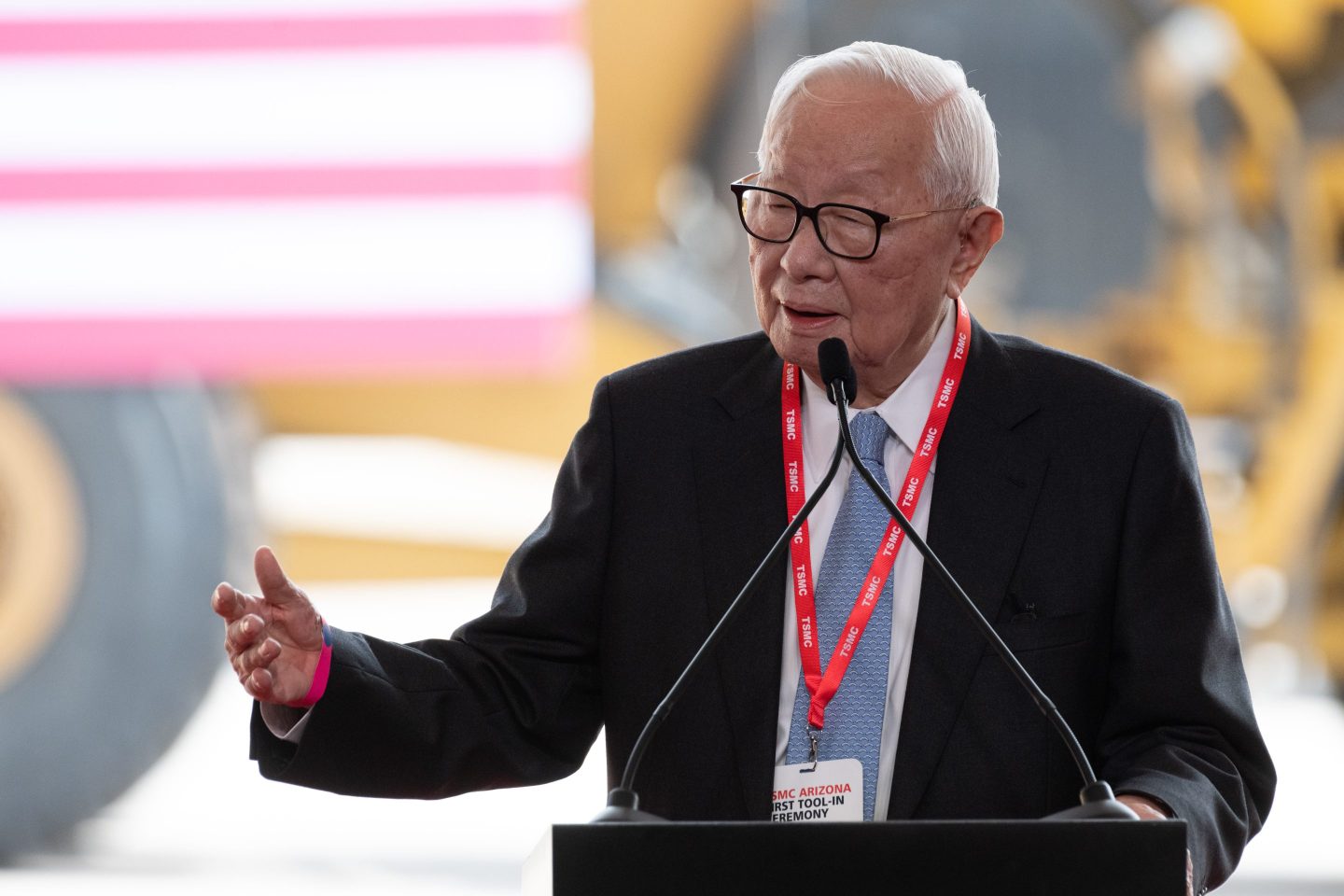

Consider, for example, TSMC’s decision to build fabs in Phoenix, Arizona and Kumamoto, Japan, or Samsung’s new fab in Taylor, Texas. These locations don’t offer the same benefits as TSMC’s home of Taiwan, or Samsung’s home of Korea: less expertise, higher costs and more troublesome regulations. Why, then, did these chip giants decide to invest in the U.S. And Japan? Geopolitics is one obvious possibility.

Granted, the Chinese chip industry has also received a massive amount of financial support from both central and local governments. Beijing raised a semiconductor fund in the amount of $19 billion in 2014 and $27 billion in 2019, respectively. It is now planning to raise a new fund of $41 billion. Clearly a number of Chinese chipmakers can be called SOEs.

Yet endeavors like the Chip 4 Alliance risk creating a behemoth to fight a behemoth. One side may win against the other—then may wither because of stifled innovation and competition.

For chip companies, this whole plan is a Catch-22. In the course of restructuring the global supply chain, chipmakers are encouraged, if not forced, to discuss coordinating business activities with their counterparts. This line of close consultation reveals the Achilles’ heel of global corporations: the web of competition rules and antitrust sanctions in various states.

Members of the Chip 4 Alliance might downplay their competition rules, but non-participating governments, like the European Union, China, or others, might think otherwise when they feel short-changed from a new supply chain.

Semiconductors are just the most high-profile area where countries are using friendshoring to shift away from “countries of concern.” Yet if these policies become the norm, then the global system could end up with much less competition and much less innovation—dominated by a new breed of state-owned enterprise.

Jaemin Lee is currently Professor of Law at School of Law, Seoul National University in Seoul, South Korea. His major areas of teaching and research are international economic law and international dispute settlement.

The opinions expressed in Coins2Day.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Coins2Day .