For years, the crypto economy was a digital Wild West: volatile, speculative, and often untethered from the real world. Now, Asia is leading a reinvention—building a blockchain ecosystem that doesn’t just trade coins, but tokenizes roads, solar farms, and financial instruments. It’s a shift from roulette wheels to regulated rails, from speculation to scaffolding.

The first uses of the blockchain were purely virtual: cryptocurrencies and NFTs that reflected digital assets with no real-world counterpart. Yet the next wave of financial innovators are trying to make blockchain work in the “real world” by tokenizing real-world assets like artwork, real estate—and, if two small Asia-based financial startups have their way, clean energy.

If predictions hold true, real-world assets on the blockchain can be a lucrative opportunity: Standard Chartered believes the market could be worth $30.1 trillion within the next decade.

Amber Premium, a Singapore-based institutional crypto services provider, and Evolve, a tokenized infrastructure company specializing in renewable energy, are tiny by global standards: Amber’s market capitalization hovers around $600 million, while Evolve manages a relatively small asset base.

Unlike crypto giants such as Binance or Coinbase, Amber and Evolve are niche, but their focus on tokenizing real-world infrastructure is an example of how Asia is transforming the realm of digital finance.

What connects both Amber and Evolve are tokens: the conversion of real-world assets into digital tokens onto a blockchain. In principle, this offers institutions a compelling alternative to legacy investment structures. Rather than have layers of financial intermediaries, investors have direct, auditable ownership through the blockchain. Users can then divide and trade these tokens however they wish, and set up smart contracts to automate yield distribution.

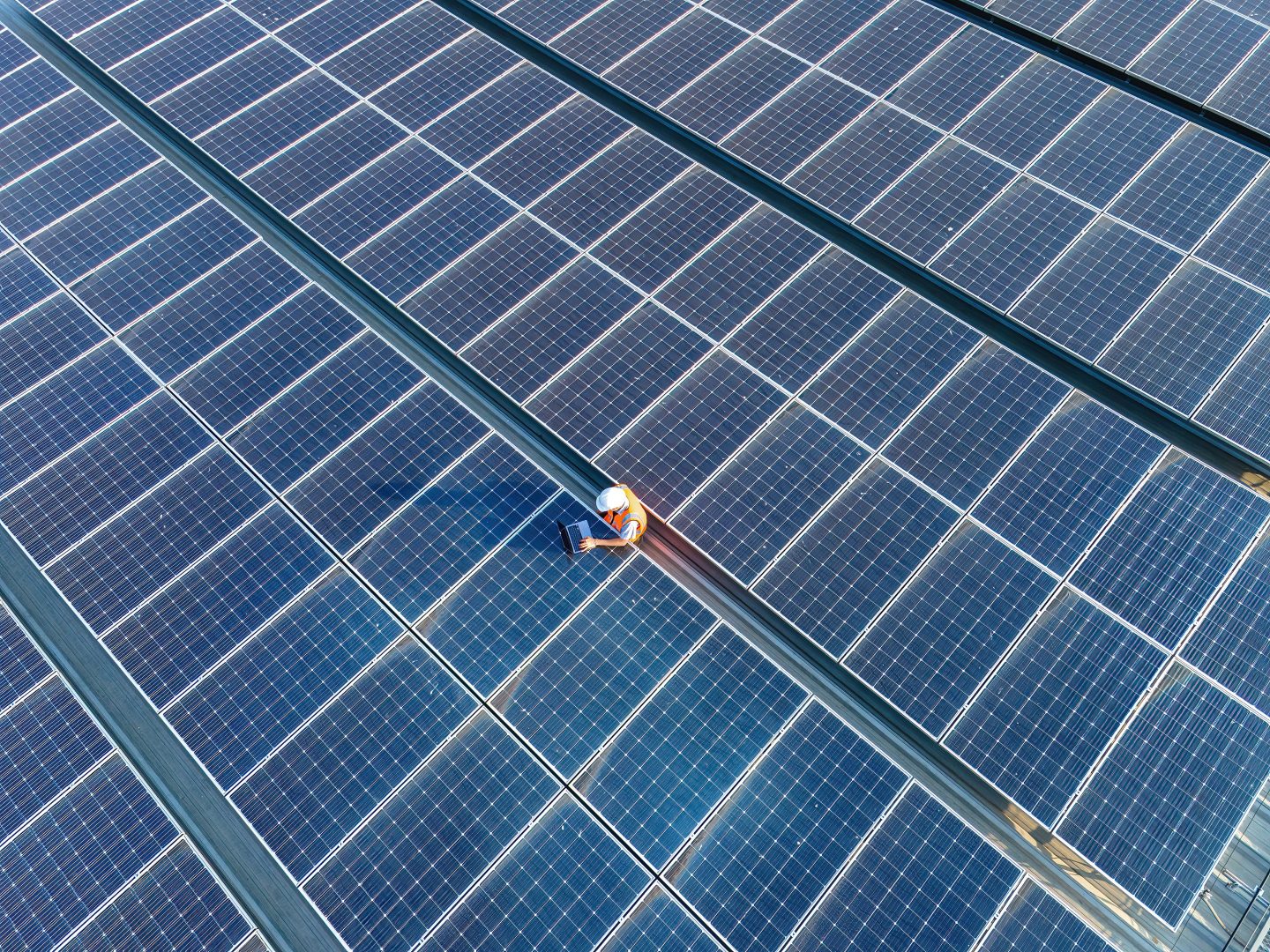

These tokens represent tangible physical or financial assets—solar arrays, government bonds, EV fleets—bringing real yield, lower volatility, and legal transparency to crypto markets, Evolve’s tokens are linked to solar farms and battery networks, seamlessly bridging the gap between industrial infrastructure and digital finance.

