There’s one thing both the Republican and Democratic Parties can agree on: Being tough on China. U.S. Politicians and officials worry about Chinese semiconductors, Chinese EVs, Chinese cranes, and Chinese-owned social media apps—to name just a few.

This bipartisan sentiment makes it challenging for those trying to argue for a more cautious, less aggressive approach to the world’s second-largest economy, like former U.S. Treasury Secretary Larry Summers, who was instrumental to helping China join the World Trade Organization. (China formally joined the international body in December 2001). “I am, in many respects, an admirer and a friend of China,” Summers said in a virtual conversation with Clay Chandler, Coins2Day‘s executive editor for Asia, at the Coins2Day Innovation Forum in Hong Kong on Thursday.

The U.S. And China “really have no alternative but to find a modus vivendi for cooperation if either of them are to succeed,” he said. “It is very difficult for me to imagine scenarios in which the U.S. Is highly successful while China is failing, or where China is highly successful while the U.S is failing.”

Summers compared the U.S. And China to “two guys who don’t like each other much, don’t know each other terribly well, and find themselves in a lifeboat that requires two oars, in a very turbulent sea, a long way from the shore.”

Yet Summers said that some of Beijing’s actions aren’t making it easy for those more dovish on China to make their case for improving relations.

“I have to say that sometimes China seems to be doing its very best to make it difficult to be less confrontational or containment-oriented in policy debates in the West,” he said. “What is…coming out of China makes it much more difficult for those of us who want to emphasize negotiation and cooperation.”

U.S.-China relations have been on a downward spiral ever since former U.S. President Donald Trump slapped hefty tariffs on imports from China. The Biden administration has largely chosen to keep Trump’s tariffs.

In recent years, Washington has blocked the sale of advanced chips and chipmaking equipment to Chinese companies, and banned U.S. Investment into Chinese companies involved in sectors like quantum computing, AI, and semiconductors. The U.S. Is also encouraging companies to “de-risk” their supply chains from China, and move operations to other countries, including those friendlier to the U.S.

Chinese officials have attacked these policies as violations of global trade rules, even filing cases at the WTO.

Summers predicted those claims will fall on deaf ears, given China’s own reliance on industrial policy, protectionist measures, and subsidies. “I don’t think China is in a strong position to complain about industrial subsidies…[and] nationalist economic policies.” He said on Thursday.

Working with allies

The Biden administration, unlike its predecessor, says it is more open to working with allies to contain China. The U.S., for example, persuaded Japan and the Netherlands to impose their own controls on selling chipmaking equipment to China.

But domestic political pressures could undercut those efforts. U.S. Politicians, including President Biden, have attacked Japanese steelmaker Nippon Steel’s $14 billion deal to buy U.S. Steel on national security grounds.

Nippon Steel, for its part, has tried to defend its acquisition by claiming it would create a steelmaking giant capable of competing with China.

Summers has previously criticized efforts to block the deal. “There is no remotely plausible national-security rationale for questioning the Nippon-U.S. Steel transaction. Japan is a staunch ally.” He told Bloomberg TV in January.

The economist on Thursday again alluded to the idea of trying to keep U.S. Steel in domestic hands. “The U.S. Employs more than 60 times as many people in industries that use steel, as it does in the steel industry,” he noted.

“When we do things that raise the price of steel with various types of economic restrictions, we have to think very carefully about whether we are, on net, helping or hurting American workers,” he continued.

Where are U.S.-China relations going?

Other speakers at the Coins2Day Innovation Forum noted that, even amid trade tensions, there were still some positive trends in U.S.-China economic relations. On Wednesday, Chinese president Xi Jinping met with U.S. CEOs in the wake of the China Development Forum, Beijing’s summit for Chinese officials and foreign business leaders.

“There was less criticism also this year from Washington about U.S. Business leaders doing business in China,” Ben Harburg, managing partner of global investment firm MSA Capital, said on Wednesday at the Coins2Day Innovation Forum. “These kinds of narratives that it was treasonous to do business in China have been ratcheted down a bit, and so that gave people a bit more confidence to show their feathers.”

Washington and Beijing have worked to restore ties in recent months, including a summit between Xi and Biden last November.

But speakers at the Coins2Day Innovation Forum were wary of predicting that U.S.-China relations would improve any time soon.

“The geopolitical situation is not going to really improve. If anything, I think I’ll be very happy if it doesn’t deteriorate further,” Victor Fung, chairman of Fung Investments, said on Wednesday. Fung, who led the supply chain management company Li & Fung, predicted that “geopolitical repression” could drive a “total fragmentation” of supply chains to avoid direct trade between China and Western markets.

