Harry Potter is a hard act to follow. With over $25 billion made between books, movies, video games, and more, the boy wizard’s commercial franchise has far outshone and outlasted most pop-culture fads.

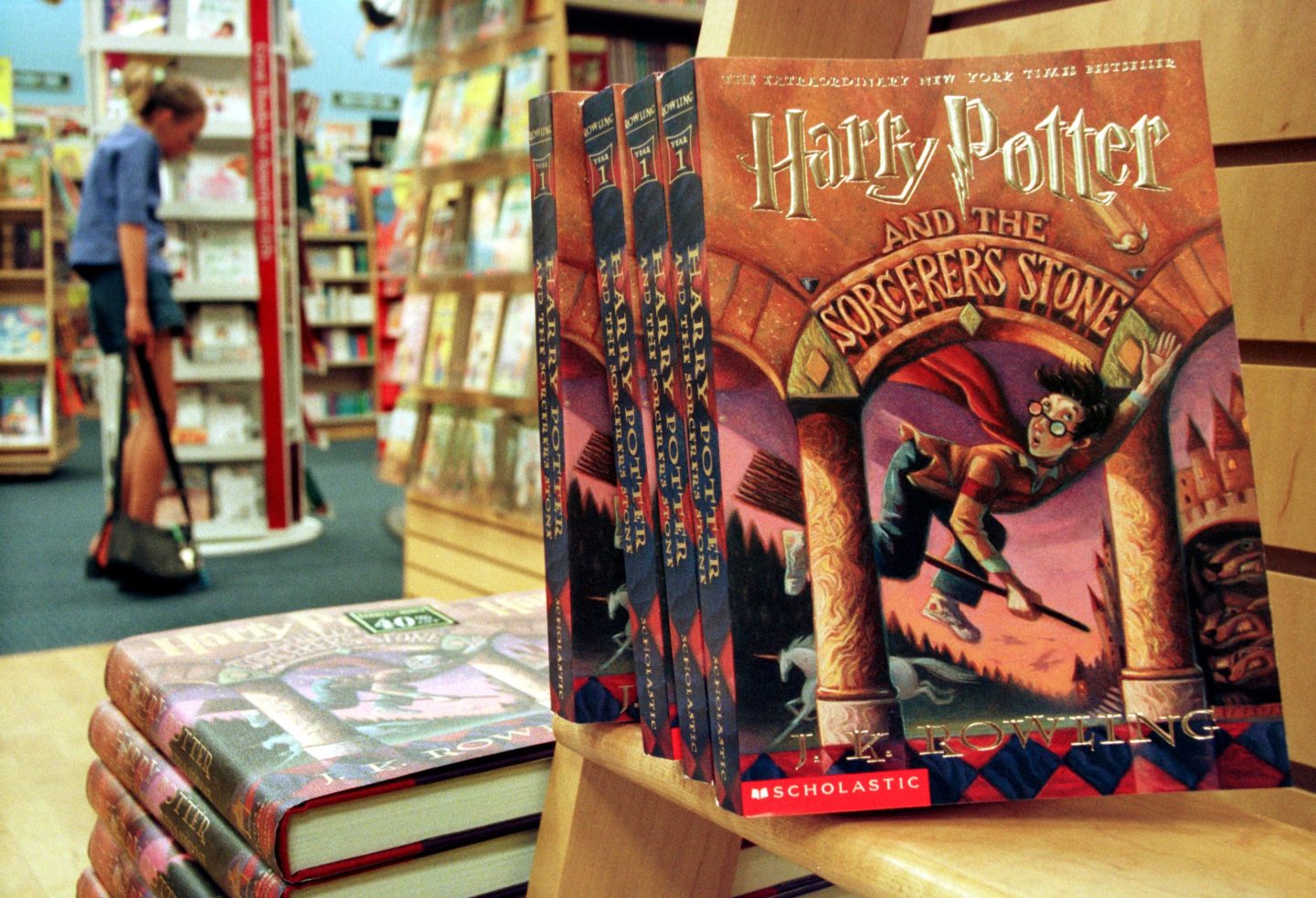

For Bloomsbury, the British publisher behind the series, it’s proven a massive cash cow, helping it become one of the world’s leading players. But it’s also been 27 years since the first J.K. Rowling–authored book was released (yes, it’s that old).

Since then, genres have come and gone; e-books rose, fell, and then started rising again; and social media sites like TikTok upended the way many people discover books. Amid all these changes, Bloomsbury has been able to avoid becoming a one-wizard wonder, and its titles crowd bookstore windows to this day.