Amber Premium, led by CEO Wayne Huo—a former Morgan Stanley trader—recently merged with iClick, securing a Nasdaq listing and establishing itself as a fully regulated institutional crypto player. Amber’s regulatory framework spans multiple jurisdictions: Its Singapore arm (formerly Sparrow Tech) operates under the Monetary Authority of Singapore (MAS), while other subsidiaries hold licenses adapted to local Asian markets. The firm invests heavily in compliance infrastructure, aiming to meet the expectations of institutional clients and regulators alike.

Amber’s Nasdaq listing established the company as a U.S.-listed institutional gateway into “Web3”—shorthand for an internet built on decentralized blockchain technologies. Huo took over as CEO, giving the company a bridge to traditional finance.

Amber Premium’s clientele is distinctly institutional. As of Q1 2025, the platform counted roughly 928 active clients—an increase from 891 the previous year—which collectively held $1.275 billion in assets under management. These clients span regional banks, family offices, hedge funds, and corporate treasuries across Asia, the Middle East, and North America. A significant share of Amber Premium’s clients are looking for exposure to digital assets amid uncertainty around Asia’s treatment of cryptocurrency.

Amber is still a tiny company, generating just $14.94 million in revenue in the first quarter of 2025, up from $1 million a year prior. Amber Premium has yet to turn a profit, instead prioritizing infrastructure, licensing, and regulatory compliance over short-term earnings.

Revenue has tracked the ups and downs of the crypto market: The affiliated Amber Group generated just $33 million in revenue in 2024, down from $308 million in 2021, the height of the COVID-era crypto boom.

Amber Premium’s shares have lost half their value since the listing, falling from a peak of around $12.80 in March to around $6.50 today. Analysts blame low awareness, thin trading volume, and skepticism about the viability of crypto-finance hybrids after FTX’s spectacular collapse in 2022.

Evolve, founded by Maverick Hui, a pioneer of Canadian crypto ETFs and early digital asset regulation, is turning renewable energy infrastructure like battery-swapping stations, solar farms, and EV-charging networks into digital tokens that deliver proportional returns to investors. Several of its ETF offerings, including those tied to Bitcoin and Solana, have received approval from the Ontario Securities Commission. The company partners with U.S.-licensed custodians like Coinbase Custody Trust for cross-border holdings.

Hui, from Evolve, is focusing on yield-generating clean-energy assets, particularly through e-scooter and battery station manufacturer Mile Green. In early 2025, Mile Green secured $50 million from CMAG Funds, a Singapore-based private investment firm, to expand battery-swapping and EV-charging infrastructure across Southeast Asia and parts of Africa.

(Coins2Day’ s parent company holds a minority stake in CMAG Funds. Chatchaval Jiaravanon, Coins2Day’ s owner, is also an investor in Amber, Mile Green, and Evolve. Chatchaval recently took part in a $25.5 million private placement in Amber.)

Mile Green is Evolve’s infrastructure partner: Mile Green develops the clean energy assets, which Evolve converts into investment-grade digital tokens. Investors can now track performance through these tokens rather than company filings.

Asia leads the way on crypto

Asia is taking the lead in tokenized finance, thanks to clearer regulatory frameworks, innovation sandboxes, and startups that are eager to experiment. Even mainland China, which bans most cryptocurrency trading and mining, is experimenting with enterprise blockchain through its state-backed Blockchain-based Service Network (BSN) and central bank digital currency, the e-CNY.

The financial hubs of Hong Kong and Singapore are among Asia’s most crypto-friendly jurisdictions. Yet regulators in both cities are still cautious about cryptocurrency. Tokenized products still face strict limitations, retail access is tightly controlled, and approval processes can be unpredictable. One major constraint is the difficulty of transferring tokenized assets between wallets. As a result, wallet-to-wallet transfers are often restricted or require complex approvals, limiting broader adoption.

Changing winds in Washington are also buoying Asia-based crypto platforms. The second Trump administration is taking a decidedly more pro-crypto stance. In January, U.S. President Donald Trump signed an executive order promoting responsible blockchain growth. He paused enforcement actions against crypto exchanges like Coinbase and Binance, and Trump’s SEC then launched a “Crypto 2.0” task force to clarify rules on crypto, moving away from the preceding Biden administration’s more skeptical stance.

In March, the White House announced a Strategic Bitcoin Reserve and Digital Asset Stockpile, naming Bitcoin, Ethereum, Solana, XRP, and Cardano as national digital assets. Then, in August, new rules opened 401(k) retirement plans to crypto, private equity, and real estate—unlocking trillions in potential institutional capital.

The administration also backed the GENIUS Act, which clarifies rules for stablecoins. Together, these moves are ushering in what the crypto industry hopes will be a more friendly, legally stable foundation for growth.

These shifts benefit both Amber and Evolve. Amber, as a Nasdaq-listed company, gains regulatory legitimacy and improved U.S. Market access. Evolve’s yield-bearing, tokenized infrastructure may soon appeal to pension funds and fiduciary investors seeking new types of assets.

As the U.S. Softens its stance and Asia doubles down on digital finance, companies like Amber Premium and Evolve are quietly building the financial plumbing for the next phase of blockchain adoption—and getting the real world on the blockchain.

There’s still a long way to go. Liquidity remains thin, valuation remains depressed, and the sector remains vulnerable to global regulatory swings. Then there’s the ownership question: How do you ensure a digital token on the blockchain grants a clear and enforceable claim on the real-world asset in question?

Tokenized finance may still be in its early innings—but the infrastructure is maturing. Asia didn’t invent blockchain. But it may be where blockchain becomes real.

Correction, August 14, 2025: A previous version of this article misstated details about Amber Premium, including its headquarters and its revenue.