Harburg predicted that U.S. Politics could again send relations with China downwards. “The trade tensions are going nowhere and will continue to ratchet up over the years,” he said, “especially as we go through an election cycle where everyone’s got to compete on who’s harder on China.”

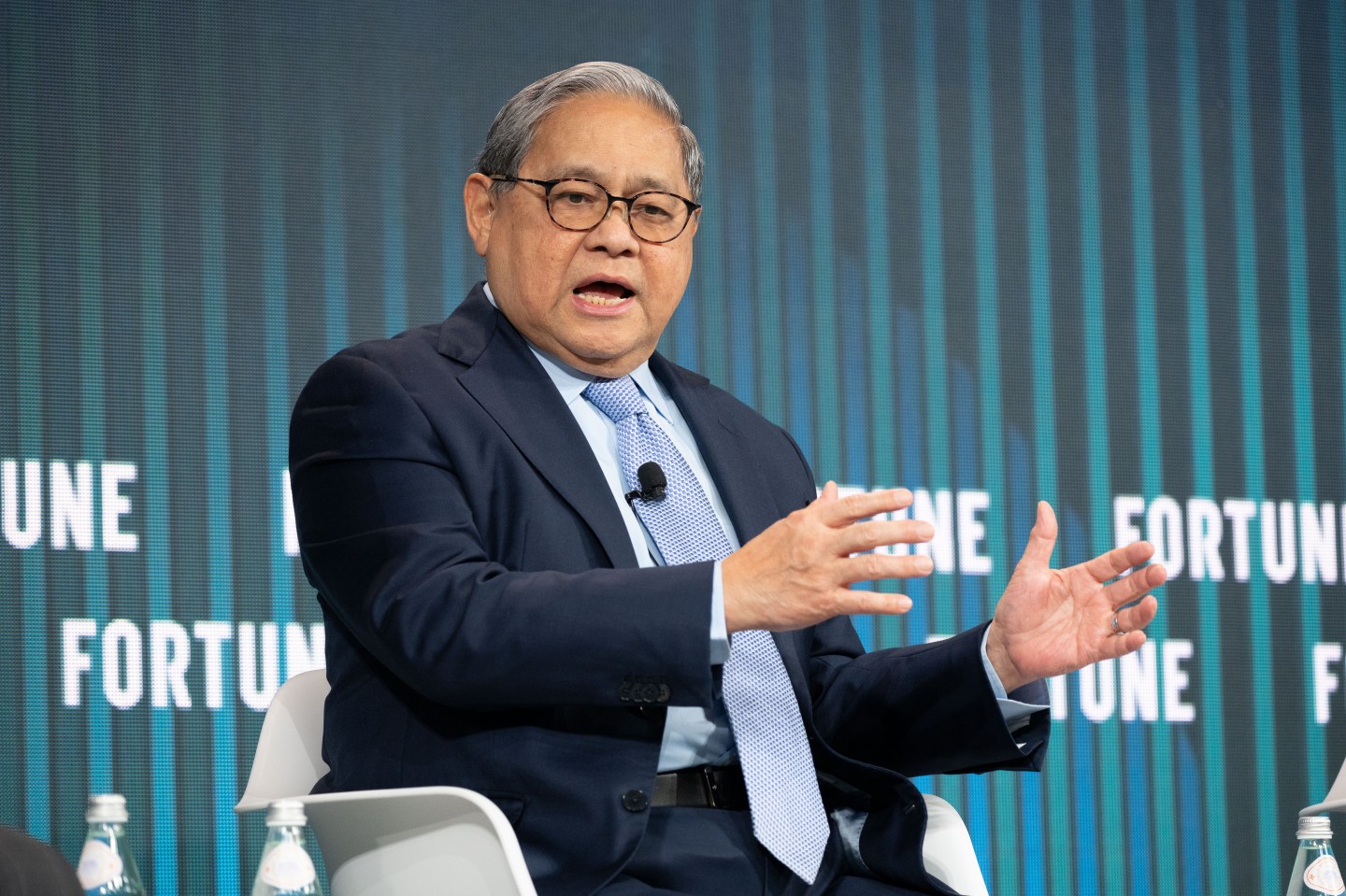

!["Sometimes China is doing its very best to make it difficult [for Western policymakers] to be less confrontational, or containment-oriented,” Larry Summers said at the Coins2Day Innovation Forum on Thursday.](https://fortune.com/img-assets/wp-content/uploads/2024/03/GettyImages-1243961446-e1711639175924.jpg?format=webp&w=1440&q=100)