Last week, Bloomsbury reported a 30% jump in sales to £343 million ($436.6 million) and a nearly 60% hike in profits to £49 million ($62.4 million) in the year to Feb. 29, 2024, closing a record-high 12 months for the company. That’s not a one-off case—the company has had solid results for several years, beating records year after year.

Meanwhile, its rivals haven’t shared the same growth in fortunes. Penguin Random House, a much larger publisher, saw a 7% increase in revenue in 2023, while profits shrank slightly by 0.3%. American publisher HarperCollins saw its fiscal 2023 profits dip 45% in the 12 months to June 30 as sales plunged 10%.

Bloomsbury’s latest acquisition—the £65 million ($82.5 million) purchase of American academic publisher Rowman & Littlefield, announced Wednesday—provides a window into why the company has succeeded.

What has Bloomsbury done differently?

In short: its eye for fantasy fiction writers capable of building loyal readerships, and its nose for diversification.

When the pandemic began to subside amid high cost of living, people turned to books for budget-friendly entertainment—a trend that’s worked wonders for Bloomsbury, and the wider industry.

The British publisher’s growth in recent years has been driven by bestselling authors like Sarah J. Maas (sales of whose titles grew 161% year over year) and Samantha Shannon, who have yielded big hits for the publishing house.

Maas’s “books have a huge audience which continues to grow, backed by major Bloomsbury promotional campaigns, driving strong word-of-mouth recommendation, particularly through TikTok and Instagram channels,” Bloomsbury CEO Nigel Newton said earlier this year, referring to the “BookTok” phenomenon where book enthusiasts recommend new reads on TikTok.

Another source of success for the publisher has been the fantasy series Three Body Problem, which was turned into a Netflix show.

And while peak Harry Potter mania may have long passed, its magic continues to draw Bloomsbury new business. For instance, last year the first Harry Potter was the U.K.’s No. 1 bestseller in children’s books for the first time since 2002. The London-listed company has also expanded the franchise with new books like the Wizarding Almanac.

But book publishing for the mass market isn’t all that Bloomsbury does. With its “game-changing” purchase of Rowman & Littlefield, an independent publisher whose authors cover topics like arts, humanities, and social science, Bloomsbury is leaning further into the realm of academic publishing, adding 40,000 titles to its existing roster and expanding into North America.

It’s part of a diversification strategy that kicked off several years ago, and includes a joint venture in China designed to grow its international presence. Now, academic publishing accounts for about 20.5% of Bloomsbury’s revenues, with a further 7.7% from its rapidly growing digital resources platform, which leverages the academic division’s IP for the online educational market.

“We believe this is highly attractive strategically, providing the opportunity for BMY (Bloomsbury) to deploy the content into its digital resources platform,” analysts at Investec said in a note Wednesday. The wealth management group added that Bloomsbury’s “flywheel” growth potential and track record was “underappreciated.”

In its latest earnings release, Bloomsbury announced that it’ll hike dividends following an “outstanding” year.

“Our strong cash generation and balance sheet enables us to continue investing in innovative content and authors, as well as capitalizing on emerging opportunities,” Newton said in a statement.

What could the path forward look like?

Although Bloomsbury has secured its position, it still shares the challenges that other publishers face—such as with generative AI.

“The most important issue right now in our industry is to prevent books being trained upon by generative AI because they, in effect, steal the author’s copyrighted work,” Newton told the Financial Times last year.

He added that it opens the door for greater productivity among authors who use AI tools, but it still marks an uneasy new chapter in the troubled relationship between publishing and Big Tech, which goes back to the days when Amazon first started devouring the bookselling sector.

Bloomsbury expects its portfolio this year to match last year’s performance, although it has no new titles by Maas for the upcoming months, which investors fear could set the company back.

“That shifts the emphasis on making money from her [Maas’s] back catalog, in the same way that Bloomsbury has managed to sweat its Harry Potter assets with new versions of the beloved book series,” AJ Bell’s investment director Russ Mould said.

“The news is like a famous band saying they’re going on a hiatus—disappointment now, but the potential to make even more money when they return.”

Still, Bloomsbury is confident it’ll rise above the tide. It’s set up a strong fan base with its core authors, who keep new and old readers coming, while leaving room to experiment with new and innovative ones. And with academic books in the mix, it has what CEO Newton calls a “resilient model” in the face of volatility that typifies creative industries.