Escape from New York is more than just the name of a 1981 film featuring Kurt Russell. It's the warning that real estate agents in Westchester County and Florida shared with the public (including Coins2Day) regarding the potential consequences of Gotham electing a mayor with socialist leanings. However, a new chapter is needed, one with a distinct narrative.

TL;DR

- High-end Manhattan residence sales surged in November, defying predictions of an exodus.

- Agreements for residences over $4 million increased significantly, outpacing the general market.

- Real estate experts state data does not support a "Mamdani effect" of wealthy residents fleeing.

- Wall Street bonuses and population growth suggest continued appeal for affluent New Yorkers.

Following considerable attention from affluent panic about a potential mass exodus in New York's wealthy circles after the election of mayor-elect Zohran Mamdani, the opposite is now occurring, with purchasers of high-end Manhattan residences expressing their preferences through their spending.

In November, agreements for Manhattan residences valued at $4 million or higher reached 176, marking a 25% jump from the 141 transactions recorded in October, as indicated by recent data from the firms Douglas Elliman and Miller Samuel Inc. The report highlighted that new agreements exceeding $4 million saw a growth rate more than double that of the general market.

Olshan Realty also observed an increase in demand from affluent purchasers in Manhattan. In its latest market report, the company reported that the 17 agreements executed during the final week of November for Manhattan residences valued above $4 million surpassed its decade-long average for Thanksgiving week. In contrast to October's 115 luxury transactions, November saw a rise of over 31% in sales, reaching 151 properties, as per the firm's data.

New York City's property market surge defies the storyline from only a short while ago, when some of Manhattan's top figures were getting ready to depart if socialist Mamdani was elected mayor. Mamdani has supported stronger tenant protections and rental cost caps, in addition to a 2% income tax surcharge for individuals residing in the metropolis who make over $1 million annually.

Mamdani’s shock primary win in June coincided with some real estate agents in Westchester, the suburb just north of the city, reporting an influx of interest in the area, with Zach and Heather Harrison of the Harrison Team at Compass, telling Realtor.com they saw “a spike in Manhattan residents reaching out about suburban properties.”

Other real-estate leaders, however, argued that the data says differently.

“There is no Mamdani effect,” Donna Olshan, president and founder of Olshan Realty, told Bloomberg. “The idea that people would flee New York was overblown. The numbers just aren’t bearing that out.”

Why New York is still booming

Jonathan Miller, who heads Miller Samuel Inc. As its President and CEO, informed Coins2Day that the pattern of affluent purchasers acquiring high-end New York properties has been evident throughout the year, contradicting the more recent account of wealthy individuals departing the metropolis.

“Throughout 2025 on a year-over-year basis, overall sales have risen, prices have risen, sales have risen faster than inventory, rents have risen, rental activity has risen, and especially in October and November,” Miller said. “I’m looking at this anecdotal argument, and the plural of anecdotal is not data.”

According to Miller, affluent individuals have numerous motivations for relocating to or remaining in New York. In 2024, Wall Street experienced its largest bonuses since 1987, propelled by a robust market. This upward trajectory is expected to continue this year, with projections indicating another exceptional year for Wall Street, potentially boosting compensation for investment bankers, traders, and wealth-management experts by as much as 25%, as detailed in a November publication by the compensation advisory firm Johnson Associates Inc.

This isn't the initial instance of alarmist predictions regarding New Yorkers relocating to outlying areas. During the nascent stages of the pandemic, considerable apprehension existed that New York would empty out as affluent individuals sought refuge in their country estates. Although a substantial number of affluent New Yorkers did depart the metropolis, the five boroughs nevertheless gained about 10,000 millionaires from 2020 to 2021, as indicated by official state figures. Manhattan even experienced gained 17,500 residents in 2022, primarily due to individuals moving from other sections of the city.

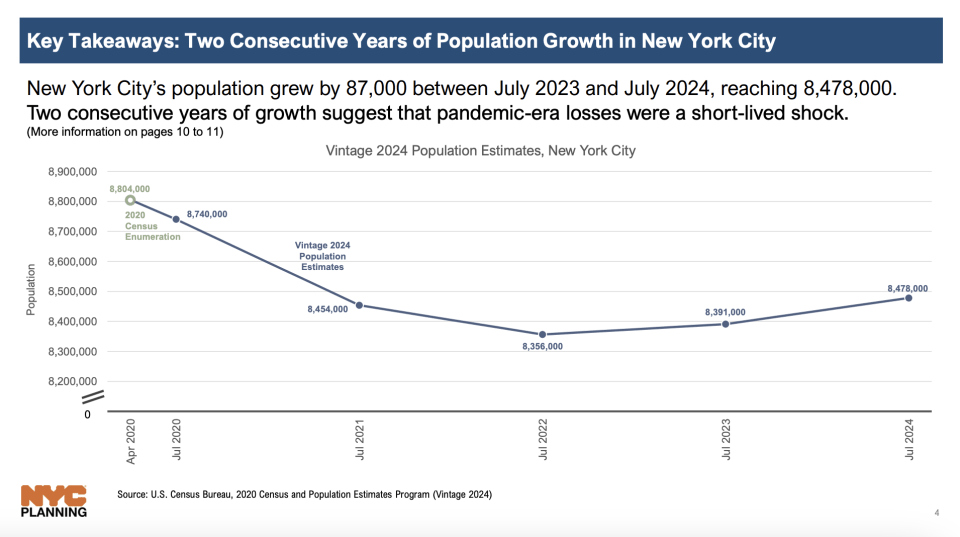

New York City’s population was gradually growing for decades up to the pandemic, as the census shows a recent peak of 8.8 million in 2020, with more recent data showing the city’s population at 8.5 million. The city had lost nearly a million people between 1970 and 1980, after which it grew consistently before the Covid shock.

The municipality reached a recent low point of 8.36 million in 2022, yet it has experienced two successive years of comparatively slow expansion following that. The NYC Department of City Planning contended in May 2025 that the growth observed over the past two years indicates that pandemic-related losses “were a short-lived shock.”

Miller stated that while he's uncertain how Mamdani's upcoming strategies will affect the municipality, he indicated no data supports a large-scale exodus of wealthy individuals. “This whole thing is a classic misinformation scenario, where no one’s looking at actual data,” he commented.